2014 Surprises and Predictions

January, 08 2014 If 2013 was pretty much a continuation of 2012 – maybe 2014 will be something different! 2014 is going to prove a lot more “interesting” than widely predicted.

If 2013 was pretty much a continuation of 2012 – maybe 2014 will be something different! 2014 is going to prove a lot more “interesting” than widely predicted.

The markets are generally displaying the complacency of a man who just walked across a mine-field and came out with all his limbs still stuck on…

Beware – the problems in the global economy have not been resolved – they have been papered over. Everyman and his dog wants to short treasuries, buy dollars, increase their equity longs, dump emerging currencies, and is still baying at China imagining some sort of a crisis (and this for the past ~14 years). Fools, we think!

Our betting is that the three top trades for 2013 still have legs; in decreasing order of conviction: LONG RMB, short yen, long Nikkei. We missed the equity rally and will likely miss it again. We think it ends in tears.

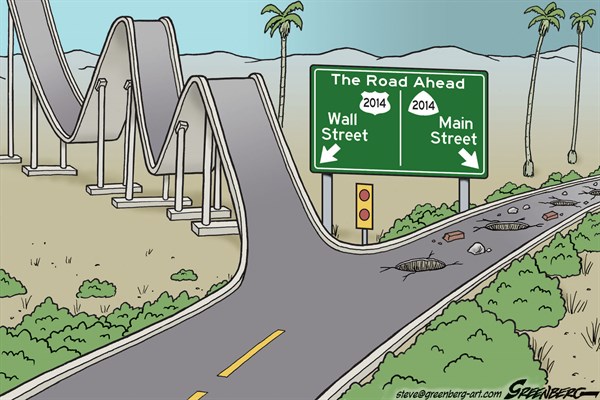

We continue to be skeptical about equities expecting only a weak recovery in the West. The only place where we meet the consensus is the emerging currencies, which are a good trading short.

Good luck – we will need it…

Wien defines a “surprise” as an event which the average investor would only assign a one out of three chance of taking place but which Byron believes is “probable,” having a better than 50% likelihood of happening.

Will these surprises pan out? We don’t know, but they would certainly change the landscape in 2014 if they do. As Monty Python has famously said “nobody expects the Spanish Inquisition”.

Here are a list of surprises for the coming year. A “surprise” as an event which the average investor would only assign a one out of three chance of taking place but which I believes is “probable,” having a better than 50% likelihood of happening.

- We experience a Dickensian market with the best of times and the worst of times. The worst comes first as geopolitical problems coupled with euphoric extremes lead to a sharp correction of more than 10%. The best then follows with a move to new highs as the Standard & Poor’s 500 approaches a 20% total return by year end.

- The U.S. economy finally breaks out of its doldrums. Growth exceeds 3% and the unemployment rate moves toward 6%. Fed tapering proves to be a nonevent.

- The strength of the U.S. economy relative to Europe and Japan allows the dollar to strengthen. It trades below $1.25 against the euro and buys 120 yen.

- Shinzo Abe is the only world leader who understands that Dick Cheney was right when he said that deficits don’t matter. He continues his aggressive fiscal and monetary expansion and the Nikkei 225 rises to 18,000 early in the year, but the increase in the sales tax, the aging population and declining work force finally begin to take their toll and the market suffers a sharp (20%) correction in the second half.

- China’s Third Plenum policies to rebalance the economy toward the consumer and away from a dependence on investment spending slow the growth rate to 6% in 2014. Chinese mainland traded equities have another disappointing year. The new leaders emphasize that their program is best for the country in the long run.

- Emerging market investing continues to prove treacherous. Strong leadership and growth policies in Mexico and South Korea result in significant appreciation in their equities, but other emerging markets fail to follow their performance.

- In spite of increased U.S. production the price of West Texas Intermediate crude exceeds $110. Demand from developing economies continues to outweigh conservation and reduced consumption in the developed world.

- The rising standard of living and the shift to more consumer-oriented economies in the emerging markets result in a reversal of the decline in agricultural commodity prices. Corn goes to $5.25 a bushel, wheat to $7.50 and soybeans to $16.00.

- The strength in the U.S. economy coupled with somewhat higher inflation causes the yield on the 10-year U.S. Treasury to rise to 4%. Short-term rates stay near zero, but the increase in intermediate-term yields has a negative impact on housing and a positive effect on the dollar.

- The Affordable Care Act has a remarkable turnaround. The computer access problems are significantly diminished and younger people begin signing up. Obama’s approval rating rises and in the November elections the Democrats not only retain control of the Senate but even gain seats in the House.

Every year there are always a few Surprises that do not make the Ten either because I do not think they are as relevant as those on the basic list or I am not comfortable with the idea that they are “probable.”

Also rans:

- Through a combination of intelligence, extremism, celebrity and cunning, Ted Cruz emerges as the clear front runner for the 2016 Republican presidential nomination. Chris Christie and the moderates fade in popularity as momentum builds for fiscal and social conservative policies.

