MARKETSCOPE : RISK ON

June, 19 2023Exuberance Returns

“The current chase for stocks related to “artificial intelligence” has undoubtedly grabbed everyone’s attention. Retail investors are jumping back into the markets with both feet for the first time since last year”

SEE BONUS at bottom

Financial markets have made significant progress this week, following the decisions of several central banks, which were ultimately well received. Market participants appear to be betting that despite ongoing high inflation and other expected interest rate hikes, the global economic slowdown should prompt monetary easing earlier than anticipated.

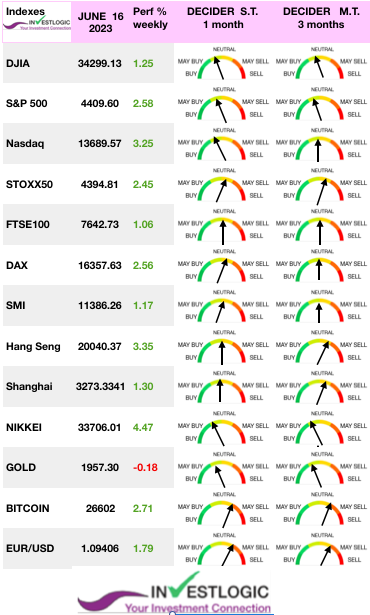

Stocks scored strong gains for the week, as investors celebrated a pause in rate hikes by the Federal Reserve and steps by China towards strong economic stimulus.

Two important inflation measures during the week supported market expectations. The consumer price index report for May showed a Y/Y deceleration in both the headline number and the core CPI figure. Additionally, the producer price index report for May came in, with the headline number falling more than expected on a M/M basis and trailing the consensus on a Y/Y basis. On Thursday, the US Labor Department reported that weekly jobless claims had jumped to 261,000, well above expectations and the highest level since October 2021.

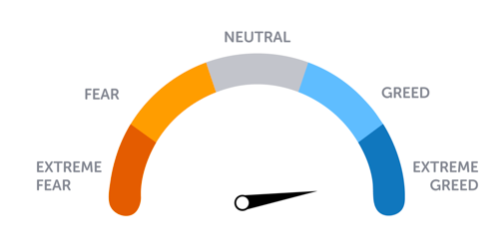

Bullish sentiment has surged as the “Fear Of Missing Out,” or FOMO, kicked in in recent weeks. The stock markets continue to look away when the Fed waves its arms to announce that the inflationary threat has not disappeared. Risk appetite remains in place in recent sessions, as investors await the upcoming company reports.

Bullish sentiment has surged as the “Fear Of Missing Out,” or FOMO, kicked in in recent weeks. The stock markets continue to look away when the Fed waves its arms to announce that the inflationary threat has not disappeared. Risk appetite remains in place in recent sessions, as investors await the upcoming company reports.

For the week, stocks closed the week modestly higher as the S&P 500 Index moved into bull market territory, or up more than 20% off its mid-October lows. The indexes continue to be carried by large-cap technology stocks.

Nevertheless, market advance is broadening, with small-caps outperforming large-caps, and value shares outperforming growth stocks.

The Dow Jones average rose 1.3%, and the Nasdaq Composite jumped 3.3% for its eighth winning week in a row. The S&P and Nasdaq hit their highest levels since April 2022 this week. The bond market is more cautious.

The ECB, on the other hand, was less mysterious, making a quarter-turn in its rates to bring them to 4% and proclaiming that austerity is not over… The pan-European STOXX Europe 600 Index ended the week slightly lower.

Japan’s stock markets rose over the week, reaching fresh 33-year highs, with the Nikkei 225 Index gaining 2.4% and the broader TOPIX Index up 1.9%. Chinese equities were mixed after the latest inflation data increased concerns about the country’s faltering post-pandemic recovery.

The macroeconomic calendar will intensify starting Wednesday with the release of the UK’s annual inflation and speeches by U.S. Federal Reserve officials. Thursday will be a key day as the Swiss National Bank will conduct its monetary policy assessment and announce its interest rate decision.

Investors will also be watching to see if the momentum rallies for highly-shorted stocks can extend.

MARKETS : FOMO (Fear Of Missing Out)

The market is overheated and everyone and their grandmother can see it, but it may take some time before we see a blow off top.

