What to consider when investing in crypto

November, 24 2022

Many of the assets one currently invests in have long, storied histories. The use of gold in trade has been traced as far back as 560 BC to the ancient Kingdom of Lydia. The first modern stock exchange was created over 400 years ago in Amsterdam. Even ETFs have now been traded for over a quarter of a century.

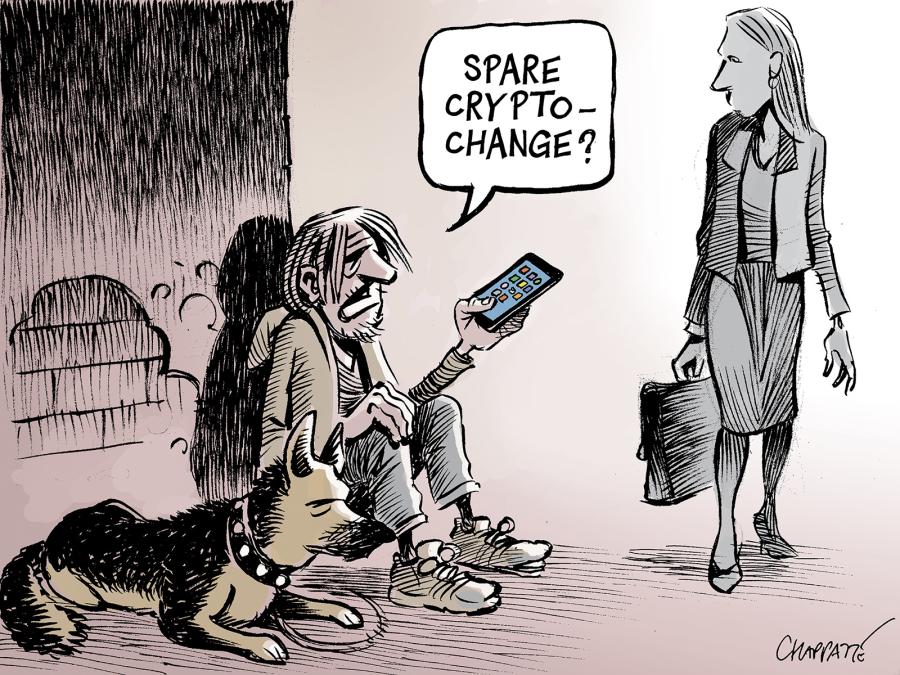

FTX’s collapse underscores the need for regulating crypto. SEE FT article

We have taken a constructive but cautious approach to digital assets so far. Constructive because the innovation potential of blockchain (and decentralised ledger technology) is considerable. Cautious because we were aware that these assets are ultra-sensitive to liquidity, as the downturn in the first half of 2022 has impressively demonstrated.

Explore key considerations for your portfolio.

- Investors should consider whether crypto fits their portfolio goals, risk profile, and personal convictions before investing.

- Crypto prices are currently volatile, and may have a higher chance of going to zero than many other assets.

- As a digital asset, crypto also requires specific security considerations.

Wondering if crypto investing is right for you?

Begin by asking yourself these 4 fundamental questions:

- Do you understand the crypto landscape and the risks involved in investing?

- Are you comfortable with the volatility?

- Do you know how to keep your crypto safe?

1. Get educated

When you hear about people investing in crypto, it might sound like a singular asset like a stock or a bond. It’s not. “Crypto” encompasses a wide range of investments with varying purposes, including bitcoin, ethereum, and more than 19,000 other cryptocurrencies—many untested and unlikely to survive.

Before you invest, get educated on the ins and outs of this fast-growing industry. For example, you should be able to explain the value of blockchain technology and decentralization to friends and family. If you’re interested in bitcoin, you should know why concepts like cryptographic hashes and mining are important to its function.

In addition to the fundamentals, investors should be knowledgeable about the latest crypto news. It’s a fast-paced market, and new developments happen almost daily. Government regulations are also evolving, and each new decision can impact how crypto is treated legally.

Once you’ve learned how the technology and economics work, be honest with yourself: Do you truly believe crypto will have value in the long run? If your answer is “no” or “I’m unsure,” it may not be the right investment for you. This is an important question because choppy markets may test your conviction.

2. Prepare for volatility

There are no two ways about it: Crypto investors currently ride wild price swings. You’ll want to ask yourself if you’re comfortable with the turbulence before investing.

Consider bitcoin, the oldest and largest cryptocurrency by market cap. Bitcoin’s price regularly experiences both double-digit drops and double-digit rallies, sometimes within the same week. If you bought a single bitcoin at $7,000 at the start of the coronavirus pandemic in March 2020, it would have risen to $69,000 in November 2021—a gain of over 850%. But by now November 2022, it would have plummeted to $16,500—a price cut of over 70% from its November 2021 highs.

