MARKETSCOPE : A Bit Of A Horror Story

July, 11 2022The Good News is that H1 Is Now Over.

The Bad News : H2 Outlook is Not Looking Good.

“Slower, Lower and Weaker “opposite to the Olympic motto could be the tip for the coming earnings announcements and guidance as well as market performances.

After a relatively quiet start  to July that has seen the S&P 500 and other leading indices stage a rally, thanks to bargain buying and economic recovery in China. Investors had a mixed reaction to the better-than-expected monthly employment report, the economy added a stronger than expected 372,000 jobs in June, as it could strengthen the Fed’s case for aggressive rate hikes.

to July that has seen the S&P 500 and other leading indices stage a rally, thanks to bargain buying and economic recovery in China. Investors had a mixed reaction to the better-than-expected monthly employment report, the economy added a stronger than expected 372,000 jobs in June, as it could strengthen the Fed’s case for aggressive rate hikes.

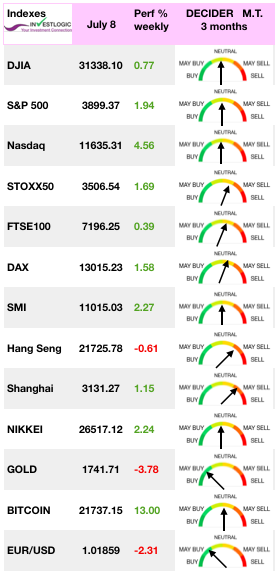

The three major US market indices finished higher for the week, with the Nasdaq Composite jumping 4.6%, the S&P 500 gaining 1.9%, and the Dow Jones edging 0.8% higher.

In Europe, stocks advanced after 3 consecutive months of losses while Germany’s trade balance showed a deficit — the 1st since 1991— as exports fell unexpectedly.

In Asia, Japan stocks gained while Chinese stocks eased as rising covid cases and elevated geopolitical tensions hurt sentiment. China is getting restless. The market seems to have absorbed some of the bad news of the last few weeks. It no longer rule out the possibility that restrictive monetary policies will succeed in reducing inflation without undermining the economy too much.

Investors are now awaiting the corporate earnings and targets that will start to be published this week. It will give us more clues whether listed companies, which have resisted the inflationary shock remarkably well, are facing lower demand and will examine the effects of commodity price and shipping cost pressures on companies’ profit margins. – see below-

Volatility is expected to continue as earnings season with banks and a few key S&P 500 components leading the way.

A Closer Look At The Catastrophic First Half Performance

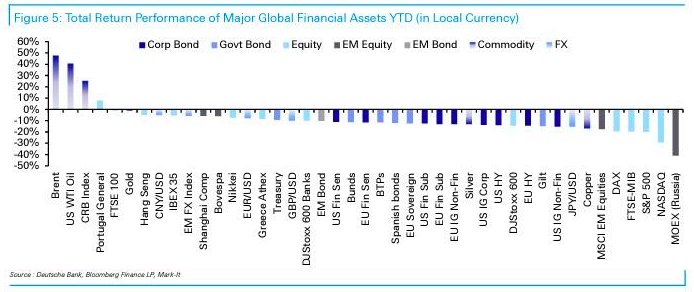

If you are long safe-haven dollar and crude, your portfolio is outperforming the pack. The U.S. benchmark West Texas Intermediate (WTI) is up 39% on the year, and the greenback is far outperforming the world’s currencies so far. Congratulations.

But if you’re heavily invested in Bitcoin, tech stocks, blue-chips, Asian shares, you name it—it’s been a first half to forget.

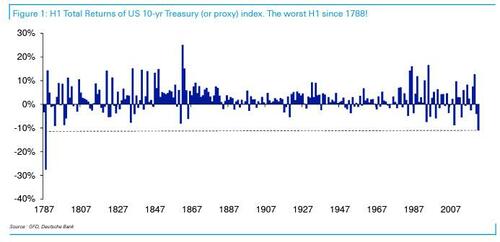

It was an ugly first half for bond holders too, with the closely watched 10-year Treasury now down 9.4% on the year. According to Bloomberg, this is the first time in 48 years that both stocks and bonds fell in the same period, dealing another blow to the tried-and-true 60/40 stocks-to-bonds investment strategy.