A few months ago, most investors feared having too much exposure to equities. Now many are worried they may not have enough.

The shift from bearish to bullish sentiment has been steady since the beginning of March. However, recently, there was an apparent capitulation as bearish investors turned bullish.

One of the simplest, yet effective indicators we have here is the “Fear and Greed” gauge. And lately — it’s been flashing “Extreme Greed.”

So here’s the question — is this good or bad for stocks?

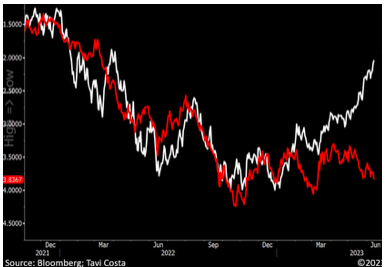

$QQQ vs $TLT: what an enormous divergence! One of them is lying.

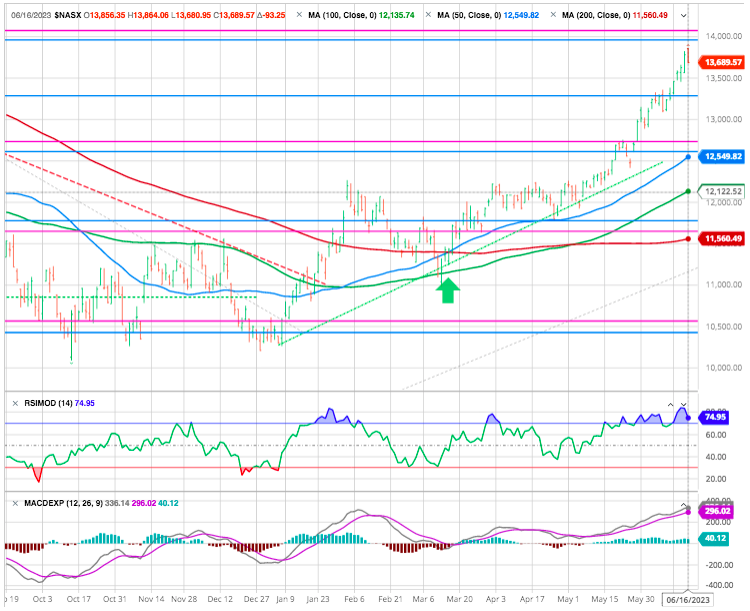

Since the market peaked, Nasdaq has been significantly impacted by the increase in interest rates.

Despite the continuous upward movement in 10-year yields, this correlation has been disrupted by the euphoria surrounding AI and, consequently, the surge in mega-cap companies. Ultimately, the present value of long-duration businesses must reflect the ongoing rise in discount rates.

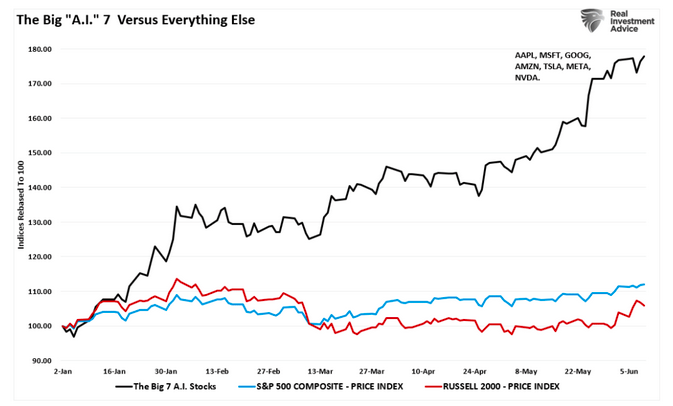

If it weren’t for the 7-largest market capitalization-weighted stocks in the S&P 500, the market would only be higher by a measly 3% for the year, not 12%.

The current chase for stocks related to “artificial intelligence” has undoubtedly grabbed everyone’s attention. Retail investors are jumping back into the markets with both feet for the first time since last year.

