Highlights

Should You "Sell in May" ?

"Sell in May and go away" is a stock market adage based on what the Stock Trader's Almanac calls the "best 6 months of the year." Historical data reveals that the top performing 6-month rolling period, on average, has been November through April. Hence, the saying investors should "sell in May and go away" Read more...

Be A Successful Investors

These steps can help you increase your investing success and achieve financial wellness, even when financial markets seem unfriendly. Read more...

Q2 Investment Strategy Update

Momentum on equity markets worldwide began to falter in April. How long a series of triumphs can be sustained on the financial markets ? We are adjusting our portfolio to the new environment we want to adjust our allocation to a more neutral Asset Allocation. We shall not add more exposure to equities at this stage. We recommend taking profits from the growth stock-dominated US equity market, and investing in global value stocks instead. Read more...

Q2 Investment Strategy & Asset Allocation

Our quarterly Investment Strategy and Asset Allocation publication includes our positioning including the conclusions from the analyses, asset classes, based on an assessment of the current economic situation in various regions, and our current model portfolios. Read more... Read more...

Well-Informed Investors

What’s the best way to survive a financial crisis with your wealth intact? The answer may surprise you. Read more...

Beijing’s Bazooka

Chinese banks cut a key reference rate for mortgages by a record amount. The five-year loan prime rate (LPR) was lowered by 25 bps to 3.95%, the first cut since June and the largest reduction since a revamp of the rate was rolled out in 2019. Read more...

RISING SUN

It took over 34 years, but trading floors across Tokyo today erupted in cheers and applause at the end of the market session. The Nikkei 225, Japan's main stock index, closed at a new all-time high above 39,000, following a record run last seen during the country's late-1980s asset bubble. In fact, the Nikkei has been the world's best-performing major index in 2024, surging 17.5% only two months into the year and trouncing the impressive near 5% advance of the S&P 500. Read more...

Super Bowl LVIII : Market Indicator

On Super Bowl Sunday, February 11, will you be serving Kansas City barbecue or San Francisco cioppino in sourdough bread bowls? More important question: Will the outcome of the game impact your investments because of something called the Super Bowl Indicator? The only prediction I am confident of is that during the Super Bowl television broadcast, there will be many reaction shots of Taylor Swift. Read more...

China : The Wooden Dragon Year : Predictions

Chinese New Year is upon us, and on February 10, 2024, we will enter the Year of the Dragon ! The Dragon sits in the 5th position in the Chinese Zodiac and is one of the most revered signs in China. We must wonder what the Year of the Dragon holds for financial markets? Read more...

Outlook 2024

Falling US inflation and prospects for easier Fed policy are increasing talk of a soft landing rather than a recession, hard landing and bear market. Leading indicators point to slowing growth but not a collapse. Select real estate, corporate and household delinquency rates are rising, but these are usually lagging indicators for investors.Liquidity is expected to be a driving force for markets in 2024, with rate cuts by central banks and possibly the end of quantitative tightening. Read more...

Equal Weight Index and Return to the Mean

We need not look so far back in time to find examples of market rotation between Equal Weight and cap weight. In calendar 2022, Equal Weight outperformed the S&P 500 by 6.7%; in the first six months of 2023, Equal Weight lagged by 9.9%. But the candid observer must recognize that difference does not accrue smoothly. Read more...

Our Toolbox : Chart Trend Indicators (2)

To help us there are many possible approaches. In our toolbox we use the Fibonnaci ratios and the Elliott wave theory coupled with our Multiple timeframe oscillator system. Today let’s review the moving average crossover system following last week golden cross identification see Our Toolbox : Chart Trend Indicators (1) Read more...

Our Toolbox : Chart Trend Indicators (1)

A golden cross, a bullish January barometer, mega caps outperforming, and more. Some charts may be hinting that 2024 could be a year of caution. Here are some of the biggest chart trends that helped shape the market in 2023—and might provide clues for what to expect in 2024. Read more...

Charting an Investing Path

While there are multiple manners of evaluating your investments, we have found technical analysis to be a tool of immense utility for traders and investors alike. Read more...

RSI : Discussing A Stock Sell Signal

The relative strength index (RSI) provides short-term buy and sell signals. Low RSI levels (below 30) generate buy signals. High RSI levels (above 70) generate sell signals. The S&P 500's RSI suggests stocks may be expensive. Read more...

Fibonacci Sequences and Elliott Wave Theory

We are going to take some time to explain how we view the current structure from an Elliott Wave perspective. Read more...

Investment Strategy and Asset Allocation for Q4

The recipe for success is a well-planned investment with limited risk. If you have a clear, long-term strategy, you should stick to it. Investment is similar to many other aspects of life: patience and perseverance lead to long-term success. he subdued economic outlook allows us to maintain our overall defensive positioning. Read more...

INVERTED YIELD CURVE : A RECESSION WARNING ?

The current market climate has become increasingly challenging to decipher. It often forces us to confront a difficult truth: admitting when we were wrong and didn't anticipate such market movements. Read more...