As Rabobank’s Michael Every said that “if you bought stocks in H1, you lost; if bonds, you lost; if commodities, you were doing great until recently; if crypto you lost; if the US dollar, you were fine”

To demonstrate just how bad H1 was let’s sesame of Jim Reid’s charts from Deutsche Bank :

1) Deutsche Bank’s US 10yr Treasury proxy index did indeed see the worst H1 since 1788 in spite of a sizeable late June rally, and…

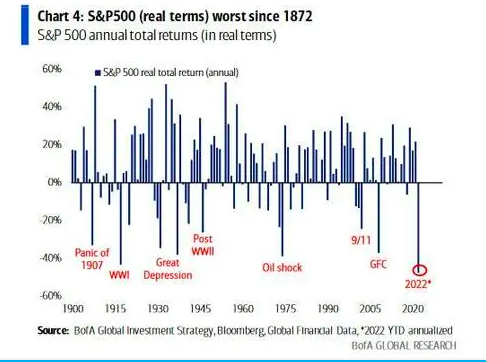

2) For BofA the S&P 500 saw the worst H1 and notes that in real timers, the S&P500’s performance was the worst since 1872!

On a YTD basis as well, just 4 of 38 tracked assets are in positive territory, which as it stands is even lower than the 7 assets that managed to score a positive return in 2008.

The main reason for these broad-based declines is the fact that recession and stagflation risks have ramped up significantly over Q2. This has been for several reasons, but first among them is the fact that inflation has proven far more persistent than the consensus expected once again, requiring a more aggressive pace of rate hikes from central banks than investors were expecting at the start of the quarter.

A similar pattern has been seen from other central banks, and the effects are beginning to show up in the real economy too, with US mortgage rates reaching a post-2008 high. The good news is that as of today, the market is now pricing in not just rate hikes to peak in Q4, but about 14bps of rate cuts in Q1.

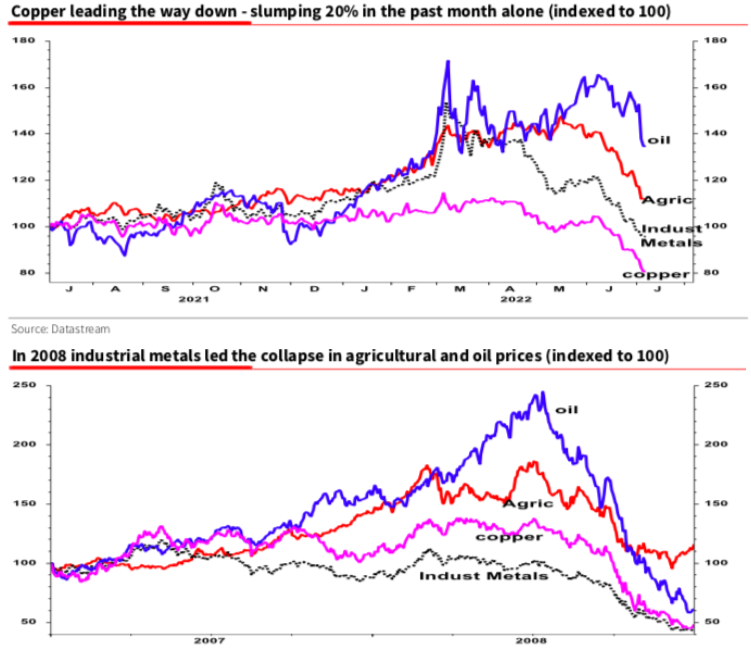

Fears of a global recession have knocked industrial metals prices significantly, and the London Metal Exchange Index has just seen its first quarterly fall since the initial wave of the pandemic in Q1 2020,

MARKETS

As we expected a counter trend move took place last week and closed to our targets.

That rally has lacked a strong pickup in volume and the advance lacked commitment by traders. Unfortunately, the small advance consumed the majority of the oversold condition with the 50-dma remaining stiff resistance for the time being.

On June 16 of this year, the S&P 500 closed at 3666 -as Edward Yardeni reminded us the 666 devilish number also marked the bottom in the previous bear market- , down 23.6% from its record high on January 3. That marked the bottom to date in the current bear market.

