MARKETSCOPE : Fed Hawks Are Circling

February, 19 2023Soft – Hard or No-Landing

Never happy. The US economy is too strong. Too much consumption, too much confidence, and retail sign of economic resilience came in the past week, when monthly data showed U.S. retail sales increased by the most in nearly two years in January. Last but not least, the latest producer price index rose 0.7% in January, its biggest gain since June.

The figures finally driving the message home that bringing the economy in for a soft landing will be extraordinarily challenging and there will likely be plenty of turbulence along the way.

Investors are caught up in the fear that the Fed will raise rates higher than expected, which caused risk assets to bend as of Friday. Statistics are no longer going in the direction of easing prices, which raises some questions after the big rebound recorded by the equity markets.

Equity markets are ending the week in the red after finally falling victim to the persistent disappointment of US economic data. Fears that the Fed would need to raise short-term interest rates more than previously pushed the yield on the US 10-year to our target zone at 3.90/3.95%.

Equity markets are ending the week in the red after finally falling victim to the persistent disappointment of US economic data. Fears that the Fed would need to raise short-term interest rates more than previously pushed the yield on the US 10-year to our target zone at 3.90/3.95%.

The S&P 500 concluding its second straight weekly decline, as Federal Reserve officials reinforced the message that interest rates need to rise. Fed Bank of Richmond President Thomas Barkin said he favors a quarter-point move to give the central bank flexibility, and Fed Governor Michelle Bowman said the central bank should keep raising rates until there is much more progress on inflation.

Lael Brainard announced that she will leave the No. 2 role at the Fed. She was also known as one of the most “dovish” members of the FOMC, urging a somewhat less aggressive approach in the fight against inflation, and providing a counterweight to the spectrum of policy especially when compared to “hawks”

Earnings results from major retailers in the coming weeks will test the strength of the U.S. stock market rally, as investors gain insight into the health of consumer spending and the fallout on company bottom lines from inflation.

On Wednesday the Federal Reserve’s latest meeting minutes will be in the spotlight amid renewed uncertainty over how high interest rates may ultimately rise in the central bank’s battle against inflation.

Shares in Europe rebounded as better-than-expected corporate results. as the CAC40 and the FTSE100, broke their all-time records at the beginning of the week. Consensus corporate results continue to reassure investors and helped markets shrug off fears about additional interest rate hikes by the ECB, which has now reached 3.75%. Currently, the German 10-year yield is trading at around 2.55%, which shows the upside potential if the expectations are correct!

Chinese equities fell for a third consecutive week as concerns over escalating geopolitical tensions with the U.S. hampered prospects of faster economic growth.

MARKETS : Frustrating bulls and bears alike

See more in this month What Are the Charts Telling Us ?

Over the last few weeks SPX has moved higher into a decent confluence of chart and Fibonocci resistance as defined by the December high, the 50% retracement of the decline, and a significant internal trend line (dotted green).

However, on Friday, the MACD signal deepened. This is the first sign of a potential retest of the multiple support levels clustered around the 3950-4000. If the market fail to hold those levels it will suggest a deeper correction is at work.