Oil Prices and Energy : WTF What's the Future?

Gains among energy stocks have slowed this year, after their breakaway performance in 2023. But historically high energy prices—supported by constrained supply and rebounding demand—could set up a positive backdrop for the sector over the near-to-intermediate-term future. Read more...

MACD signals caution for stocks

What do the charts say? Investors that use indicators to help figure out which direction stocks may go over the short term can find that MACD is registering a bearish signal for US stocks. Read more...

The AI Investing Boom

A world may be coming soon where you see a movie or TV show written entirely by artificial intelligence. Maybe even a world where you or a loved one are given a life-saving drug that was discovered with the help of machine learning. And it’s due to some revolutionary technology that has many investors very excited. Read more...

Midyear Strategy : Climbing a Wall of Worry

The prospects for global markets for the second half of 2023 rest largely on whether the appearance of convincing evidence of recession (or other factors) shakes the currently optimistic view of investors. We update our view of the likely appearance of a recession in addition to our usual weekly MARKETSCOPE review of major global stock, bond, currency and commodity markets. As well, we are updating and commenting on our investment activities. CHEERS Read more...

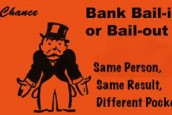

Investment Strategy and Asset Allocation: Gloomy outlook

After a hawkish start to the first quarter, volatility especially in bonds, surged during March, following the collapse of Silicon Valley Bank. That led to fears about broader contagion across the banking system. The financial stability that has been receiving heavier focus from the central banks generated relief among market participants. We share the investment conclusions of our latest Investment strategy committee below and our asset allocation. Read more...

Investing During A Recession

History may suggest that selling stocks before a recession arrives and buying them after it departs would be a smart strategy. But savvy investors know that it is extremely difficult to do this successfully and often a recipe for locking in losses instead. We give some clues. Read more...

What Are The Charts Telling Us ?

We have been in a bear market all along 2022. Then moving sideways following the end of the year. The question is which way the index will move out of this channel remains unknown. Time and charts will tell. Read more...

NEWSLETTER : Turbulence in the Financial System

Concerns about the stability of the international financial system have increased in recent days. STRATEGY : Defensive positioning to be maintained Read more...

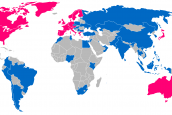

Foreign Markets Strike Back !

Don’t Overlook These Foreign Markets After more than a decade of underperformance, international stocks have recently offered significantly lower valuations than US stocks. Opportunities have arisen in Europe due to the continent’s renewed focus on energy independence and defense spending. Emerging markets could also be an attractive destination for investors, thanks to young and growing populations, plus valuations that are even lower than those in developed markets. Read more...

What Are the Charts Telling Us ?

Just keep it simple ! Technical analysis is a factual analysis coupled with our in-house tools employed to evaluate investments and identify trading opportunities in price trends and patterns seen on charts based on market data. Don’t try to anticipate the future pattern. Following our usual risk-management advice – including using risk-adjusted position sizing and trailing stops on every position – we recommend to stick primarily to the healthiest stocks in the market's strongest sectors and generally avoiding most stocks in the weakest sectors. Read more...

INVESTMENT STRATEGY & ASSET ALLOCATION

Our Investment strategy review includes a topical editorial, our positioning including the conclusions from the analyses, a market overview of the most important asset classes, an assessment of the current economic situation in various regions, and our current model portfolios. Read more...

What Are the Chart Telling Us ?

As usual we review the long term charts with our favourite weekly indicators. No suspense : the bear market is not over yet. Just shy of the new year, financial markets continue to be dominated by the extent of monetary tightening. Especially in major advanced economies, bonds and stocks have shrugged off the summer rebound and posted losses on the view that high policy rates and quantitative tightening would persist longer. Much attention is now given to the coming recession in the U.S. economy. Read more...

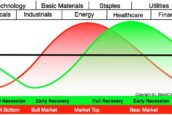

ABS Matrix Update for December ISM PMI

The business cycle, which encompasses the cyclical fluctuations in an economy over many months or a few years, can therefore be a critical determinant of equity market returns and the performance of equity sectors. Check our proprietary ABS matrix Read more...

What to consider when investing in crypto

Crypto is currently a questionable and speculative asset with high volatility. To prepare yourself for the risks, make sure you have assessed its long-term potential before you buy. You may also want to consider limiting your investments to an amount you can afford to lose. Some basic rules. Read more...

Behind The Crypto Scam

Bitcoin briefly fell below $15,700 on Tuesday. This is its lowest level since November 2020. The FTX scandal continues to weigh on the crypto world. But that's not the only dark cloud on the horizon. The latest is FTX, one of the largest trading platforms, which is accused of fraud. We review the scheme and the the latest developments in a complete Absence Of Trustworthy Financial Information ! Read more...

Are we still in a long-term bull market?

Bear markets are often littered with face-ripping rallies, of course, so the fact that we saw one should surprise no one. Read more...

