MARKETSCOPE : Banks Are Bleeding

March, 27 2023

Pain Killer

A bank failure, a speech by Jerome Powell and a rate hike… This was another turbulent week on stock markets! Stocks ended a volatile week with gains on Friday.

US equity returns varied widely over the week as banking industry and recession worries weighed on value stocks and small-caps, while large-cap growth stocks benefited from falling interest rates. Financials underperformed for a third consecutive week while the average stock remained significantly weaker than the S&P 500 Index’s return suggests.

US equity returns varied widely over the week as banking industry and recession worries weighed on value stocks and small-caps, while large-cap growth stocks benefited from falling interest rates. Financials underperformed for a third consecutive week while the average stock remained significantly weaker than the S&P 500 Index’s return suggests.

The easing of fears about the banking sector was short-lived. Last weekend it was Deutsche Bank’s turn to worry investors. Germany’s largest bank fell at the end of the week as a sharp increase in the cost of insuring against the risk of default fueled concerns about the stability of the entire European banking ecosystem.

The banking stocks are still the strongest sectorial decliners, but other sectors are also losing ground in a context of renewed risk aversion. Despite hopes that the rate hike cycle will soon come to an end, volatility is likely to remain high in the coming sessions, especially with fears of wider contagion and the resurgence of recession fears.

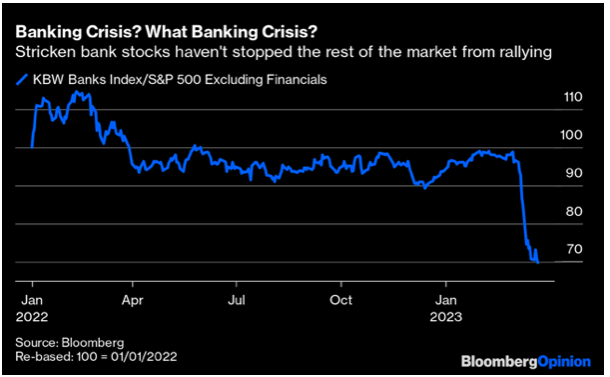

Worries about banks have plainly not been quelled. The KBW banks index dropped again Thursday, and its underperformance of the rest of the market is growing extreme:

That dive for the banks is one for the history books. Falls like this don’t happen at all often, and when they do tend to mean bad things for everyone else. Saudi National Bank replaced its chairman, whose ill-judged comments fast-forwarded Credit Suisse’s slow-motion train wreck.

Banks will dominate the headlines again this week with the earnings and economic calendars light.

Some upside data surprises on the macro side, the S&P Global’s Composite Index of both current services and manufacturing activity jumped from 50.1 to 53.3, indicating the fastest pace of private sector growth since last May, with new orders turning higher for the first time since September, appeared to lift the yield on the benchmark 10-year U.S. Treasury note from a six-month intraday low on Friday morning, but the yield still finished modestly lower for the week.

The recent drop in Treasury rates may have gone too far and seems to have held critical technical levels thus far. This suggests that interest rates could rise from current levels.

In Europe gained ground, despite weakness in bank stocks. Chinese stocks rose on hopes that the country’s central bank will maintain an accommodative stance amid the global banking turmoil.

It’s set to be a much quieter week on the economic calendar – the highlight will be Friday’s core PCE price index – the Fed’s favored measure of inflation. It accelerated in January, adding to concerns over the prospect of a more hawkish Fed.

MARKETS :

Although some positives technical dynamic signs appeared with the banking crisis unfolding, the latest could limit any upside to equity prices near term until the crisis is “contained” or the Fed reverts to monetary accommodation.

