MARKETSCOPE : Come on, baby, let’s start anew

April, 03 2023The End of the Bear Market ?

“There is no route out of the maze. The maze shifts as you move through it, because it is alive.” — VALIS, Philip K. Dick

The mood on financial markets was upbeat last week, with traders quickly regaining their appetite for risk as concerns about the banking sector eased and inflation slowed, raising hopes that monetary tightening would end.

Stocks closed out March with all major market indexes higher than they were at the end of February, as the turmoil caused by the collapse of Silicon Valley Bank was contained, at least for now. US technology stocks and their flagship Nasdaq dominated the charts.

Over the quarter, the Nasdaq Composite index jumped more than 16%, while the S&P 500 Index rose approximately 7%. However, the narrowly focused large-cap Dow Jones Industrial Average was only modestly higher.

Friday’s Commerce Department data that showed the Fed’s favored inflation gauge coming in slightly lower than expected, coming in at 4.6% versus consensus expectations for 4.7%, in February reinforced those hopes.

In Europe, Headline CPI slowed to 6.9% in March from 8.5% in February as energy costs subsided. Shares in Europe rallied as fears of financial instability waned.

Chinese stocks advanced as strong economic data coupled with supportive comments from Beijing boosted confidence in the country’s growth outlook.

Investors still do not believe that the Fed will keep its key rates high for long. Employment and consumer confidence figures in the US remain strong and the price surge seems to be easing.

Clearly, investors have instead opted to buy before the end of the cycle, as has been the practice since the early 1990s. The common thread is that the US central bank will always come to the rescue of the market. Never the less, central banks are maintaining a firm stance on the risks of inflationary drift, but the message does not really seem to be getting through.

The banking turbulence may well weigh on lending conditions in the months ahead, creating a new headwind for the U.S. economy, but the prospect of further Federal Reserve rate increases appears to have diminished.