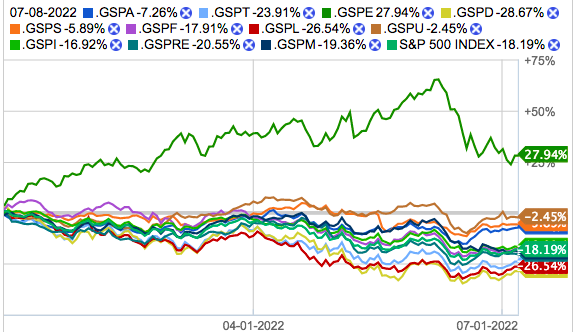

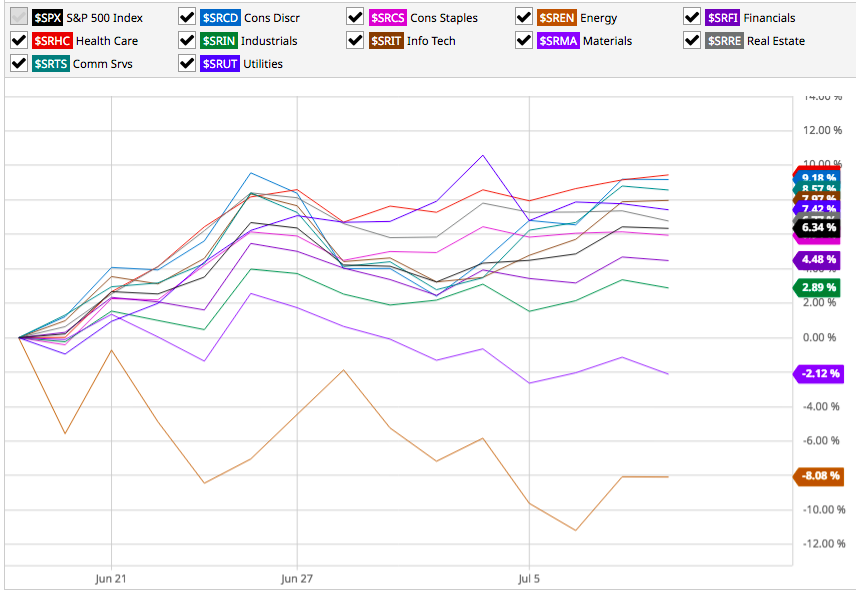

The recent rally in the S&P 500 has seen a reversal of fortune for the Energy sector, which is still the only one up ytd at 27.9%, but it is down by 8.1% since June 16.

The outperforming sectors since then include the worst performing ones so far this year. Here is the performance derby for the S&P 500 and its 11 sectors from June 16 through Friday’s close

This rebound will turn out to be an unsustainable short-covering rally in a bear market. A break below 3666 could lead to a drop to 3386, the February 19, 2020 record high prior to the pandemic.

Fundamentally investors may have backed off a bit from overriding recession fears, as the strong jobs report and a recent sharp decline in prices for oil and other commodities allowed for a somewhat higher possibility that the U.S. economy could achieve a soft landing.

History shows that bear markets last, on average, about 16 months. That would would suggest investors are stuck in the first half of an uncertain stretch, particularly as the odds on a recession continue to climb.

Michael Burry of The Big Short fame figures we are about halfway through this bear market.

We remain in the camp that we have only completed one of several legs down in the deflating of this bubble. Earnings will be the next test. Let’s see in a few weeks.

EARNINGS SEASON : Hot Summer

There are still a number of people posting charts and the like showing how a bottom is probably in. This could be true. Maybe earnings will hold up and all will continue to be sunshine and rainbows.