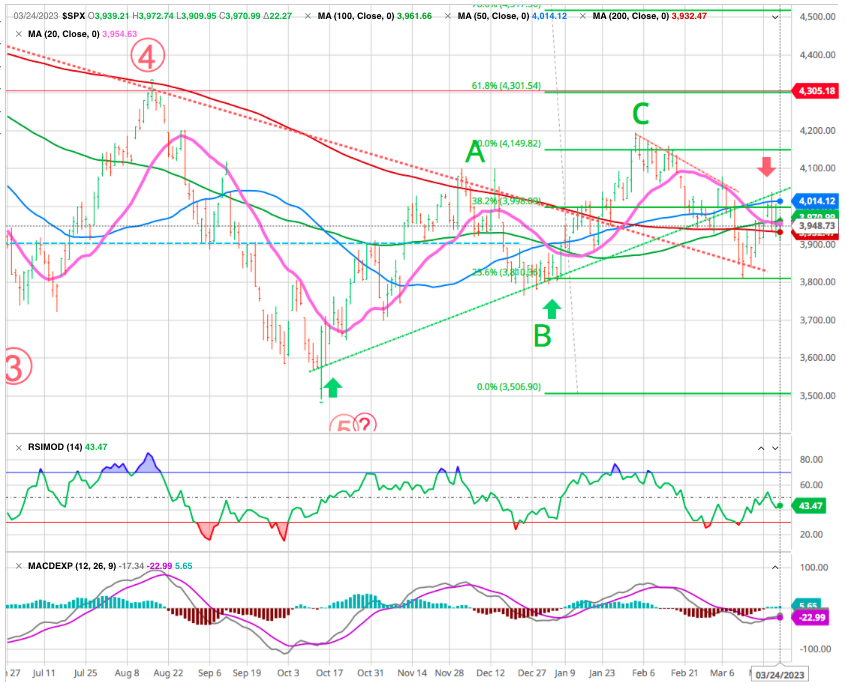

S&P500: Oscillating around its 200-day SMA

After a series of positive technical signals (including the break of the upper band of the downtrend channel) the positive momentum failed to help the index move comfortably beyond 4,100, the subsequent retreat to the breakout level symptomatic of a healthy pullback before the positive momentum resumed. With higher lows (green arrows) the index still has to confirm with new higher highs (red arrow).

The market defended the 200-DMA, repeatedly confirming support despite the negative headlines. but also the MACD, triggering a confirming “buy signal.” Short-term, the key long-term support is given by the 200-week SMA, currently holding at 3,730.

The medium-term technical outlook remains uncertain, and the price could continue to oscillate in a wide sideways range between 3,760 and 4,200. Short-term, the closest resistance holds at 4,014 (the 50d SMA).

Nasdaq 100 (LT): Is tech the bright spot once again?

The Nasdaq 100 seems to be forming a bullish flag pattern. After some consolidation, the positive momentum has resumed, and a golden cross has formed (green arrow) the 50-day moving average crosses above the 200-day moving average. This is looked at by stock-chart technicians as an intermediate to a long-term buy signal.

In the short term, the price would have to break above its former top at 12,800 to validate this positive scenario.

It recently pulled back from intermediate resistance at 12,880 (the 38.2% Fibonacci retracement of the entire correction phase) to the breakout level (also the 50-day SMA) which, together with the 200-day SMA should present support from which the positive momentum could resume.