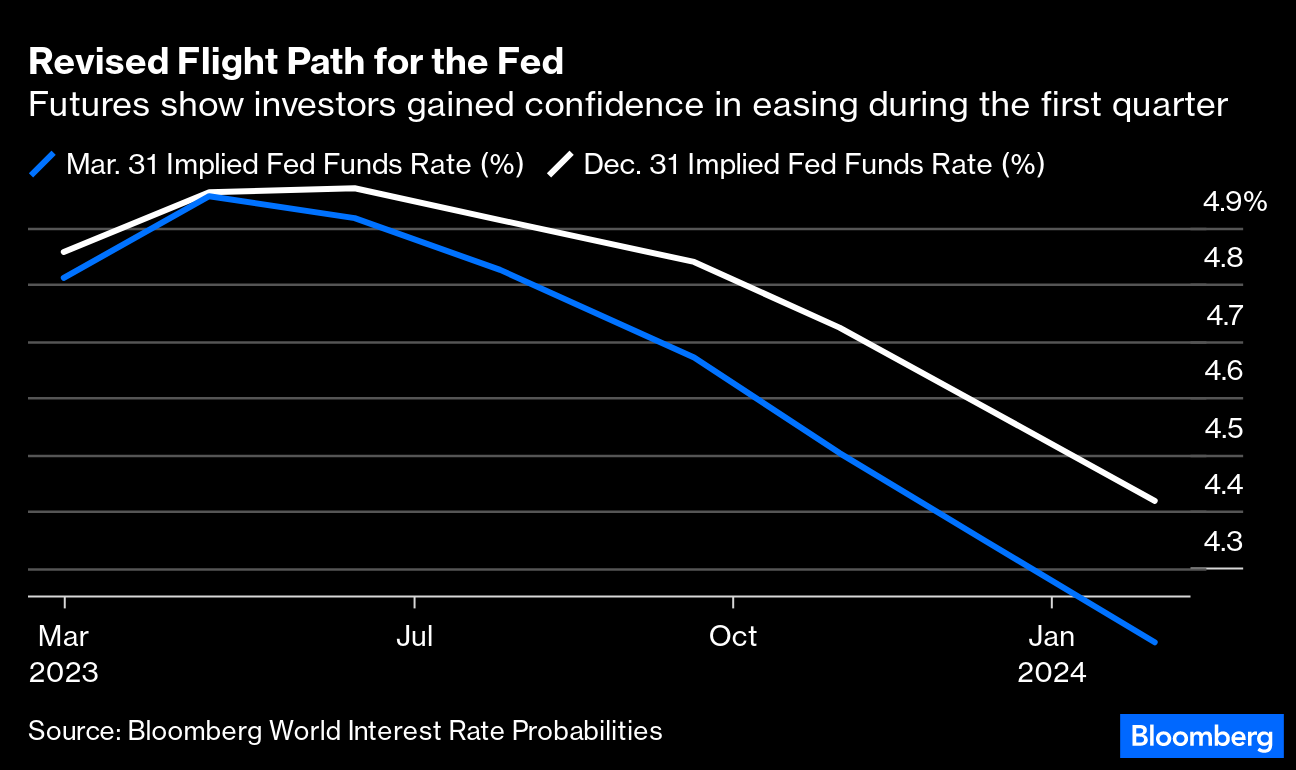

Bloomberg’s World Interest Rate Probabilities function shows that confidence in significant rate cuts before the year is out has grown :

Source Bloomberg

The blue sky scenario of the moment? The banking fire has been contained, inflation continues to fall and key interest rates are on the way down in the medium term. But some clouds are darkening this picture as new surge in the oil market. Crude is back in the news following a shock oil output cut from major producers in the OPEC+ group. WTI crude futures surged past $81 a barrel at the open to its highest price since late January.

Caution is still in order, since just two weeks from now earnings season will start.

MARKETS : Liquidity driven markets

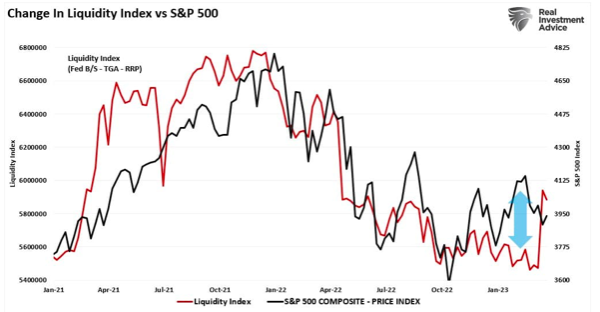

There is no denying that technically the markets have just become a whole lot more constructive and some bottoming processes seem to be in place. Recent interventions to offset the “banking crisis” by providing liquidity was the effective “ringing of the bell.”

That was enough to spark a rally and trigger bullish buy signals that provided technical support for the market.

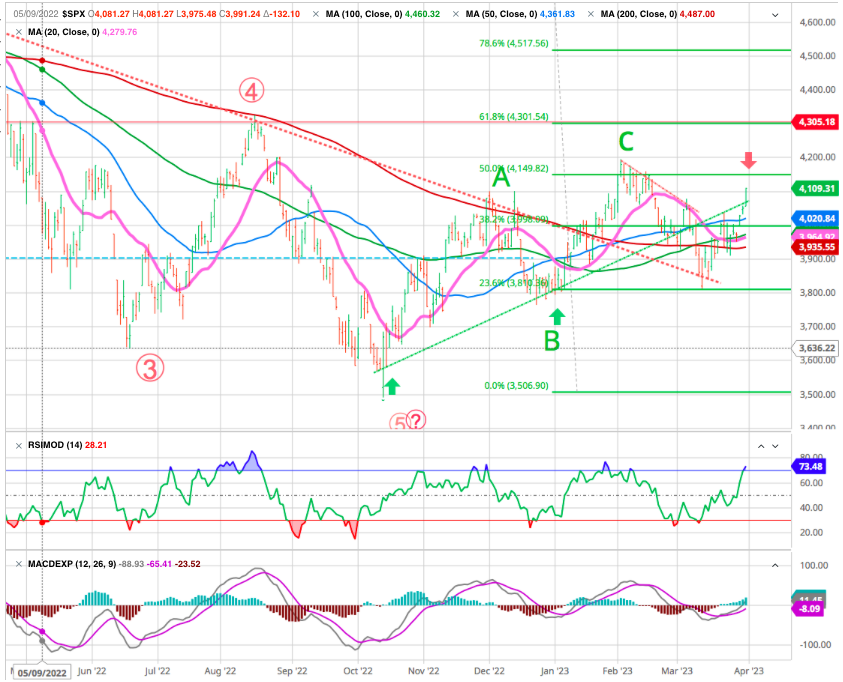

SPX remains highly resilient and should attempt to break out again soon. It’s moving to critical 4,100-4150 resistance (red arrow); if it can overcome this zone, 4,200-4,300, resistance could come next – a 61.8% retracement of the downtrend. Short term it is confirmed by the Moving Average Convergence Divergence indicator (MACD) positive signal.

