Cryptos’ Volatility Explained

May, 15 2024

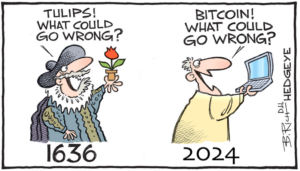

Cryptocurrencies like bitcoin are notorious for periodic eye-popping price swings.

If bitcoin and other crypto prices going up and down leaves you curious and/or confused, you are not alone. Here are some of the factors behind the sometimes stomach-churning volatility that help drive crypto prices, using bitcoin as our guide.

What affects bitcoin’s price?

There are thousands of cryptos, and while most have some similarities, each one is unique. We’ll talk about bitcoin here to get specific because it was the first crypto launched. But you should know that each cryptocurrency can have differing factors that drive their respective prices.

With that said, a commonality across all cryptocurrencies is the difficulty in identifying fair value. The reason is that valuation methods that are used for traditional investments do not apply to bitcoin and other cryptocurrencies.

Unlike stocks, for example, cryptocurrencies have no cash flow and do not have the ability to pay dividends, and unlike commodities (such as gold and copper), they have no industrial use.

Traditional methods that use this data to help derive an investment’s fair value are not applicable to cryptocurrencies, and the inability to use established valuation methods has helped lead to big crypto price gyrations.

As today social media

A Satire of Tulip Mania by Flemish painter Brueghel the Younger (ca. 1640), depicting the social hysteria at the time as if the market was run by brainless monkeys.

Bitcoin’s price is also impacted by a wide variety of other factors, including:

Company news reports.

Companies that announce investments in Bitcoin technology, adoption of bitcoin as payment for goods or services, or even the acquisition of bitcoin for their own reserves can positively affect the price. Conversely, announcements that bitcoin will no longer be accepted as a form of payment or the adoption of competing cryptos may negatively impact bitcoin’s price.

A high-profile example occurred when Tesla announced that the electric car company would start accepting bitcoin as a form of payment in March 2021.1 In the wake of that announcement, bitcoin’s price went up about 5%.2 A couple of months later, when Tesla halted cryptocurrency payments due to environmental concerns over bitcoin mining, the price dropped about 5% in the immediate aftermath.

Economic performance.

Bitcoin is a high-risk investment compared with most traditional investments (e.g., stocks and bonds). Like other riskier investments, bitcoin’s price may have a tendency to perform better when the economy and/or market is generally thought of as doing well or expected to do well, and investors are willing to take more risk.

Alternatively, bitcoin’s price may go down when the economy or market is not performing well or is not expected to perform well, and investors are generally not as willing to invest in riskier assets.

Central banks.

While central banks do not control cryptocurrencies, some crypto analysts have observed that the US central bank in particular may be indirectly influencing bitcoin’s price. The Fed does affect interest rates and, consequently, inflation.

Some analysts think bitcoin’s price may increase when the Fed lowers interest rates, and bitcoin’s price may fall when the Fed raises rates.

Of course, bitcoin is a relatively new asset, compared with stocks and other traditional assets that have existed for much longer, and so there is not much historical data to support that these relationships are correlated.

Regulatory actions.

A significant source of uncertainty for bitcoin and other crypto prices is government regulation, along with any other actions that governments may take in regard to cryptocurrencies.

For example, bitcoin fell 8% in the days immediately after China banned cryptocurrency mining in June of 2021.2 Conversely, the announcement of regulations perceived as favorable—such as a 2021 executive order signed by President Biden establishing government oversight for cryptocurrencies —can boost bitcoin prices. Immediately after the Biden administration’s announcement, bitcoin’s price rose almost 9%.

In general, investors favor certainty over uncertainty, and this executive order was perceived as a framework for creating more certainty in regard to cryptocurrencies. It’s worth noting there remains a significant amount of uncertainty surrounding global regulation of cryptocurrencies.

World events.

Similar to how geopolitical and macroeconomic news can affect stocks and other investments, they can also influence bitcoin’s price over the short and long term.

For example, the war in Ukraine led many investors to reduce the amount of risk they were willing to take, and that negatively impacted bitcoin and other crypto prices.

Accessibility.

Bitcoin is not new—it was created in 2009. But investment options that enable investing in bitcoin have started to proliferate in recent years. This includes futures, ETFs, and other ways to invest indirectly in bitcoin. The bitcoin futures market, in particular, has grown dramatically in size and liquidity.

Futures allow investors to buy or sell contracts based on the underlying price of bitcoin. Some crypto watchers think that trends in the bitcoin futures market may influence short-term changes in bitcoin’s price.

Network factors.

Features specific to each network, such as the Bitcoin network, can have an impact on the strength and security of the network. This can influence user sentiment toward the network and its token—with the potential to ultimately influence the crypto’s price.

While the code and rules of the Bitcoin network are unchanging, some elements that influence the network’s overall strength and security are dynamic. This includes the hash rate (the total computational power being used to mine and process transactions).

The more computing power in the network, the greater its security and overall resistance to attack.

When China banned bitcoin mining in June of 2021, for instance, the total hash rate of the network fell by over 50% (China is an epicenter of bitcoin mining).6 It has been speculated that the sharp decline in the hash rate may have led to concerns over the security of the network. As previously noted, bitcoin’s price fell 8% shortly thereafter.

Bitcoin and bitcoin

An interesting fact is that Bitcoin is the network that the cryptocurrency operates within, and its token is also called bitcoin (BTC). That naming system is not always the case for other networks. For example, on the Ethereum network, its token is called ether (ETH).

Crypto volatility and your portfolio

Buying bitcoin and other cryptocurrencies may not be appropriate for everyone. Before buying, remember that crypto is highly volatile, and may be more susceptible to market manipulation than securities.

Also note that crypto holders don’t benefit from the same regulatory protections applicable to registered securities. Crypto holdings aren’t insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation, and the future regulatory environment for crypto is currently uncertain.

All these factors mean you should only buy with an amount you’re willing to lose.

Even if you are a believer in the future for crypto, it’s critical to learn as much as you can about what factors influence its price before entering the market—including the big historical price swings that have occurred on a relatively frequent basis.

Until next time

* Fidelity Active Investor