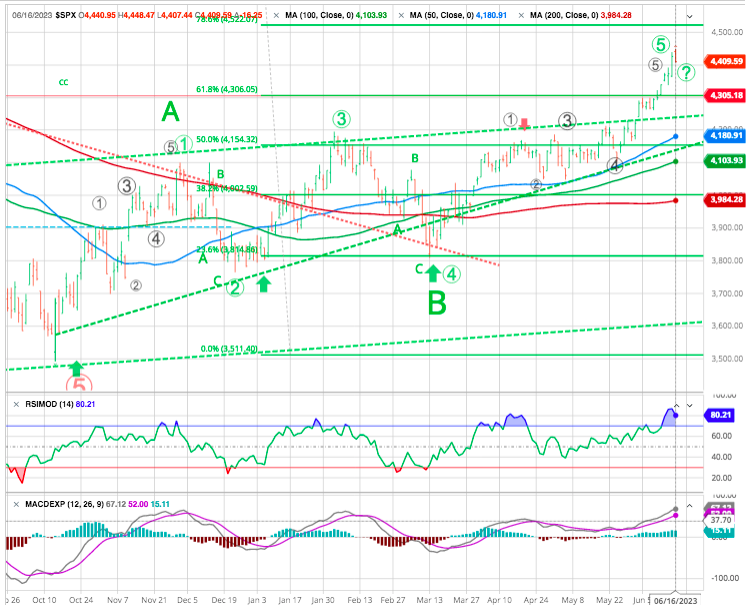

While the uptrend remains robust, the S&P is highly overbought here in the near term. It has appreciated by a whopping 27% in just eight months, is now about 25% above its 200-day MA, and shows an RSI approaching 80. Other technical indicators like the CCI, full stochastic, and others illustrate a similar overbought image in the index.

We witnessed a similar overbought dynamic last August, right before the significant drop to 3,500. Of course, the current fundamental backdrop is different from the previous year. Nevertheless, we often see corrections if the SPX’s RSI shoots up to or near the 80 levels. Therefore, we could see transitory correction develop in the near term, and a 5%-10% drop would bring the SPX down to the solid 4,000-4,200 support/buy-in range.

The 20 % year-to-date rally in the Nasdaq is pulling once doubtful investors back into the market. Many who had whittled down stock holdings during 2022’s painful decline are shifting gears. While no signs of reversal have yet emerged, the rally looks overextended.

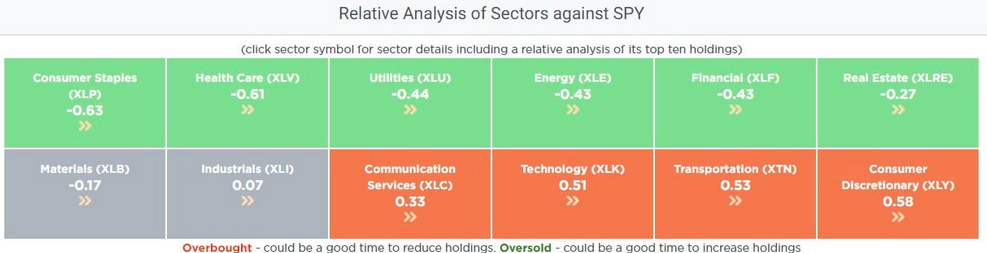

Over the past two weeks, most sectors, except for staples, have improved performance. While Technology, Discretionary, and Communications are still leading the charge, other sectors have seen improvement, with the overall breadth of the market beginning to broaden. If this bullish market is going to continue, broader breadth is a requirement..

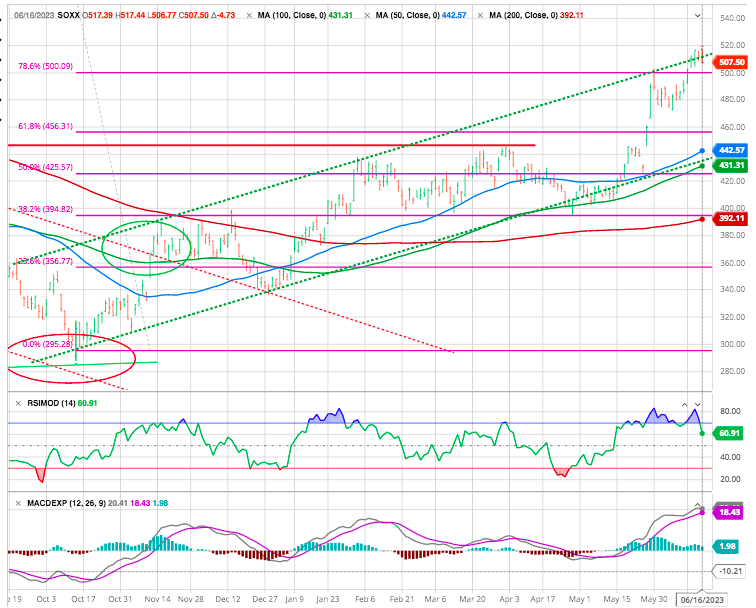

SEMI

Semiconductors (often considered as the new Dow Jones Transport) are leading the rally but are clearly overbought.