Investment Strategy: Treats & Tricks

The return of inflation leads to a return of the cycle. From now on, it will be key to know how to identify the moments of inflection. This return of the cycle therefore allows a winning return of active management capable of anticipating inflections. It multiplies and diversifies opportunities. We remain tactically defensive in our investment committee. It is still important for investors to adopt a long-term perspective and not become over pessimistic. Read more...

The 200-Day Moving Average Rule of Thumb

The 200 day moving average has gained in popularity as it can be used in many different ways to assist traders. But we think it’s also an ideal recommendation for challenging markets like we’re experiencing today. Lately you probably didn't escape to what a "great support" the 200 days moving average is and such an "alarm signal" if broken. We review some basics here. Read more...

What Are the Charts Telling Us ?

As usual we review the long term charts with our favourite weekly indicators.No suspense : the bear market is not over yet. It is a bit confusing. It’s not yet clear if this move is one of those violent short-term rallies that will quickly be reversed, or the start of another multi-week bear market rally. Either outcome is possible. Read more...

What Are the Charts Telling Us ?

Most major stock markets are in bear market territory. “The trend is your friend” - until it is broken. And once broken, it usually takes quite some time for a positive trend to be restored. Momentum calls for momentum, whether it is positive or negative. It’s been the worst first half of a year for markets since the Great Depression. We tell the story and forecasts in what are the charts telling us. Read more...

How strong is this market?

Our ADX indicator.-Build and Use- If you are an active investor, you may have found yourself asking if the market's rebound from the June lows is for real. In recent weeks, a rising ADX line has confirmed the strength of the uptrend. Check it ! Read more...

Matrix Reloaded

This proprietary ABS matrix to guide us to the optimum investment opportunities in the prevailing economic environment tracking the recorded US ISM indicator published each month. Accordingly we review our investment recommendations to various investment approaches based on style or sensitivity. Read more...

What Digital Currency for Tomorrow ?

Crypto-currencies are like Icarus' wings: they melt away as they approach not the sun, but the limits assigned by their very architecture to their possible use in the financial world. Read more...

Tracking the Recession

RECESSION CHARTS : More and more it looks like recession is here. This includes a dramatic decline for ISM Manufacturing discovered early this month. Our proprietary ABS Matrix which shows us what could be decided relatively to our asset management styles and how we can position ourselves. Read more...

Finding the Market Bottom

Has the stock market hit bottom? Have stocks found support? When will prices stop falling? Stock traders ask these questions every day, but they keep looking in the wrong place to find the answers. Read more...

Cryptocurrencies : Tulipmania meets the real economy

Fintech and crypto apps have already expanded rapidly into digital cash, loans and complex products that can seem as simple as a credit card in e-mail form. That has created financial channels far beyond a one-way wager on Bitcoin or Bored Apes. it’s time for regulators to reflect on the real-world impact of the next boom-and-bust crypto cycle. Read more...

Bonds warning: Raise interest rates or we’ll do it for you

Jerome Powell played with fire, and the US economy is about to get burned. The bond market will be the incinerator. The bond market doesn’t get the attention it deserves. But bond markets are uncanny in predicting economic troubles ahead. Read more...

What If the FED Put Is Still Prevailing ?

Jerome Powell : "We all must be ready for the unexpected to occur, assess how risks have changed when it does, and stay aware of shifts in the strength of the economy. “ What does it mean ? where does the FED go ? see inside. Read more...

STRATEGY : Is this Time Different ?

OUR STRATEGY AND ASSET ALLOCATION OUTLOOK The current backdrop could easily be the most complicated backdrop that investors have ever faced, so our hope is to put things into perspective. Positioning portfolios for recession means deciding that the Fed will fail to win a game in which it ultimately controls nearly all the cards and sets nearly all the rules. We remain tactically defensive in our investment committee. It is still important for investors to adopt a long-term perspective and not become over pessimistic. Read more...

Be a Successful Investor

Markets are more volatile than ever, but investors aren’t changing with the times. Regardless of whether you invest or trade, your strategy needs to match the market conditions and match your long term plans. We propose you the following steps to help you to increase your investing success. Read more...

Risk Profile : Investing Adventurer

You are an INVESTING ADVENTURER ! Now discover how your investing personality shapes and drives the investment decision-making process. Read more...

Risk Profile : Investing Explorer

You are an INVESTING EXPLORER ! Now discover how your investing personality shapes and drives the investment decision-making process. Read more...

Risk Profile : Investing Travelers

You are an INVESTING TRAVELER ! Now discover how your investing personality shapes and drives the investment decision-making process. Read more...

Risk Profile : Investing Observer

You are an INVESTING OBSERVER ! Now discover how your investing personality shapes and drives the investment decision-making process. Read more...

What Kind of Investor Are You ?

Take the Risk Profile Test ! Understanding your investing personality can help you fine-tune your approach to investing. Find out how your investing personality shapes your investment decision-making process. Read more...

ANATOMY OF A BEAR MARKET (part 2.)