However, if the SPX doesn’t penetrate 4,150 and reverses, the technical image becomes bearish, and the critical support we continue watching is the 4,000 and the 3,800 levels now.

If it starts slipping below critical levels of support, it will become highly probable that the SPX will either double bottom, retracing back to 3,500, or reach a new low in the worst-case outcome.

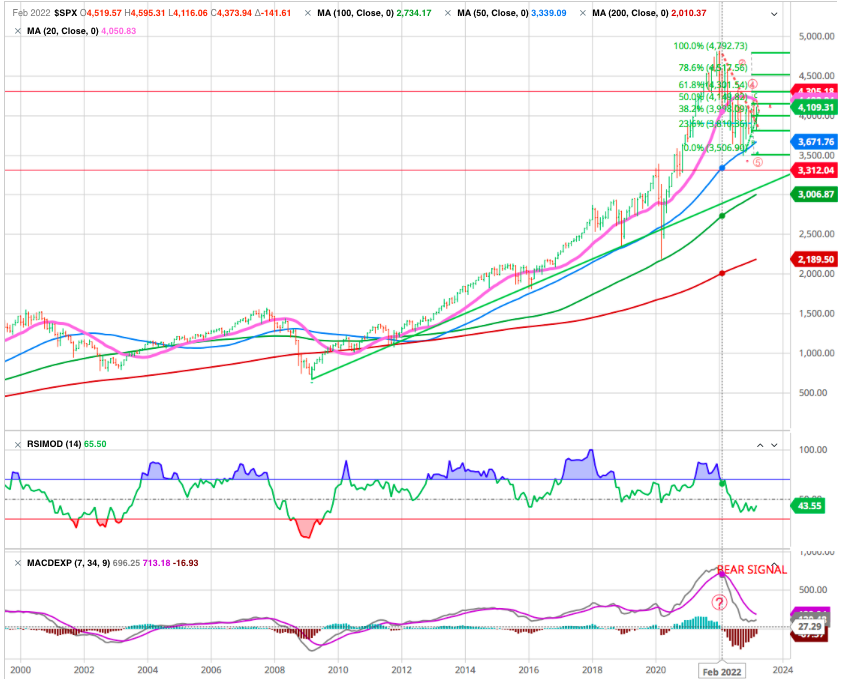

Longer term we remain cautious as our indicators are not pointing to an upturn . ( see our DECIDER and BEAR SIGNAL ).

So, the end of the bear market ? Certainly not !

Investors could modestly increase equity exposure, as the likely path for stock prices is higher over the next two weeks to two months. As shown, the most likely target for the S&P 500 is 4200 before serious resistance is encountered and a reasonable level to take profits and again reduce risk.

NASDAQ

The technical outlook for the tech benchmark index improved significantly after it broke above the downtrend line and a ‘golden cross’ -green arrow- (when the 50-day average crosses above the 200-day) formed. It recently pulled back from intermediate resistance at 12,200 (the 38.2% Fibonacci retracement of the entire correction phase) to the breakout level (also the 50-day SMA) which, together with the 200-day SMA, currently at 11,406, should present support from which the positive momentum could resume. The next resistance holds at 12735.

SMI

After a period of underperformance, which saw the SMI retrace 61.8% of the rally that it initiated in October, the index looks set to attempt a bottom. A rally to the 200-day moving average occurred and the next resistance holds at 11,250. As long as price remains below this level, the technical outlook will remain challenging.

Gold

Gold prices rose slightly as investors turned to safer assets in the face of the banking crisis.Will gold continue to rise? The precious metal should challenge its major resistance around 2025.

OIL

Crude is back in the news following a shock oil output cut from major producers in the OPEC+ group. WTI crude futures surged past $81 a barrel at the open to its highest price since late January. The black gold hold its supports around 68$, holding the support previously mentioned at Fibo 50% retracement of the last upleg. Resistance at 82.

Cryptos

Bitcoin is up 1.5% this week and is now hovering near its 2023 highs. The digital asset market leader is benefiting from the return of risk appetite in the markets and still has a significant positive correlation with the Nasdaq. Despite the US regulatory crackdown on the cryptocurrency industry in recent days, particularly towards Binance, bitcoin is proving particularly resilient.

Happy trades

BONUS :

Neil Sedaka