Ethereum has seen its share of volatility as well. In March 2020, it hovered around $120. It then skyrocketed over 3,900% to $4,867 by November 2021. By June 2022, it had dipped back down to $880.

Despite the 2022 bear market, buy-and-hold investors who entered the crypto market in 2020 or earlier may still have gains. But many investors have also lost money, or will realize losses down the road. Time will show if cryptocurrency prices become less volatile over time. For the near future, however, potential investors should be prepared for continued volatility.

TOTAL MARKET CAP

3. Manage risks

Given the volatility and uncertainty of crypto investing, it’s best to think defensively. While there can be a lot of upside, remember that the downsides can be sudden and sharp. Also note that crypto may have a higher chance of going to zero than many other assets. In light of this, you may want to consider limiting your investments to an amount you can afford to lose.

If you’re looking to diversify your portfolio or are saving for a particular goal (particularly a short-term goal), crypto may not be an appropriate investment vehicle due to its unpredictability.

If you make gains that make crypto a larger part of your portfolio than intended, consider reallocating at least some of those gains to more stable asset classes. This may help iron out some of the unpredictability from your overall holdings.

4. Get smart about security

One of the most important aspects of investing in crypto is keeping it safe keeping it safe. Investors who aren’t interested in learning the ins and outs of crypto cybersecurity may find it easiest to keep their coins with a trusted custody provider with strong and audited security protocols. These platforms generally have security processes that may be better suited for beginners.

On the other hand, investors looking for a more hands-on approach may choose to custody and secure the asset themselves. This typically involves buying crypto on a crypto trading platform, then transferring holdings to a private digital wallet or physical cold wallet (a USB-like device for crypto storage)

Strategies that can help you store bitcoin and other cryptos safely

Here are 4 strategies that can reduce the chances your crypto gets stolen.

1. Choose where to store your crypto

There are 2 primary options to consider: Store your crypto with a trusted custodian, or provide your own custody.

Store your crypto with a trusted custodian

Third-party custodians may be a better option for inexperienced investors. One example of a third-party custodian is traditional trading platforms. These are typically platforms that traditionally offer equities, and are now also offering crypto. There are a few advantages to storing your crypto with this method.

First, you may have a lower chance of losing access to your crypto. If you lose your login, you may be able to work with a dedicated customer service team to recover it. This often isn’t the case if you provide your own custody, where it can be impossible to find your login information if you lose it.

Second, keeping your investments secure can be a simpler process if you choose a reputable custodian with years of experience. Providing your own custody can be a complicated, multi-step process with more chances for errors. In contrast, using a third-party custodian may mean you only need to keep track of one username and password.

All things considered, this route may be the most secure strategy for those who don’t have time or the desire to learn about the nuances of crypto cybersecurity.

The one drawback to this strategy is that some platforms do not yet provide the ability to send your coins to other wallets. Though this may change in the future, it may also not be a significant downside if your only goal is to use crypto as an investment.

Provide your own custody

If you decide to manage your own security, you’ll first buy crypto on a crypto trading platform. When you complete your purchase, it’ll initially be stored in a digital account (also known as a “hot wallet”) managed by the platform. From there, consider transferring it to a digital crypto wallet or a physical, USB-like device known as a “cold wallet.”

The benefit of providing your own custody is that it gives you full ownership of your coins. You can use them however you want, including to pay for goods and services.

The downside is that it can be both more complicated and more risky. If you lose the password to your wallet, or accidentally send your crypto to the wrong wallet address, you won’t have access to a customer service department. Cold wallets may protect you from virtual theft, but are still vulnerable to physical theft and damage. Any of these events can result in losing access to your crypto forever.

2. Always research founders’ backgrounds before investing

Because anyone can start their own coin, crypto often attracts pump-and-dump scams (commonly referred to as “rugs” or “rug pulls”). In 2015, a Bulgarian woman named Ruja Ignatova launched OneCoin, promising it would soon overthrow bitcoin. After accumulating over $4 billion from investors around the world, Ignatova pocketed the money and disappeared.

New investors may want to consider sticking to cryptocurrencies that have established histories and have survived impactful events. Also look for interest from institutional investors with large research teams. Coins that have institutional interest may be comparatively less likely to be brought down by a single bad actor.

However, if you’re committed to exploring relatively unproven coins, always research the founders’ backgrounds before you jump in. This might help you spot potential red flags. Ignatova, for example, had a history of frauds and multi-level marketing scams.

3. Only buy through established exchanges with reliable histories

If you choose to buy your crypto on a crypto trading platform instead of a brokerage, choose your exchange carefully, as security features can vary widely.

