MARKETSCOPE : Dry January

January, 18 2022

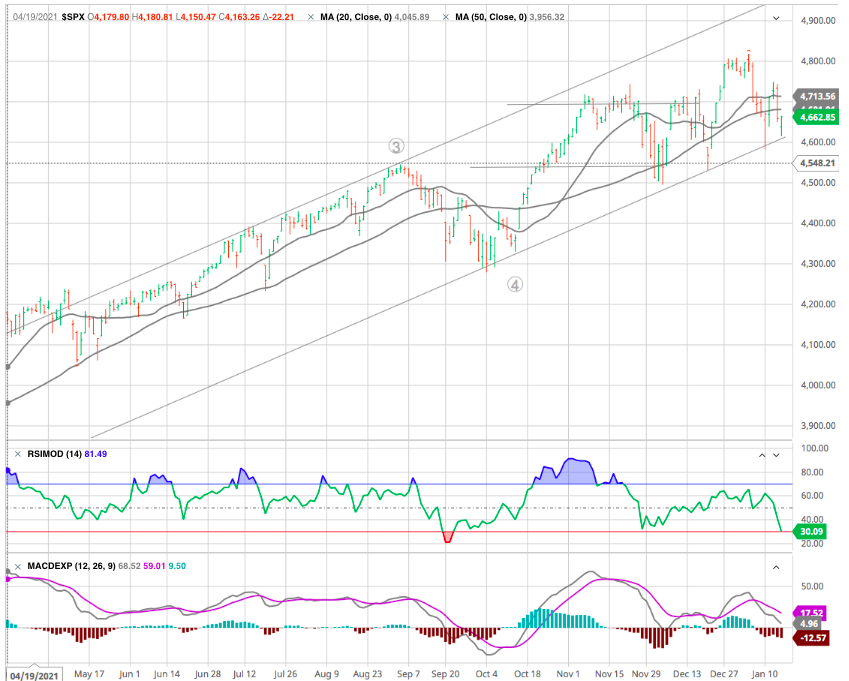

Initially a little deaf to the prospects of a more restrictive monetary policy, equity markets had a rude awakening last week when they realized that the Fed could proceed with four rate hikes this year to counter inflation. In fact, December’s U.S. inflation numbers, measured at 7% year-over-year (not seen since 1982). The message came through in a somewhat painful way for stock market indexes, especially those rich in technology stocks and more generally in so-called growth stocks. If the U.S. central bank acts as planned, liquidity will be less abundant, forcing investors to be more selective.

As earnin gs season begins with banking stocks in the US, traders seem to be anticipating a slowdown in growth despite the rather good initial figures published by financial players.

gs season begins with banking stocks in the US, traders seem to be anticipating a slowdown in growth despite the rather good initial figures published by financial players.

A potential catch-up is anticipated as inflation is in full swing and interest rates could rise faster than expected.

Notably, despite the market’s failure to hold previous gains, it successfully retested and held the lower trend line. Despite an easing pressure in our oscillators, sell signals remain in place and have not yet reached more oversold levels.