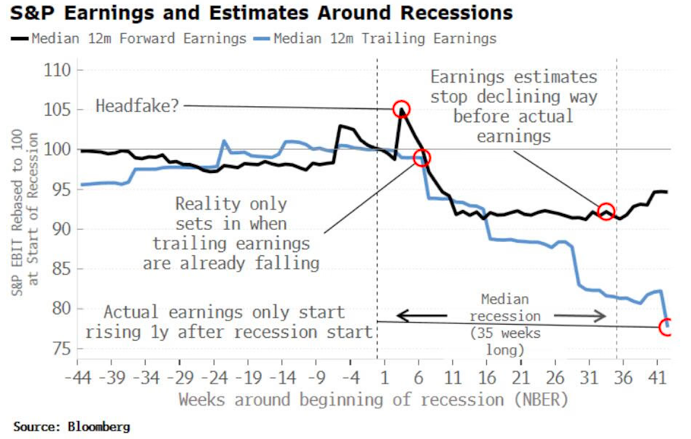

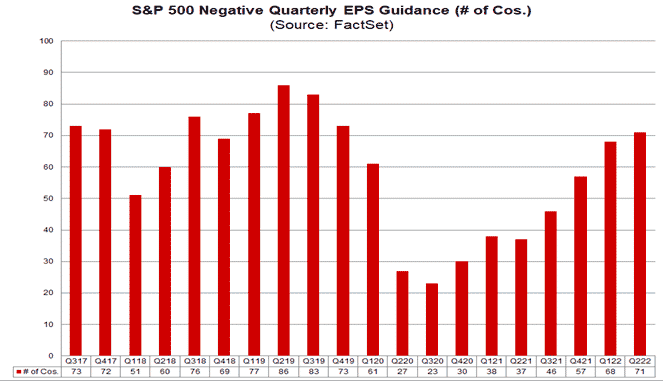

As we enter 3rd-quarter earnings season, the big risk to the market won’t be the reported earnings but the forward guidance. With the increases in input costs, labor costs, and bulging inventories which will get discounted, the risk of an earnings recession have increased as consumption slows.

Currently, earnings estimates for stocks are not accounting for much slower economic activity. While the “P” in the valuations (P/E) calculation has declined, the “E” has not. During a recession, earnings tend to fall quite significantly.

As inflation impacts consumption and slows economic growth, market will have to reprice for slower earnings. As noted last week, forward earnings estimates have fallen, but if history is any guide, they are still too optimistic.

WHAT WILL COME OUT FROM THE EARNINGS SEASON?

- Overall, S&P 500 sales and earnings per share are likely to have hit a record high in the quarter

- But growth on both lines is expected to have slowed and profit margins to have narrowed

- That shift will be evident on earnings calls

- You are going to see an increasingly cautious tone from management teams

- We are clearly past the peak in profit growth

Simon White at Bloomberg confirmed the same concern that earnings are at risk stating:

“I showed that earnings estimates are most wrong in recessions. Earnings themselves don’t start to fall for several weeks, while forward earnings have one last burst of optimism, jumping higher, before reflecting reality and falling.”

What will cause earnings and profits to contract, potentially putting more pressure on the S&P 500 index? A recession will do the trick, and commodities which are a real-time economic barometer say one is on the way, as mentioned in our last report ISM : The Canary in the Coal Mine

We recommend Albert Edwards’ excellent paper with SG.

This suggests to us that this bear market could last much longer than people think. Everybody again seems to think events are priced in instantaneously, like the Fed is going to cut rates in 2H 2023 because of a recession. But there are a million other factors between now and then.