Recently, a lot of people have been talking about the possibility of a multi-year recession. So we propose additional key points of understanding of bear market structures, and influence of market sentiment. Read more...

What Are the Charts Telling Us ?

It is said that a picture is worth a thousand words. The charts and indexes provide indications of trends and should be used as a guide along with all the other available data before you make a long term investing decision. Coupling with a disciplined business cycle approach, it is possible to identify key phases in the economy, and to use those signals in an effort to achieve active returns from sector allocation. Read more...

Better an Egg Today than a Hen Tomorrow

OUTLOOK AND INVESTMENT STRATEGY UPDATE : There is always a time when financial markets diverge from the economic underpinning (under or over anticipating the future). In our fundamental approach we refer to the ISM manufacturing PMI indicator to gauge where we are in the economic cycle (i.e. the business cycle). The stock market tries to anticipate the business cycle which results in certain sectors outperforming the market at different points of that cycle. We adapt accordingly our investment strategy to our ABS MATRIX. Read more...

Business Cycle & Sector Rotation Methodology

BUSINESS CYCLE AND SECTOR ROTATION our methodology Read more...

Periodic Table of Asset Class & Sector Performances

Performances over times and reference tables Read more...

Investlogic's Tips : Are you a Trader or a Gambler ?

A successful trader/investor has a backtested trading plan that he sticks to and optimizes along the way, adapting to changing market conditions. Read more...

ANATOMY OF A BEAR MARKET

Lately, there has been much discussion that a major “bear market” is looming. But given the massive deviation from historical norms, would such a reversion fit the actual definition of a bear market, or will it remain a correction in an ongoing bull trend? INCLUDE a possible superbubble blow off by Jeremy Grantham Read more...

Roar with Confidence in 2022 the Year of the Water Tiger

2022 is the Year of the Water Tiger, which officially begins on February 1 in the Oriental lunar calendar. Feng shui experts predict that it will be a year made for bold action, since the tiger is known for its power and ability to do everything on a grand scale whereas water is associated with being sensitive, creative, and open to change. Read more...

Does Your Advisor Understand Responsible Investing? Ask Them These 5 Questions To Find Out.

Investors are putting significant and increasing emphasis on their portfolios’ exposure to climate change, but many financial managers/advisors are still woefully unprepared to talk to their clients about sustainable finance ! Read more...

What is Obvious is Obviously Wrong

OUTLOOK & STRATEGY 2022 In our view, the wall of worry built on the back of high multiple stocks bodes well for equities. The strongest bull markets do climb a wall of worry. This time around, the wall of worry has scaled to enormous heights. If four catalysts break the right way the market could move significantly higher next year. Among them: 1) Inflation peaks, 2) Central banks don't tighten too much, 3) Earnings remain very strong, 4) COVID ends. If all the scenarios come to fruition, the S&P could close as high as 5,775 Read more...

The Decider : The Market is always Right

Fill your bowl to the brim and it will spill. Keep sharpening your knife and it will blunt. Chase after money and security and your heart will never unclench. Care about people’s approval and you will be their prisoner. Do your work, then step back. The only path to serenity. -Tao Te Ching Read more...

We cannot command the winds but we can adjust the sails

OUTLOOK & STRATEGY 2022 There are conditions like in the trade winds regions when virtually all stocks rise. Then there are environments such as roaring 40’s with rougher seas when mounting headwinds make smart stock picking a particularly precious skill. Read more...

Investlogic's Tips : Myths and Reality of Trading

As you may already know, there are so many false statements that beginners run into before starting their trading journey. Those statements are illustrated on the layout and interpreted on our website Read more...

This time it is different ! LOL

No man ever steps in the same river twice, for it's not the same river and he's not the same man.” - Heraclitas ( c. 535 BC ) The river may continue to look the same, the experience may be similar; but the river has changed and so have they. Read more...

The wall of worry is growing, and stocks love to climb it

The market has seen a long uptrend, then a sudden pull back ! Most likely markets have room to run over the long-term, but that doesn’t mean the volatility is behind us. As scary as that sounds, it’s actually a healthy sign to have pullbacks and corrections. At Investlogic we use an integrated indicators system (technical and fundamentals) to take our investment decisions in a discipline way. Read more...

ABS - The Business Cycle Approach to Equity Sector Investing

We are glad to share with our clients and followers our proprietary ABS matrix (allocation to business cycle system), an integrated tool we use to achieve the optimum investment opportunities in the prevailing economic environment (recorded as the US ISM indicator published each month) and according to various investment approaches based on style or sensitivity. Read more...

METAVERSE at a glance

Metaverse technologies use Displays, Smartphones, sensor-type devices, and software to augment real-life environments with artificial experience. Most metaverse-based applications use smart devices to overlay digital information onto the user’s real-world view. Read more...

Stop TAFTA

The central problem of TAFTA/TTIP is the corporate sovereignty that is inherent in ISDS -- the fact that companies are allowed to place the preservation of their future profits above any other consideration, such as the environment, health and safety or social goals. Thus far from protecting the environment, TAFTA/TTIP is shaping up to be a very toxic trade deal. Read more...