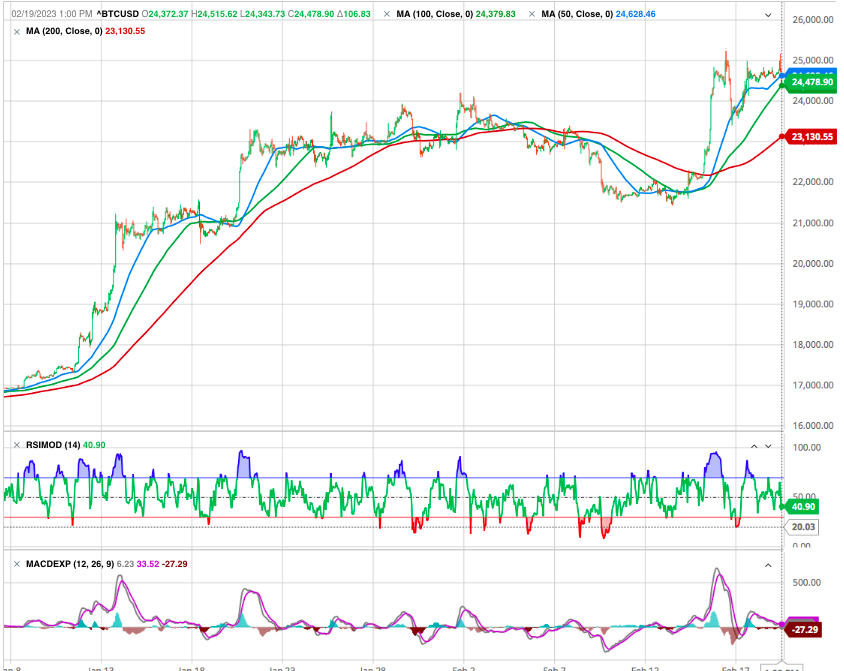

While markets are rallying short-term, history suggests that equities will not be able to fend off higher rates indefinitely. (see below).

The Fed will be forced to keep risk-free rates at 5%+ for 9-12 months at least, which means the housing market and the real economy must handle 7-8% borrowing rates for a long time to come.

Hard to make the case for rapidly expanding valuations.

On the growth front, check this: Between 2010 and 2020, the US barely managed to produce an average 2% real GDP growth with an average Fed Fund rate of 0.62%.

What makes you sure the economy will avoid a medium-term recession with Fed Funds at 5%+ for long?

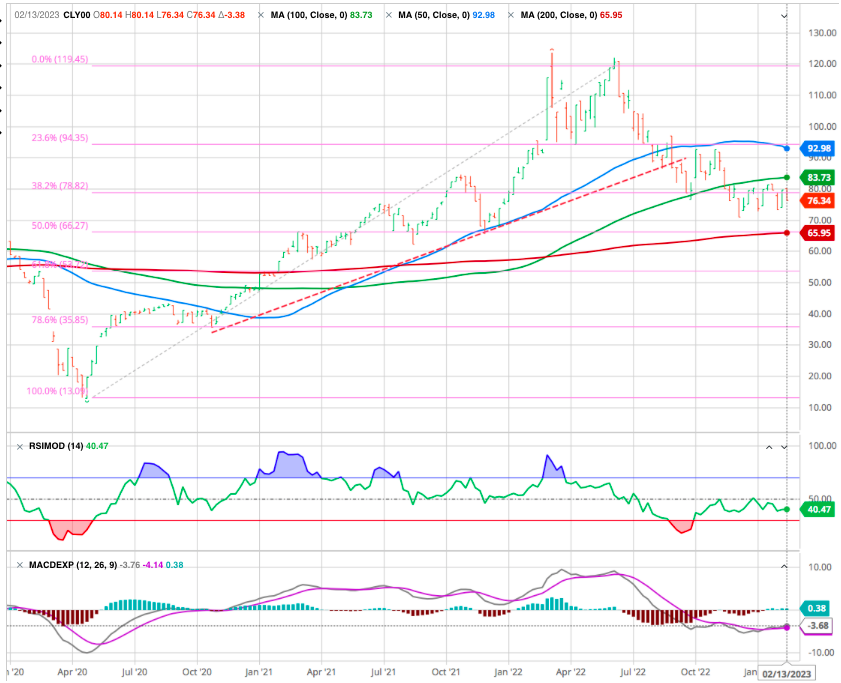

OIL

OPEC revised its demand outlook for 2023 upward, displaying a degree of optimism that the cartel had not shown in months. OPEC still expects the Chinese revival to boost global oil demand this year and raised its forecast by 100,000 barrels per day. In terms of prices, US WTI is trading at USD 77 per barrel.