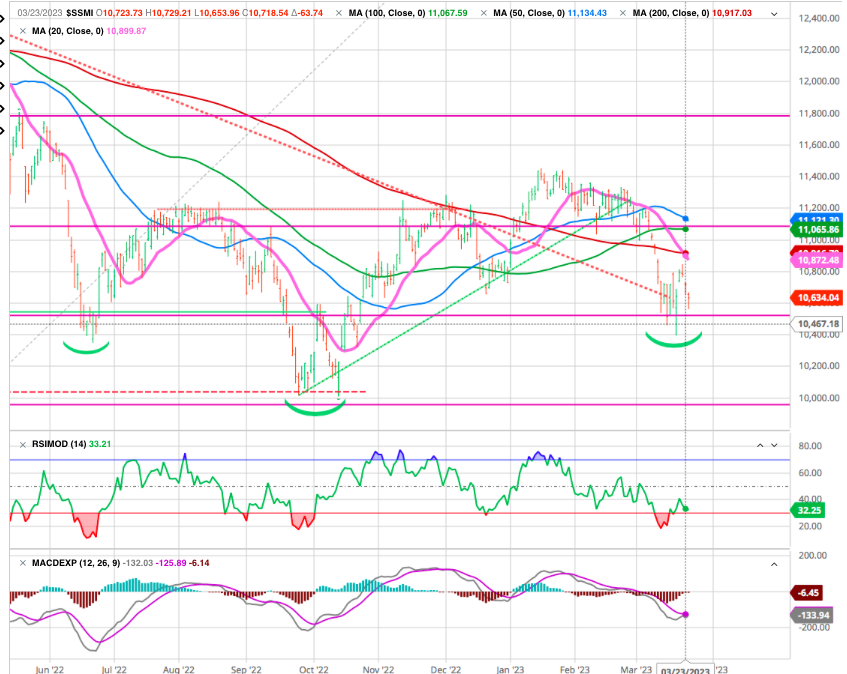

SMI : A bottom attempt?

The Swiss index could break out of the negative trend, as it retraced to the 50% of the rally initiated in Octoberas wwe targeted.That level offers a good support.

The index is still facing a zone of resistance below its 50-day SMA (currently holding at 11’125) and the 38.2 %fibo retracement level at 11100. The negative momentum may resume the 61.8% fibo at 10’000.

Hang Seng: Testing a key support

Recent consolidation has sent the index back down towards its 200-day SMA from where a rebound attempt is currently under way. However, the 50-day moving average, which currently stands at 20,735, could serve as resistance – also 38.2% fibo recovery.

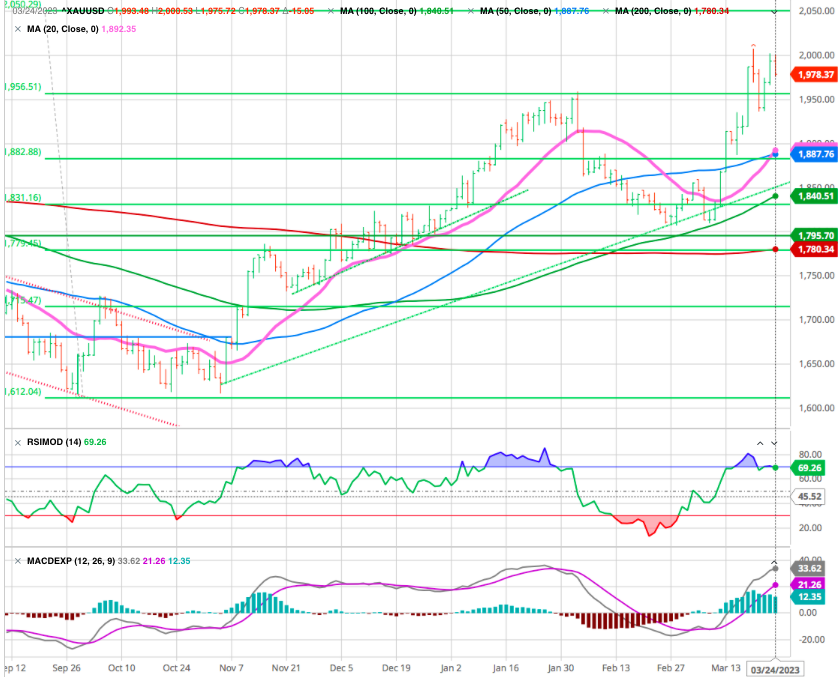

GOLD : Bank woes have helped gold shine

Gold’s function as a safe haven has been on display since Silicon Valley Bank collapsed. New York gold prices have increased to $1,992 per ounce since regulator’s seized SVB (see Gold rises amid bank troubles chart below) within striking distance of $2,000—a price level that many gold investors believe is technically significant.

Many investors view gold and other real assets as a bulwark against economic uncertainty. Its performance over the past couple weeks has reflected that.

Janet and Jay : Next stop Recession

The metaphore reported by John Authers in Bloomberg Opinion about the Rocky’s Horror movie wishing that this haunted house party of an economic crisis would not blast off for different galaxy.

The combined Powell’s and Yellen’s remarks last week has the effect to increase the concerns of market participants about the risk of a U.S. recession later in 2023.

After Federal Reserve Chair Jerome Powell hiked the benchmark fed funds rate for the ninth straight time since FED launched its aggressive monetary tightening campaign over a year ago to curb surging inflation in the US.