R.I.P.

The Swiss Banking Secret is dead and rests in peace on the Federal Council's desk. Please do not pay any visit and instead of flowers make a donation in favor of our beloved FINMA. Read more...

Growing the Green Bond Market

Green bonds create a new flow of finance for low-carbon development. That’s crucial. But they do more – they have the potential to move the finance fulcrum in a cleaner direction, away from traditional fossil fuel investments and into the projects that will build our low-carbon future. Read more...

From Russia with Love : How to Play Russia

Nineteenth century statesman Lord Palmerston famously said that “nations have no permanent friends or allies, they only have permanent interests.” As anyone who has ever opened a history book knows, Russia’s permanent interest has always been access to warm-water seaports. So perhaps we can just reduce the current showdown over Crimea to this very simple truth: there is no way Russia will ever let go of Sevastopol again. Read more...

Financial Advisors Need Relationship Alpha

It takes a delicate mixture of compassion, knowledge and courage to provide direction to clients during uncertain or confusing markets. All markets are perplexing to some degree. This is the irony of investing . . . we trade actual capital today for the possibility of future returns Read more...

China is approaching its “Minsky Moment”

"It is clear to us that speculative and Ponzi finance dominate China’s economy at this stage. The question is when and how the system’s current instability resolves itself. The Minsky Moment refers to the moment at which a credit boom driven by speculative and Ponzi borrowers begins to unwind. It is the point at which Ponzi and speculative borrowers are no longer able to roll over their debts or borrow additional capital to make interest payments.... We believe that China finds itself today at exactly this juncture." Read more...

Les dessous pas sexy des accords transfrontaliers

Longtemps, le banquier suisse ne s’est préoccupé que du respect des lois suisses. La simple évasion fiscale que pouvait commettre un client étranger en lui confiant de l’argent ne concernait pas la banque suisse et ses employés. Ceci reposait sur la noble idée que chaque citoyen est responsable de déclarer sa fortune ainsi que ses revenus à ses autorités fiscales et que les banques n’ont pas à prêter assistance au fisc, a fortiori si celui-ci est étranger. Read more...

Feng shui investing in the year of the horse

It’s that time of the year again where visitors to China are deafened by firecrackers, mobbed by mass ranks of red-capped tourists, and overcharged for, well, everything. The year of the slippery snake is drawing to a close, the year of the galloping (and in 2014, wooden) horse is upon us. But it’s also the time to use our feng shui compass to figure whether this year’s qi will be good or bad news for investors. Read more...

Thunder Road Report : The New New Great Game

Here is the long awaited Paul Mylchreest’s Thunder Road Report. In this latest must read Monument Securities' report Paul talks about the geo-political confrontation between the US on one hand and China (in increasingly close cooperation with Russia) on the other, is evolving rapidly. We see a “New New Great Game” (NNGG) emerging Read more...

Russia a Glimpse into 2014

At this time of year, asset managers and brokers make forecasts as to which markets will perform the best in the coming year. We have done our work too, and we see the low valuation in both China and Russia as an opportunity for high returns on investment. Read more...

Emerging Chronicles : Shaping the Next Decade

As we embark upon a new year, Templeton EM believes 2014 could be an important year for many emerging markets, possibly establishing trends that could play out through much of the remainder of the decade. In particular, Chinese government reform initiatives announced in late 2013 could have far-reaching significance. And, major elections in a number of countries in 2014 could bring dramatic (or not-so-dramatic) changes. Read more...

Gutsy Traders Are About to Lose Everything

We're just 10 trading days into 2014 and investors are already fretting over major market shifts that haven't even happened yet... Everyone is falling prey to prediction season. They're extrapolating what they think might happen in the markets into actionable trades--instead of reacting to clear-cut trading signals. Read more...

2014 Outlook : Market Melt-Up

If world leaders can successfully navigate the treacherous waters of global restructuring over the coming years, eventually today’s seemingly endless period of weak economic performance will lay the foundation for a powerful secular bull market that may last for decades. Until then, investing today will require flexibility, risk management, and a willingness to embrace the fact that buy-and-hold investing has taken a back seat for the time being. Read more...

2014 Surprises and Predictions

Byron Wien, vice chairman of Blackstone Advisory Partners today issued his list of Surprises for 2014. This is the 29th year Wien has published his outlook and predictions on a number of economic, financial market and political surprises and trends likely to play out over the coming year. Will these surprises pan out? We don’t know, but they would certainly change the landscape in 2014 if they do. As Monty Python has famously said “nobody expects the Spanish Inquisition”. Read more...

2014 Outrageous Predictions

Outrageous Predictions 2014 is out Saxo's analysts have put together 10 potential scenarios that, underpinned by serious analysis from our Chief Economist Steen Jakobsen and Saxo Bank's Strategy Team, could unfold in 2014. Read more...