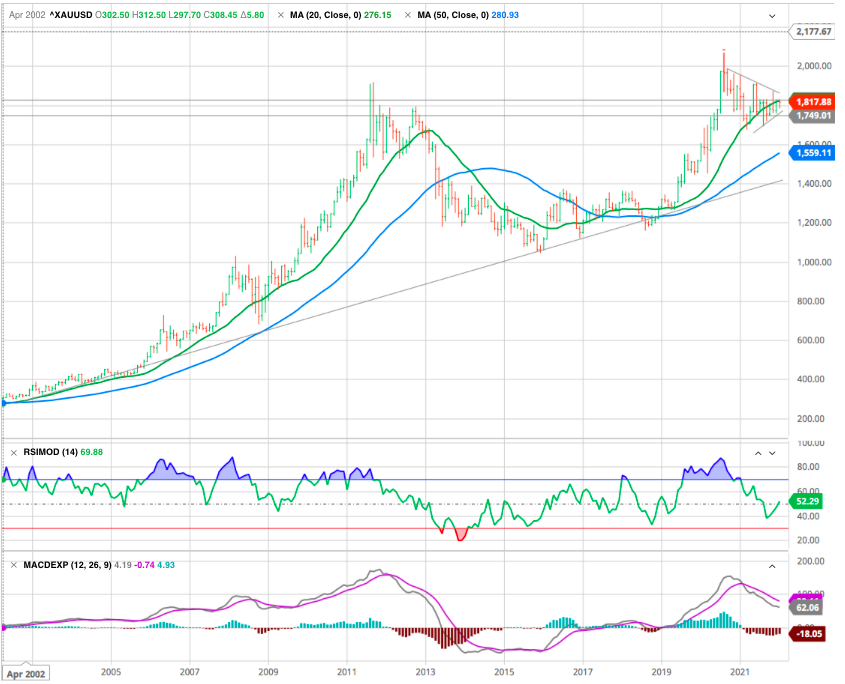

GOLD

The Federal Reserve has spooked some gold investors lately, as the US central bank has increasingly hinted at moving to withdraw some of its monetary support for the world’s largest economy. More restrictive monetary policy is generally thought to be bearish for gold prices. On the flip side, inflationary pressures are helping provide some support for gold prices—in addition to the primary supply and demand dynamics for the precious metal.

Any upside move should be limited

CRYPTO

On the bitcoin side, the price of the market leader in digital assets is stabilizing around $42,000 last week

As we mentioned previously that the main areas to look for reversal were the 40k and the 30k. As we’re approaching the 40K now, there are a few things that have to come together in order for us to have a confirmed reversal.

We must:

- Show bullish reaction (strong daily bullish candle)

- Break the risk trendline (for risk entry – see below for risk entry chart)

- Break the descending trendline (for confirmation of reversal)

Only when we see those things happen, we can see a confirmed reversal.

Also remember that if we do break the 40k level, it is likely we’ll see the 30k

Elon Musk took to Twitter again to boost his “dogecoin” darling, mentioning that some of his Tesla products will be available for purchase with the cryptocurrency. Only a few goodies are for sale. No authentic Tesla cars. Comedy stunt? Probably.

CRYPTOS AND STOCKS (mainly technology) are increasingly corrolated. That has raised risk fears. With the pandemic and central banks flooding markets with liquidity they began to dance together. That is a problem if you see crypto as a hedge……Cryptos are now more closely linked to tech stocks than gold and major currencies. BOTTOM LINE: equity holders should watch cryptos for bearish signals and also look at other alternative asset classes as part of their diversification strategy. This is where Gold can play a big role.

e-CNY

In all discretion, the Chinese central bank has just launched a pilot version of a digital wallet in e-Yuan (or e-CNY) usable on a smartphone. Even if the institution still refuses to give an official launch schedule, Beijing intends to take advantage of the Olympic Games next February to promote it more widely.

Developed by the People’s Bank of China (PBoC) Digital Currency Research Institute, Chinese people can now download an application on their smartphones that allows them to test this future currency, store it and pay for items or services with it. Still in the test phase, nearly 140 million individuals now have digital yuan accounts. The transactions made are already worth nearly 8.6 billion euros (62 billion yuan).

China, which has been thinking about the project since 2014, thus intends to keep its rank as a forerunner in digital currency and to emancipate itself from traditional crypto-currencies such as bitcoin.

Next Recession

Last but not least Deutsche Bank already thinks it knows when the next recession will occur.

DB strategists believe that the economy will begin to slow down after 2024. The risk of a recession will then creep into the economic picture for the first time since the pandemic began.

“The median and average time to the next recession is 37 and 42 months after the first surge. So that brings us to July 2025 and December 2025, respectively. The earliest gap over 13 cycles is 11 months and that would take us to May 2023,” says Jim Reid, a strategist at Deutsche Bank.

Happy Trades