As explained earlier we still have a strong support around USD 70.

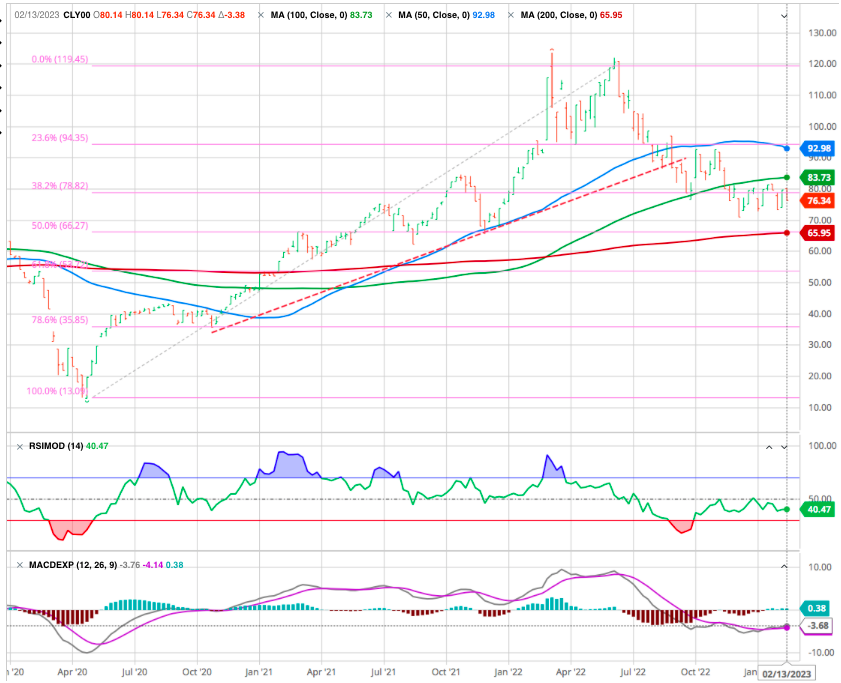

CRYPTOS

Bitcoin is recovering more than 9% this week and is back flirting with $24,000. Bitcoin is not immune it seems to the sharp shift in risk appetite throughout the markets. That comes after an immense rally earlier this week that saw it hit an eight-month high on Thursday. The digital currency even hit $25,000. With the macroeconomic environment worsening, or at least less favorable than expected by market participants, crypto-currencies have stalled at the end of the week.

Rates Higher for Longer

“Once inflation gets above 5% it’s never come down unless fed funds have gotten above the CPI.” –Stan Druckenmiller

Despite the Fed’s aggressive rate hike campaign over the past year, the funds rate remains below CPI. As such, it’s hard to call current policy “hawkish” in the context of history. In fact, on this basis the fed funds rate has now been negative in real terms for nearly 40 months running. As we stressed previously one of the reasons behind the equities rally which has been taking place over the last few months is the improvement in global liquidity.

While the fed and ecb balance sheets have been heading south, the tsunami of liquidty coming from the BOJ ($600B of JGB buiying over the last 10 months) has been a tailwind for risk assets. But it may not last the real story will unfold in H2 as bringing inflation down from 4% to 2% will require much effort as wages measured are still growing at 4%+.

Nothing changes on terminal rate pricing as there is no material surprise; however markets are slowly pricing no rate cuts for this year.

Thus, higher for longer!

In recent weeks, Fed Chair Jerome Powell has stressed that there is still a long road ahead on dealing with inflation, rather than an instant on/off switch that would result in easier investing decisions.

“The disinflationary process, the process of getting inflation down, has begun and it’s begun in the goods sector, which is about a quarter of our economy…But it has a long way to go. These are the very early stages. The reality is we’re going to react to the data, so if we continue to get, for example, strong labor-market reports or higher inflation reports, it may well be the case that we have to do more and raise rates more than is priced in.”

Happy Trades