Bail-Ins Are Likely To Take Place

The era of bondholder bailouts is ending and that of depositor bail-ins is coming. Preparations have been or are being put in place by the international monetary and financial authorities for baili-ns. The majority of the public are unaware of these developments, the risks and the ramifications. Read more...

Looking Over our Shoulders : 2014 Outlook

It is said that making predictions is often a risky business, particularly when they're about the future. The “early line” is what book makers call the very first predictions by odd makers about a given outcome. Early lines are the riskiest predictions of all. Sheer folly. Pure chutzpah. All hat, no cattle. With that in mind, and tongue firmly in cheek, here are our early lines for 2014 – in no particular order of importance as we discuss the top risks to our 2014 central scenario. Read more...

Risk is a four-letter word

The markets seem to think we live in a largely riskless world. One hedge fund manager once proudly stated that life is a bull market intersected by corrections. In the midst of the credit crisis I laughed at him. Looking at the state of the world now, he might be laughing back, having concluded that the 2007 financial crisis and the 2008 fall of the House of Lehman were nothing more than bigger corrections and hence thumping buying opportunities that could only have been missed by idiots. Read more...

Russia 2013 : A Mixed Picture

In Russia, 2013 we saw a confirmation of the economic slowdown that became obvious by the second semester of 2012. The slowdown has even get worse over this summer. Still, during the same period, Russia has also experienced a strong increase in foreign direct investments, confirming the attractiveness of the Russian economy. This gives us a view to the mixed picture of an economy in search of its identity among various models. Read more...

Emerging Markets Chronicles: Submerging Markets ?

Global stock markets have been on a tear. In the U.S., large- and small-caps are each up about 30% so far this year. Even the struggling euro zone markets have gained almost 20%. Emerging markets, however, are a different picture. The MSCI Emerging Markets Index is down around 5% this year, with many countries struggling mightily. Read more...

Thunder Road Report : Into a Bubble ?

One of the slightly irregular economic publications I look forward to receiving is Paul Mylchreest’s Thunder Road Report. In this latest must read Monument Securities' report Paul starts "Here we go again, creating another asset bubble for the third time in a decade and a half".“Have we really got to the point where it’s just about more and more QE, corralling more and more flow into the equity market until it becomes (unsustainably) ‘top-heavy’?“ Read more...

Swissness : Swiss private banking’s competitive advantages

The bank deal signed between Switzerland and the United States aimed at ending the long-running dispute over US tax dodgers with money in Swiss bank accounts has had a very lukewarm reception in the Swiss opinion. Read more...

Sustainable Investment has Entered the Mainstream

While there was a time when ethical, sustainable and responsible investment were very much niche areas, in the 21st century, investors want much more than just a decent financial return from the money they’ve invested. Environmental, social and governance (ESG) issues are now seen as paramount to a large proportion. This shift is being led by some brilliant organisations, and is placing sustainable investment at the forefront of a really significant change in the investment industry. Read more...

Gold : From the Situation Room

Public opinion and sentiment towards gold remains rotten, which is exactly what you expect to see at a major low, with the investing public at large, having been duly “educated” by the mainstream media, harboring a negative attitude to gold and if anything inclined to short it. Lastly, seasonal factors couldn’t be better – August and September are traditionally the best months of the year for gold. Read more...

Panorama des agences de notations extra-financière

Le métier d’analyse extra-financière s’est surtout développé depuis la fin des années 90. Il consiste à évaluer les politiques Environnementales, Sociales et de Gouvernance (ESG) des entreprises, des États ou d’autres types d’émetteurs de titres. En l’espace de quinze ans, le marché de la notation extra-financière s’est fortement développé et a déjà traversé une première phase de consolidation (2008-2010). Read more...

Zermatt Summit 2013 : The Common Goods

At a time of enduring financial crisis, widening gaps between developed and vulnerable economies and increasing nationalist agendas; it is more than ever necessary to remind ourselves that our interdependence makes us de facto an international community. Read more...

Switzerland to be the world leader in sustainable finance by 2015

Switzerland has to create the culture shift required to combine market mechanisms in order to promote sustainable outcomes. The Swiss tax regimes, legal and regulatory structures must be both domestically and internationally attractive and competitive to incorporate institutional and individual investors into these opportunities over time. Read more...

LEX AMERICANA

The portrayal of the assault of the IRS against Swiss Banks has usually been seen from a U.S. perspective. There is an insinuation that the IRS will put Swiss banks in their place, and they certainly do have the power to do that. While the Swiss have complied with the IRS to some extent, through the revelation of tax evaders names inside the UBS branches in the U.S. the Swiss are not cow-towing to the IRS demands in disclosing all names of U.S. clients they have despite the pressure from the IRS to do so. Read more...

The Golden Opportunity

I had the opportunity to attend the Swiss Mining Institute seminar in Geneva and meeting with leading gold miners management and commodity experts. If the Gold mining sector has been slammed with Gold sharp drop, mining companies are more “pie in the sky” than owning actual bullion, so mining shares typically move much more sharply than Gold does. Read more...

