MARKETSCOPE : Market Higher for Longer ?

May, 21 2024There’s exuberance in the markets again as traders celebrate in style following the first CPI reading of the year that drifted lower.

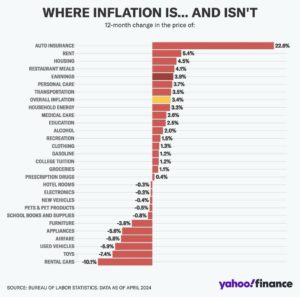

On Wednesday, the headline consumer price index (CPI) for April increased at a slower-than-anticipated rate, while the core CPI cooled for the first time since October 2023.

Never mind that the drop was minuscule, and the rate of inflation is still holding well above 3%, all that matters is that Fed Chair Jay Powell has signaled the next rate move will in all likelihood be down, and not up.

On that note, the major indices are notching fresh all-time highs, the meme stock rally has recharged, and it almost feels like new stimulus checks are about to be delivered (don’t get your hopes up).

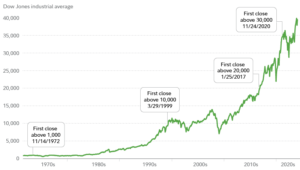

Dow Jones Industrial Average (DJI) traded above 40,000 for the first time ever on Thursday. There’s nothing like some big round numbers to get the bulls excited.

See our post DOW 40’000

The Dow is one of the oldest U.S. indexes, and was first launched in 1896. It took almost a century for the gauge to reach 10,000, but subsequent milestones are only getting quicker. 20,000 was reached in 2017 and it took less than four years to climb to 30,000 (and that was with the coronavirus pandemic). Each 10,000 points also just gets easier, with things less exciting in percentage terms.

Source Fidelity

It helped drive the yield on the US 10-year note to its lowest level in over a month.

Bad News Is Good News ?

It’s also worth noting that figures (GDP, retail sales) confirm the slowdown in U.S. growth over the past several months. So far, this deceleration has been well-received by the financial community, which sees it as concrete evidence of the restrictive conditions of monetary policy. The market, always a step ahead of the economy, is thus betting on rate cuts to restart the engine. It remains to be seen if deceleration will not rhyme with stagflation.

STOXX Europe 600 Index rose 0.4% but slipped from the record high hit during the week. Japanese equities finished the week higher, with the Nikkei 225 Index gaining 1.5%.

MARKETS : Tried and Failed

This past week, markets surged to all-time highs as a plethora of bad economic data and a weaker-than-expected inflation print lifted hopes of Fed rate cuts in the coming months.

From a technical perspective, the markets remain on a current short term (and fragile) MACD “buy signal” and have cleared all previous resistance levels. Furthermore, the 20-DMA will cross above the 50-DMA this week, providing additional support to any short-term market correction.

NASDAQ

We would expect a pullback or consolidation with the market overbought on multiple levels.

In the news Mike Wilson, long time Bear chief equity strategist at Morgan Stanley, has increased his year-end target for the S&P 500 from 4,600 to 5,400. That’s a big leap that came accompanied with a lengthy explanation. One of the last big bear on Wall Street turns bullish on US stocks

As a reminder here are the main year-end forecasts for the S&P 500

For our part we continue to be cautious.

We do not subscribe to the no-landing narrative. Investors should underweight risk-assets on a cyclical investment horizon. Given sanguine market sentiment equities are at a heightened risk of declining.

We are inclined to neutralize strong factor positionings. We are balancing exposures between defensives and cyclicals, growth and value and mega versus large/mid and small caps.

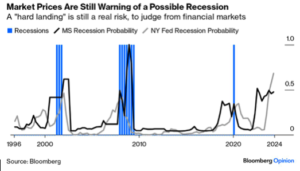

Warning: This recession signal if flashing red

Morgan Stanley’s longstanding indicator of recession probability derived from financial markets, along with the New York Fed’s measure of the same thing based on the Treasury yield curve. A hard landing certainly looks like a very real risk.

Morgan Stanley said they still expect a soft landing for the US economy, though they have lowered the probability to 50% from the previous 80%.

They project three rate cuts in 2024, compared to the consensus expectations of two, with the first cut anticipated for September.

However, the firm’s economists believe the cycle’s terminal rate will be 3.625% by the end of 2025, saying the economy is now entering “a new secular rates regime driven by structural changes and higher debts/deficits.”

For their part BCA Research highlighted a potential signal for an impending US recession based on historical patterns of unemployment rates.

According to their analysis, the 3-month moving average of the unemployment rate has risen to 3.87% from a low of 3.5% earlier in 2023, marking a concerning trend.