- In two and a half years the price of a bitcoin has increased from $25 to $975. The supply of bitcoins is fixed at 21 million with 11.5 million in circulation. Bitcoins lack gold’s position as a store of value over time. During the year bitcoin’s acceptance collapses as investors realize that it cannot be used as collateral in financial transactions and its principal utility is for illegal business dealings where anonymity is important.

- Overcoming objections from the Cuban exile community, President Obama opens discussions on initiating trade and diplomatic relations with Cuba. A reduction in sanctions is proposed, as well as limited financial support in the form of bonds, quickly dubbed as “Castro convertibles.”

- Hillary Clinton decides not to run for President in 2016. She says her work with various Clinton not-for-profit initiatives is important and unfinished. Specifically, she explains that her health was not an issue in her decision. The Democratic race for the top seat becomes chaotic.

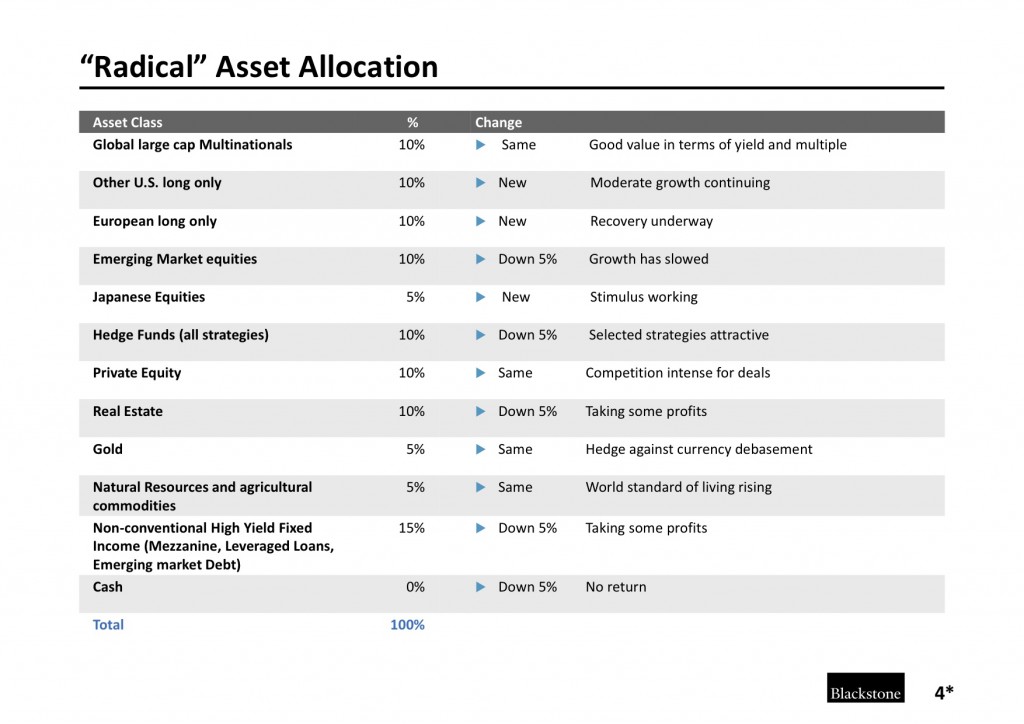

Byron Wien’s portfolio for 2014

Byron Wien, Blackstone’s vice chairman, last week outlined his 2014 asset allocation recommendations for institutional investors, split into two categories – long only and alternatives.

Mr. Wien says he believes there is further upside ahead in U.S. equities despite his belief that a correction “could occur at any time.” His current portfolio is positioned with the view that world growth might be “below expectations in contrast to the widespread forecasts of a significant pickup in economic activity.” He sees modest earnings ahead and doubts the likelihood of more double-digit increases in market indexes.

Here’s how his portfolio looks in the coming year:

- 10% position in high-quality global multinationals.

- 10% position in small and medium capitalization American companies.

- 10% position in European stocks, as he banks on a modest recovery.

- 5% position in Japan.

- 10% position in emerging markets: “Valuations are very reasonable, profits are growing and I think we will see better performance in 2014.”

- 10% position in hedge funds: “I have seen them provide strong risk-adjusted returns over a full market cycle.”

- 10% position in private equity: “There will be a number of high-return opportunities in the years ahead as companies sell off divisions to rationalize their strategic operating structure.”

- 10% position in real estate.

- 5% position in gold: “Although inflation remains tame, the price of gold reaches $1,900 an ounce as central bankers everywhere continue to debase their currencies and the financial markets prove treacherous”

- 5% position in natural resources and agricultural commodities.

- 15% position in high yield securities: “These are not conventional high yield bonds where yields have dropped sharply over the past two years, but mortgages, leveraged loans and mezzanine financing where attractive yields are available with a minimum of risk.”

- No position in U.S. Treasuries: “I expect yields to rise on these notes and bonds over the next year.

In addition we share the latest Morgan Stanley Macro Predictions