Emerging Chronicles : Check In - Check Out

There are several notable emerging market performers where positive local macroeconomic developments have attracted strong investment flows. Given that yields on some assets seen as “safe” are close to record lows, the attraction to potentially higher-yielding, but riskier assets such as emerging-market equities has continued to grow. Of course, we’ve seen some disappointments too. Most larger emerging markets have lost ground year-to-date. Read more...

Path to the Sustainable Financial Centre Switzerland.

Making sustainability an inherent part of the Swiss Financial Centre brings tangible and lasting benefits for its actors in terms of positioning, attractiveness and competitiveness on an international level. Furthermore, Switzerland can build upon a strong tradition of democratic values and high environmental standards. The country is therefore placed at the forefront in a journey towards a sustainable financial system. Read more...

Switzerland : After the Rain...the Storm

Five months after U.S. action over tax evasion led to the closure of the country's oldest private bank, and with formal investigations under way into some of its biggest institutions, the Swiss government urgently wants a compromise to end threats of criminal charges that have hurt a vital national industry. Switzerland aims to save its banks from heavier punishment in the United States for helping wealthy tax cheats by sidestepping its own famed secrecy laws to let bankers disclose data to U.S. prosecutors. Read more...

Overcoming the Crises Through Sustainable Action

In Geneva mid April we went to the biggest conference on sustainable development in Europe, delegates discussed how cities can drive a transition towards sustainability in the face of the current economic, environmental and social crises. As global policy processes have largely failed to put the world on the track to sustainability, hopes are increasingly placed on local and regional actors. Read more...

Impact Investing : Can Economic Returns And Social Impact Be Achieved Together ?

Responsible investment is an integral part of the investment beliefs shared, among many socially responsible actors, by Investlogic, taking account of mankind, the environment and society in our investment decisions. We operate on the basis of a belief that financial and social returns can go hand in hand. At the same time we are aware that this is an ongoing process that is not yet complete. Read more...

Eternal Russia - Reboot ?

Our viewpoint is best summarised by our repeated assertion that that “Russia is not, and never will be China – it is not Belgium either. Russia is now a middle-sized, middle-income, middle-European country with both greater-than-average potential, and some major problems. Long gone are the days when Russia had the world’s best parties and was either the world’s best – or its worst – financial market, sometimes both in the same year. Read more...

Emerging Markets Roundup: Following the Smart Money

In the emerging markets, a more complicated global economy calls for a more sophisticated strategy. The opportunities of investments remain high. It is however necessary to refine from now on our strategy of investment according to the particular case of every country. It is our quest in our search for new emerging countries to inform you of the best opportunities throughout our tours in Emerging Market. Here it is. Read more...

Prospérité sans croissance

Si la croissance est une impasse, comment s'en passer? Pour répondre à cette question, il faut comprendre pourquoi nos économies ont aujourd'hui besoin de croissance pour ne pas devenir socialement instable. Comment sortir de cette dynamique devenue insoutenable? Read more...

Finding the Value in Environmental, Social and Governance Performance

Today more than ever, investors are scrutinizing a company’s ESG performance for clues about the company’s future performance, and they are becoming increasingly sensitive to ESG risks. At the heart of the matter is the kind of information investors pay attention to — and that is news of an ESG material issue. Read more...

Reinvent Capitalism Without Delay

Initially, the business hardly took seriously the initiative Minder while its author, long considered a wacky, was able to detect a “deep” wave in the ultra liberal economy. As such, the result of last Sunday (12.03.03) is already outdated as we shall see. In the world, the trend is not only unanimous against unfair wages, there is also a no way through. Read more...

Gold : From the Situation Room

It’s a tad puzzling that gold has broken into new low, despite enough catalysts to move a herd of stubborn mules. But that’s the hand we’re dealt right now. We can’t get up from the table until the game reaches its conclusion. Besides, I think the stall in prices is giving us one last window to buy before prices break permanently into higher levels for this cycle. Read more...

Another year of growth for European SRI mutual funds

The 12th edition of Vigeo Italia report “Green Social and Ethical Funds in Europe” offers a general outlook on SRI mutual funds in Europe. The Vigeo study provides data regarding the number and size of funds but also information about SRI approaches, top performing funds, specific costs, companies within the portfolios and asset allocation. Read more...

Gestion de Fortune : Activité à Hauts Risques

Les banquiers privés et les gérants indépendants... sont moins soumis à des situations de conflits d’intérêts ... et contribuent à la prospérité de la Suisse, sans risque pour le contribuable de devoir les sauver en cas de défaillance.” Read more...

New Year... Old Issues

This is the time of year when all the “experts” will be making their 2013 predictions - but few will address where they were wrong in previous predictions. I’m more interested in why I was wrong. It seems I always underestimate the ability of sociopathic central bankers and their willingness to destroy the lives of hundreds of millions to benefit their oligarch masters. Read more...

