What’s the big deal about Dow 40,000?

Do these milestone numbers matter? Well, that comes down to whether you believe in the psychological significance of round numbers.

DJIA 120 years logarithmic

Many investors think milestones can act as barriers or price ceilings at first. Perhaps these round numbers serve as a trigger for investors to ask themselves if the index or investment is actually worth the market value. There might also be trading reasons, based on price levels where buy and sell orders are placed—with round numbers being widely used—causing trading activity to increase in one direction or the other.

Psychologically significant price levels can be seen across asset classes. Gold, for example, had grappled with $2,000 for years. It rallied to and fell below $2,000 numerous times over the course of several years. When it finally surmounted that price level this year and held above it, gold rallied further and is now trading above $2,300, as of mid-May.

Once investments get past these perceived psychological barriers, that can serve as momentum for accelerating prices increases—to some extent. Alternatively, if these price levels are not surpassed, that can act as a reason to be bearish. It’s worth noting that these signals, largely used by technical chart analysts, are generally meaningful for relatively short periods of time.

Dow 40,000

It would be foolish to assume that the Dow is assured of pushing quickly past its milestone—or that 50,000 is just a couple years away—based on historical trends. After all, the Dow did recoil from 40,000 back in March.

With that said, markets have a demonstrated history of producing long-term gains. And the Dow’s recent momentum has made it possible to reapproach and potentially overcome the latest milestone. In the near term, it will take sustained earnings strength (along with bullish drivers, such as constrained inflationary pressures) to maintain the Dow’s momentum. Of course, there is always the possibility of a black swan event that can come in and take the wind out of the market’s sails.

In comparison

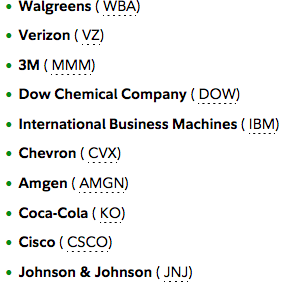

There are key differences between the Dow and other market indices. The DJIA is U.S.-centric and only tracks blue-chip companies in a limited number of sectors. The Dow (DJI) is also a price-weighted index, meaning it’s valued through the share prices of its 30 components vs. market cap-weighted alternatives like the S&P 500 (SP500) and Nasdaq Composite (COMP:IND). As a result, changes in the highest-priced stocks have a bigger influence on the index level, while stock splits and other factors call for regular rebalancing.