The decision by the Federal Open Market Committee was unanimous. Powell said all the right things:

We are committed to restoring price stability, and all of the evidence says that the public has confidence that we will do so… It is important that we sustain that confidence with our actions as well as our words.

As it stands, the Fed has found middle ground by coupling its rate hike with language that doesn’t pre-commit to more hikes in future — or a “dovish hike,” in the jargon.

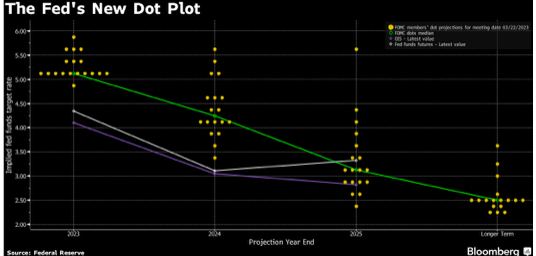

Critical to this was the summary of economic projections, or “dot plot,” in which the prediction of each committee member for future fed funds rates is shown as a dot. The FOMC now thinks that rates will end 2023 at about 5.1%, unchanged from their median estimate when the dot plot was last published in December:

Fed must not only inevitably be data-dependent, but also market-dependent.

It’s astounding that Yellen and Powell would have given contradictory messages on bank deposits at the same time. Powell essentially said that all deposits are safe; Yellen said, ‘Hold my beer.’

Meanwhile, Janet Yellen, now Treasury secretary, was taking questions at a Senate hearing. Asked if a move toward universal insurance for all deposits, abandoning the maximum limit of $250,000, as some have advocated was in the works, she replied: “I have not considered or discussed anything having to do with blanket insurance or guarantees of deposits.” Her remarks sent a quake over the market.

Now we come to a further problem: All of this means that monetary policy for the time being must be banks-dependent.

There is a case to be answered, then. High rates do naturally put pressure on banks’ liquidity, and tend to slow down the economy. And the Fed just chose to raise rates.

We will soon find out whether Powell’s comment

the “banking system is sound and resilient”

is the modern version of Ben Bernanke’s infamous declaration before Congress in 2007:

“We do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.”

If it does, then such will have enormous impacts on the economy.

But there’s more. Higher rates mean falls in the price of assets with a long duration (or in other words, particularly sensitive to interest rates). Plenty of people, including, we now know, some of the stricken banks, effectively bet that rates would stay low forever by piling up on long-duration assets such as 10-year Treasuries. The longer this goes on, the more banks’ solvency, and not just their liquidity, may be called into question.

For the future, the point from the Brad, er, Jay and Janet double-bill is that the banks’ troubles will affect the economy, but there is still minimal grasp on how big those problems will be, and what the regulators will do about it.

The questions of how unstable the banking system really is, and how much heat it will take out of the economy, now comfortably trump the issues that have been preoccupying everyone involved in the fight against inflation. Until there is some clarity on this, the banks’ health will matter more than the tight labor market, inflation expectations, or the Fed’s monetary reaction function.

Almost like Rocky Horror’s naive all-American couple, Janet could tell her companion “This isn’t the junior chamber of commerce, Jay.”

In conclusion : MINSKY MOMENT

We do think that the unpredictable events that will occur in the months to come as a result of rising rates and tighter financial conditions will result in more black swan events to come. It could well be a “Minsky moment” — a sudden crash of markets and economies that are hooked on debt — and enough to send shudders through policy makers. see Washington Post

As Nassim Nicholas Taleb made popular the term “black swan event”, and we do think that while the market seems prepared for a wide range of soft landing, hard landing or no landing scenarios, we are not at all prepared for the events that are impossible to predict.

The weak links in the system will start to show as the tide goes down and financial conditions tighten.

We do think that we will be seeing more of the unknowns in the near-term as financial conditions tighten further with the Fed’s continued hawkish stance and the tightening of credit conditions as a result of the banking crisis.

The weak links in the markets will start to break as a result of the rising rates and tighter liquidity and we will never know how severe this next black swan event will be.

Happy trades

Bonnus

Dammit, Janet