The Search For New Emerging Markets

The severity of the deepening recession in Europe has shocked government and industrial leaders in all the major emerging-market countries — China, Brazil, Russia and India — and though they have reacted quickly they have discovered that their usual tactics to boost output, such as easier monetary policies and export subsidies, have largely failed so far. Against this backdrop, some other smaller ‘emerging’ or ‘growth’ economies are becoming increasingly important. Read more...

SRI in Europe : Reasons of Success

Wealthy Europeans are Deepening and Expanding their Commitment to Sustainable Investments and Impact Investing. The last study of Eurosif shows that the sustainable finance is growing fast. However this success is due to very different factors as the national regulations, the types of clienteles, the decision-making generations, the characteristics of products, the evaluation of the impact. Read more...

How to Be an Old Tai Chi Master

It seems counterintuitive, but emerging market growth is a much bigger, slower movement. We tend to think of emerging markets in flashy, sudden bursts. There is a lot of hype out there when it comes to emerging markets. "This is the next hot market!". I just think of it as a lot of noise. It distracts you from making solid investment decisions. If you're always chasing, you're always falling ! Read more...

Guide des organismes d’analyse sociale et environnementale : Mise à jour 2012

Edité pour sa première version en octobre 2001 et mis à jour à plusieurs reprises, le guide de l’ORSE des organismes d'analyse sociétale dresse un panorama de l'ensemble des organismes dont l'activité porte ou s'étend à l'analyse et à la notation extra financière des entreprises. Read more...

Sustainable Lifestyles : Today's Facts & Tomorrow's Trends

Here a basic systemic and holistic approaches through multi-stakeholder involvement for a sustainable future. This process will result in a roadmap for strategic action for policy makers and will deliver innovative ideas for business, research and society, regarding the enabling of sustainable lifestyles in European society. Read more...

The Swiss Version of Global Warming

The new Switzerland requires some mental adjustment for those who know its past, but it still remains the world's leading offshore center in every area you may need to grow and protect your wealth – a strong currency, private banking, insurance, annuities and excellent investment management. Read more...

Sustainable Investing: Establishing Long-Term Value and Performance

The evidence is compelling: Sustainable Investing can be a clear win for investors and for companies. However, many SRI fund managers, who have tended to use exclusionary screens, have historically struggled to capture this. We believe that ESG analysis should be built into the investment processes of every serious investor, and into the corporate strategy of every company that cares about shareholder value. ESG best-in-class focused funds should be able to capture superior risk-adjusted returns if well executed. Read more...

Point Break : Long Term Cycles

Long term cycles generally take a generation to work their way through the investor public, have significant magnitudes of becoming undervalued and overvalued, and have significant implications for the way that investors should approach each of these periods. Due to their length it is sometimes not easy to identify them but generally their effects are significant and rarely can they be avoided. Read more...

Elinor Ostrom : La question des « biens communs mondiaux »

Les travaux de E. Ostrom sur les “biens communs mondiaux” dans un courant néo-institutionnaliste opposé à la théorie économique néo-classique qui ont remis en lumière la préoccupation de dessiner un cadre conceptuel capable de fournir des clés politiques pour une gestion de ce qui échappe - ou doit échapper - au marché. Dans la foulée de la déconfiture de Rio+20 il nous a semblé important de rappeler ses travaux. Read more...

Le développement durable : le concept d’un monde en mutation ?

L’expression « développement durable » apparaît pour la première fois dans un document de l’Union internationale pour la conservation de la nature (UICN), au début des années 80. Le Rapport Brundtland, au nom plus évocateur de « Our common future » (Notre avenir à tous), publié en 1987, va populariser le concept. Read more...

Individual Principles for the Responsible Investor

The aim of these principles is to provide a framework for analysis and discussion that will enable professionals to launch actions consistent with the requirements of a responsible financial sector that benefits a sustainable economy Read more...

Voyage au centre de la Russie

Entre Solitude et Frénésie : Intemporelle Russie Le professeur-voyageur Georges Nivat, nous ouvre son carnet de notes prises dans cette partie méconnue du monde où tout y est «profondément russe»: les églises à bulbes poussent (à nouveau) comme sur un terreau uniforme. Et paradoxalement, la Sibérie a été et reste une terre de brassage: Read more...

Redefining Emerging Markets And Growth Market Investment Opportunities

In 2005, GS introduced the concept of the “Next 11” or the “N-11” as it has become known. This was a simple description to bracket the eleven most populous countries and to see if they, collectively or individually, might have BRIC-like potential. Read more...

Silk Road: Expanding Economic Opportunities

Our focus on Emerging Economies leverages strong and historical cultural links that bind a region to find growth opportunities in several lucrative markets such as in Asia, Central Asia, Russia and CIS. We seek to utilize our domain expertise and leverage our broad network of relationships to create value and contribute substantially to the future growth and success investments. Read more...

Sustainability: Care Instructions for our Planet

One of our fields of expertise is Natural Resource Management and Sustainable development. Here you will get our dissertation "Does Socially Responsible Investment Contribute to Sustainable Development ?" The answer is definitely YES. Have a look at the pdf http://scr.bi/HuKrEE Read more...