The recent uptick in April from 3.8% to 3.9% has triggered what BCA refers to as a recession signal, also ticking a box in their Equity Downgrade Checklist.

They also notes that small- and medium-sized businesses (SMBs), which form the bulk of US employment, have shown decreasing hiring intentions for the coming three months. This trend is expected to exert additional upward pressure on the unemployment rate.

Adding to the recession indicators, BCA points to several segments of the yield curve that are currently inverted, alongside a contraction in the US Leading Economic Index on a year-on-year basis.

SWIZERLAND : Catch up

Swiss equity market has started to outperform strongly

EUROPE : Mission completed

European stocks seem to have been extraordinarily strong. Let’s have a look at the STOXX 50 Europe index

China

Now, let’s talk China for a moment … we have written about this market-non-grata on several occasions. China stocks have been massively beaten down, neglected, and hated. With the bullish signals in place there are signs that they have bottomed out, and might enter a “lockout” rally.

We believe the reward-to-risk of investing in China stocks now is tremendously attractive.

Also See our Feb 06 article The Biggest Long Trade On The Planet

Hang Seng Index

Bull markets are typically born on pessimism, and we have just seen sharp recoveries following major capitulation in the indices.

Chinese stock markets saw a stellar rebound over the past two months, with Goldman Sachs analysts forecasting more gains to come, especially if some key conditions were met.

The rebound was driven by a mix of bargain hunting, optimism over more stimulus measures from Beijing, and some signs of improvement in the world’s second-largest economy.

Goldman Sachs analysts said that Chinese markets had the potential to rally further, with historical evidence suggesting a greater chance of gains in the event of a bull market- ie a 20% gain from recent lows. But Chinese companies will have to deliver on the earnings front for such a scenario to play out.

On a sectoral basis, Goldman Sachs analysts said they were overweight on technology, media and telecommunications, were marketweight on developers and banks, and had downgraded their outlook on automobiles and capital goods.

A key point of uncertainty was reports suggesting that Beijing was instructing state governments to begin buying some houses to help reduce inventory for major developers.

Cryptos

Following record highs on stock indices, bitcoin is regaining ground this week. The crypto-asset has erased the past four weeks of decline, rising more than 8% since Monday, and is now around $71’000.

This increase is partly explained by a massive return of net inflows into Bitcoin Spot ETFs across the Atlantic. Between Monday and Thursday, $725 million flowed into these exchange-traded products, bringing the total assets of the 11 ETFs to over $54 billion. More broadly, the main cryptocurrencies are following the rise of the leader in digital currencies, with the market as a whole rising 6.5%, valuing it at $2.349 trillion.

FED “Another Massive Policy Error”

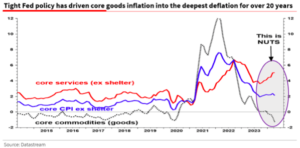

“This Is Nuts” so says Albert Edwards, Société Générale’s chief global strategist, overseeing a “policy disaster” that has triggered a deep deflation in goods prices.

The Fed’s policy of keeping rates high to kill rising supercore services inflation has resulted in unprecedented falls in core goods inflation, a record fall since the late 1950s, apart from a few months in 2003.

Edwards, a ‘perma bear’, ranks him among the best macro strategists of the past 20 years. He says the Fed’s policy stance has led to a huge divergence between goods and services inflation.

“This policy error is the mirror image of the mistake the Fed made after the 2008 Global Financial Crisis, the very mistake it was castigated for by former Fed Chair, Paul Volker, back in 2018,” warns Edwards.

The Fed’s current error is that in targeting one part of overall inflation (i.e. rising super core services inflation), it has either inadvertently or deliberately driven core goods prices into the deepest deflation for 20 years.

The Fed holds rates at restrictive levels as it waits for inflation to cool, which it thinks will only happen when the jobs market starts to deteriorate (a healthy jobs market generates strong wage growth, which boosts demand, which boosts inflation).

A firm labour market and persistent core inflation prints meant the Fed adopted a higher-for-longer stance that keeps interest rates restrictive for an extended period.

“Serious Downshift”

However, Ian Shepherdson, Chief Economist, Pantheon Macroeconomics pointed out that “a more serious downshift” in the labour market is approaching. “If jobless claims are going to trend higher at the same time, payroll growth will head south rapidly. ”

Remember, at the start of the business cycle downturns of 1990 and 2001 – the two most recent “normal” recessions – job growth dived from fine to zero in about four months. A similar shift over the next few months wouldn’t be a surprise !

The Fed might be too late in Edwards’ view, but it might cut fast once it starts in the face of official data that confirms the surveys are right and the labour market is deteriorating.

Happy trades

BONUS