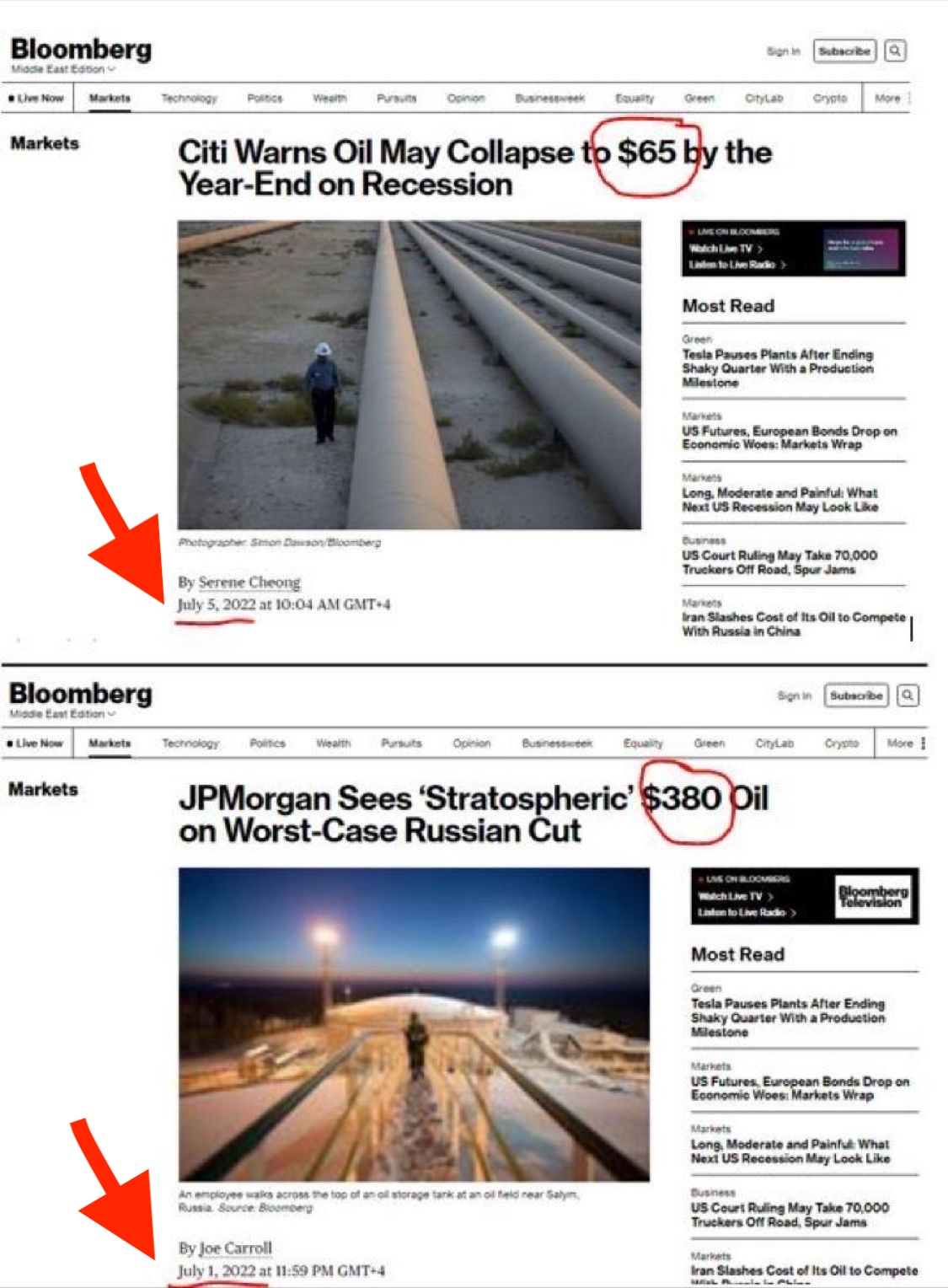

OIL

Prices plunged this week, weighed down by growing recession fears that weigh on the outlook for black gold demand. The two global benchmarks, North Sea Brent and US WTI, even briefly fell below USD 100 per barrel.

GOLD

Pressure remains intense on copper, which is in the midst of a new weekly downtrend at $7,835. Like oil, the market remains obsessed with fears of recession, which is synonymous with a decline in demand for industrial metals. The mood is not much happier in the gold metals, where a strong U.S. dollar and high bond yields have pushed gold prices to a new annual low of $1,735.

That’s not surprising since this precious metal’s price is inversely correlated with the 10-year TIPS yield.

Silver is following the same trajectory at USD 19.10.

USD

The dollar keeps strengthening euro fell 3% to $1.01112 against the greenback over one week. This may seem small, but in the foreign exchange market it is a considerable gap. The euro also lost 1.5% against the Swiss franc (to 0.9888 CHF). A strong dollar is usually bearish for commodity prices, including the price of gold.

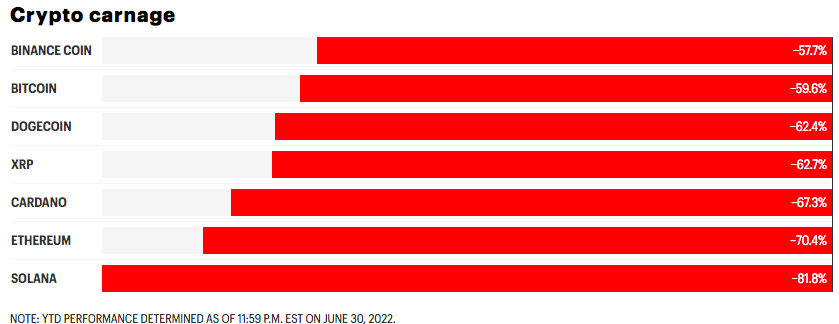

CRYPTOS

Bitcoin is starting July a little more serene than in previous weeks. In the wake of stock market indexes, the digital currency has rebounded slightly since Monday and is back flirting with $21,500 as of this writing. Crypto-investors have therefore been able to enjoy a week’s respite on bitcoin, although it will be a long road for some before they see their positions back in the green after a historic June that saw a -37% underperformance on the asset.

Few groups were harder hit than crypto bulls. Bitcoin fell nearly 60% in the first half. That was hardly the worst performance for virtual coins over the first six months of 2022.

Happy trades

Enjoy a great Summertime !