Yes the S&P finally caught up to the other key market indexes Thursday by closing more than 20% above its October 2022 closing low, exiting the bear market of last year, and entering a new bull.

These absolutely are bullish developments for the stock market overall. That said, it doesn’t mean stocks will move up in a straight line from here. There could be – and certainly will be – short-term peaks and valleys along the way.

In fact, in 10 of the last 26 times a bear market ended and a new bull began – with a 20%-plus rally off the low — the S&P 500 still suffered double-digit declines at some point during the next three to 12 months.

Temporary Drop

The top S&P 500 holdings (by weight) include:

- Apple – Weight: 7.5%, % price increase from the bottom: 49%.

- Microsoft – Weight: 6.8%, % price increase from the bottom: 67

- Alphabet – Weight: 3.8%, % price increase from the bottom: 57%.

- Amazon – Weight: 3.1%, % price increase from the bottom: 61%.

- Nvidia – Weight: 2.9%, % price increase from the bottom: 298%.

- Tesla – Weight: 1.9%, % price increase from the bottom: 160%.

- Meta Platforms – Weight: 1.7%, % price increase from the bottom: 217%.

Looking at the enormous 28% weight the seven most significant tech stocks have in the S&P 500. Technology has been on fire for months, with many top stocks appreciating by 50%-100% and more.In addition to overheated technical conditions, many high-quality technology stocks are “costly” now.

Since November, we’ve seen remarkable gains in large-cap tech stocks that have exceeded my near-term expectations. Therefore, we are probably in the early stages of a sustainable long-term bull market in tech stocks, and stocks in general. Nevertheless, some of SPX’s most significant components are highly overbought on a near-term basis.

A 10%-20% correction in several mega-cap names could cause substantial carnage in the SPX. Furthermore, while there will likely be some rotation to other sectors, the overbought mega-cap stocks should drag smaller tech and other stocks lower in the near term.

Positioning among discretionary investors, a cohort that includes fund managers to individual investors, moved above neutral earlier this month for the first time since February, Deutsche Bank data showed.

As investors, we can choose to “hide in our caves,” afraid of the next decline. Or, we can take advantage of the market we have by following rules that bolster our probability of survival.

Your choice.

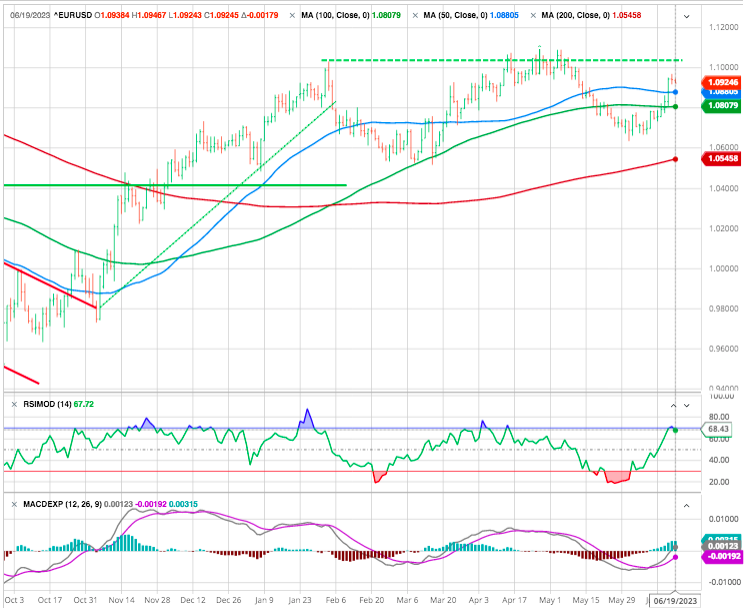

EUR/USD

Central banks are still a topic here. The timing disparity between the Fed and the ECB is clearly evident in the trajectory of the dollar, which has fallen to 0.9140 EUR. The strength of the single currency is even more pronounced against the yen, which has fallen to its lowest level in 15 years. The Bank of Japan’s consistently accommodative stance easily explains this. On Friday, the USD was trading at 141.8170 JPY.