Consider the example of Canada’s largest crypto exchange, QuadrigaCX, whose CEO passed away while traveling in 2018. Because only he had the password to the company’s cold wallets, customers suddenly found themselves locked out of their investments.

When choosing an exchange, consider sticking to well-funded exchanges with at least several hundred employees. Also be wary of exchanges that offer high yields, as they are often not sustainable. One example is Voyager Digital, an exchange that advertised yields as high as 12%. In July 2022, the company filed for bankruptcy.

Are crypto exchanges safe?

As we noted in the section “Choose where to store your crypto,” crypto exchanges come with both benefits and risks.

Investors should consider their personal risk tolerance before choosing how to invest. Those who aren’t interested in learning the nuances of crypto cybersecurity may feel more confident keeping their investments in an established brokerage.

4. Follow commonsense cybersecurity rules

You should also consider following standard cybersecurity recommendations, such as:

- If you choose to provide your own custody, never share the key to your private or cold wallet with anyone. Just as you would never share your email password, keep your keys safe. Also make sure to write it down, as losing it could mean losing access to your crypto forever.

- Avoid bragging about how much crypto you have online. To avoid being targeted by SIM swap scammers, the FBI recommends keeping details about your financial holdings private.

- Check twice before you click an email link. Phishing scams are common in crypto. If you receive an email that looks like it’s from your exchange, first check to see that the domain address is correct. For example, an email from Coinbase should come from an @coinbase.com address. When in doubt, contact your exchange’s customer support team to verify the email is legitimate.

- Never click a link in a direct social media message. Exchanges will rarely contact you through direct message on social media, unless you’ve initiated it by contacting their support team. Sending fraudulent social media message links is currently one of the most popular phishing strategies.

- Set 2-factor authentication for all accounts. This is where you must enter an additional code beyond your basic username and password to access your account. This code is usually sent to either your mobile phone or email, and adds an added level of security in case your login information is hacked.

How do cybercriminals steal crypto?

Before we look at how to help keep your crypto safe, let’s identify some of the ways your investments can be targeted. In general, cybercriminals favor the following methods:

- Exchange attacks. Hundreds of millions of dollars of crypto are kept on exchanges. Platforms with security vulnerabilities have been targeted in the past.

- Phishing emails or direct messages on social media. These include fake giveaways and fraudulent confirmation emails. They’re designed to look like they’re from an exchange or the development team of the cryptocurrency you’re invested in. The goal is to get you to click on a fake link that gives the scammer access to your crypto wallet.

- SIM swaps. A bad actor who obtains your phone number may be able to gain control of your phone by contacting your carrier and requesting a new SIM card. This gives them the ability to reset the logins to your crypto accounts with 2-factor authentication.

Stealing isn’t the only way cybercriminals can defraud the market. They can also use pump-and-dump scams (known as “rugs”), where bad actors hype a coin to attract new investors. Once the price reaches a peak, they sell all their holdings at a profit and send the price falling.

While not technically hacks, these scams can wipe out your entire investment if you’re not careful.

The bottom line on keeping your crypto safe

Hacking stories may be scary, but the reality is there are ways to lower the chances of losing your investments if you follow commonsense steps.

Hacking stories may be scary, but the reality is there are ways to lower the chances of losing your investments if you follow commonsense steps.

For most, the least stressful strategy will be to keep it on a trusted brokerage platform, where security measures are taken care of for you. If you’d rather provide your own custody, consider transferring your investments to a cold wallet.

Never click on links without first verifying the source, and think about sticking to blue-chip coins if you are new to crypto. Take these precautions and bad actors will likely have a harder time getting your coins

Note that while this route gives you more flexibility with how you use your crypto, there’s also no customer service team for those who manage their own security. If your investments or exchange account are hacked or phished, the crypto trading platform you use goes bankrupt, or you transfer your coins to the wrong wallet address, you may lose access to them forever.

Summing it up

Crypto is currently a speculative asset with high volatility. To prepare yourself for the risks, make sure you have assessed its long-term potential before you buy. You may also want to consider limiting your investments to an amount you can afford to lose.

Be sure to study all your security options before buying. Choosing between storing your coins with a trusted custody provider versus a crypto trading platform could make a big difference when it comes to protecting your assets, especially if you don’t have the time to study crypto cybersecurity protocols.

And as with all investments, make sure you understand the tax implications. There are more rules for crypto than there are with traditional asset classes, so don’t leave room for unwelcome surprises come tax season.

When all is said and done, keep risk management at the forefront of your crypto investment strategy. This may help you minimize stress in both the short and long term.

Source : Fidelity Investment

Until next time