Crypto:

For the third consecutive week, Bitcoin is declining and settling around $26,500, down 1.5% since Monday. Ether is suffering even more, falling nearly 5% over the same period and now hovering around $1,650. As long as the crypto asset industry remains entangled in regulatory issues on the other side of the Atlantic, with the SEC showing no signs of progress on this matter, Bitcoin and its counterparts will struggle to regain a short-term bullish momentum.

FED Taking a timeout?

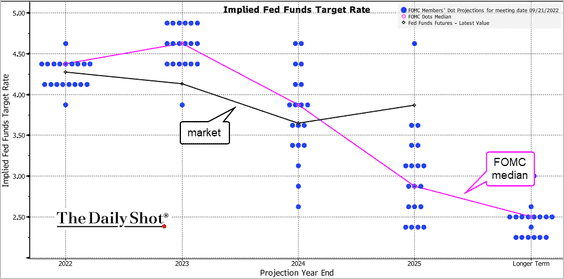

Breaking a streak of 10 straight hikes over 14 months, the Federal Reserve on Wednesday kept its policy rate unchanged at 5.0%-5.25%. “Nearly all policymakers” still feel further hikes will be appropriate this year, according to Fed Chair Jerome Powell, who added that none of them projected a rate cut for 2023.

The FOMC’s decision to pause/skip the current (interest) rate hiking cycle.was widely awaited, with only very low odds for an additional hike, the hawkishness expressed via the FOMC’s Dot Plot took some by surprise:

At the median, FOMC members now expected Fed Fund rates to be at 5.6% by the end of the year, which would equal roughly to more hikes.

As seen so often in recent past, after the hawkish tone of the press release post FOMC meeting, Powell then came into the press conference, with the apparent intention of soothing “upheaval” in markets again.

THE FED PAUSED AND DOESN’T IGNORE POLITICS

While some investors may cheer the pause and hope that the Fed’s next step will be to lower rates soon because they believe it will help stocks, they should be careful what they wish for. If the Fed does start cutting rates, it’s likely going to do so to try to avoid or end a recession.

Potential or actual stock market volatility shouldn’t excessively worry long-term investors, though, and whether rates move higher, lower, or nowhere, markets should adjust as they have historically.

By not hiking rates now, the FED may be buying time to minimize the impact of the Treasury’s borrowing, totalling nearly $300 BN past week alone .The FED also may be giving banks a bit of extra breathing room.

By restraining inflation with more rate hikes later this year, the FED has scope to lower them during the 2024 election campaign.

Cynical but it is naïve to ignore politics

When the Federal Reserve tried to set a hawkish tone after keeping rates unchanged last Wednesday, it failed. The European Central Bank did a better job of it.

On Thursday, ECB President Christine Lagarde lifted interest rates by another quarter-point to 3.5% — the eighth consecutive increase and the highest level in more than two decades — in line with economists’ expectations. She also made clear that the move probably won’t be the last. Neither a pause nor a skip is on the ECB agenda. It adds to the growing dissonance in central banks’ response to a global inflation problem.

Lagarde said inflation in the euro zone looks to remain “too high for too long” and that a further hike in July is “very likely” despite Europe entering a technical recession.

Last but not least China’s central bank takes opposite stance !

While the Fed was signaling more monetary tightening ahead, China’s central bank ramped up its monetary stimulus to help support a flagging economy.

The People’s Bank of China earlier Thursday lowered the rate on its one-year loans by 10 basis points to 2.65%, the first reduction since August, just a few days after cutting its seven-day reverse repo rate by 10 basis points to 1.90% from 2.00%.

Recent data has shown China’s recovery is stalling as domestic and global demand falters, with data released earlier Thursday showing that industrial output grew 3.5% in May from a year earlier, slower than the 5.6% expansion in April.

Happy trades

BONUS

Tom was the first one to lose his job because of AI