MARKETSCOPE : Point Break

November, 27 2023Also check our older presentation Point Break : L.T. cycles Kondratieff and Elliott waves

Fast and Furious

With the exception of the traditional turkey, investors, especially in the US, didn’t have much to eat. Equity indices have managed to maintain their bullish course, including in Europe, even if volumes at the end of the week were particularly sluggish.

At the end of an unremarkable week, U.S. stocks closed higher to mark four consecutive weeks of gains. Of the 11 S&P sectors, nine closed in positive territory during the shortened session, led by Health Care. Communication Services and Technology were the two losers.

At the end of an unremarkable week, U.S. stocks closed higher to mark four consecutive weeks of gains. Of the 11 S&P sectors, nine closed in positive territory during the shortened session, led by Health Care. Communication Services and Technology were the two losers.

The US 10-year yield is attempting to rebound from its 2022 peak of 4.34%. We’ll be keeping an eye on 4.60% as initial resistance, which, if breached, could put a damper on the fine upward momentum seen in equities over the past month.

The STOXX Europe 600 Index ended the week 0.9% higher. The German Bund has also stabilized above its 200-day moving average around 2.60/53%, with a first rebound target around 2.75/77%, which if breached should result in a retest of 3.01%.

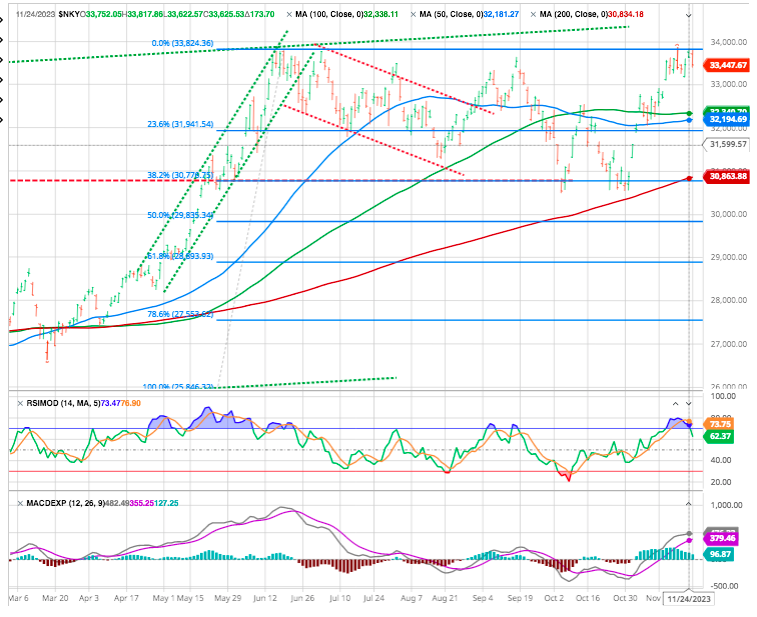

Japan stocks returns were muted over the week while stocks in China retreated as news that Beijing may introduce fresh stimulus measures for the property sector was not enough to offset broader economic woes.

MARKETS : What Is Obvious Is Obviously Wrong

Stocks continued to rally this week, with the S&P 500 climbing by 1%, approaching their July peak. This was primarily a function of a FOMO positioning and have nothing to do with improvement in the fundamental outlook for the economy or earnings growth. Stocks might continue to rise early this week as investors assess consumer strength during the holiday shopping season.

As a reminder, one of the pillars of the current narrative remains a soft landing for the US economy, which would therefore not be compatible with a sharp downturn in consumption we shall discuss it below.

The big event of the week was Nvidia Q3 results. The stock fell despite the company beating earnings and revenue estimates as it issued cautious guidance because of export restrictions to China. Nvidia’s weakness was reflected in the underperformance of the Nasdaq over the week though growth stocks outperformed value stocks overall.

November and December are very strong months historically. As a result, we might end up having a strong year-end rally in the S&P 500. But the risk-reward just doesn’t make sense here.

See our analysis RSI : Stock sell signal

The index trades at an above average forward P/E multiple, future EPS might be overestimated if we slip into a recession (likely), and historically a recession and rate cuts tend to lead to significant downside in the index. I’m not willing to take on these risks just to make extra 5% in the year-end rally.

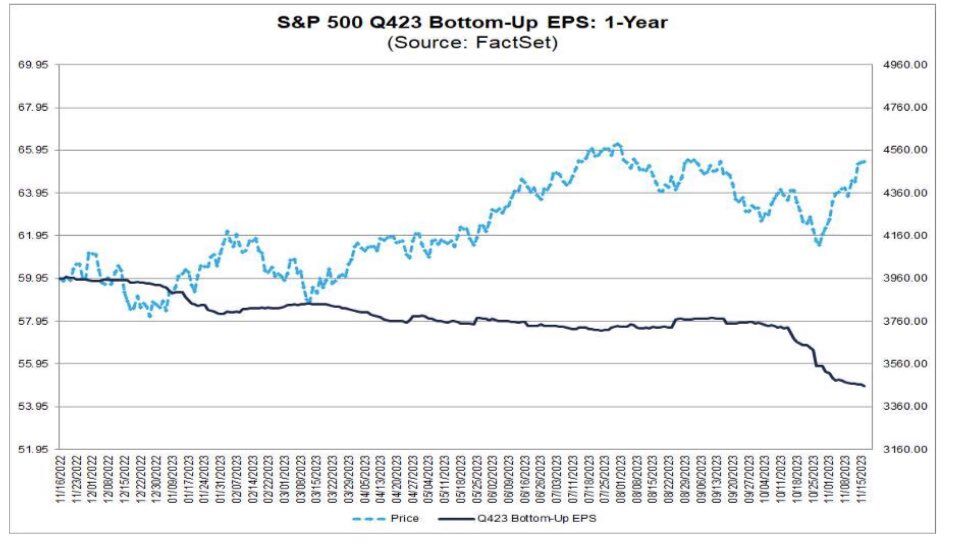

Actually, the rally in US stocks in recent weeks has taken attention away from what looks like a pretty concerning forward picture from earnings releases. Q4 earnings expectations have come down considerably in recent weeks, in contrast with equity market strength.

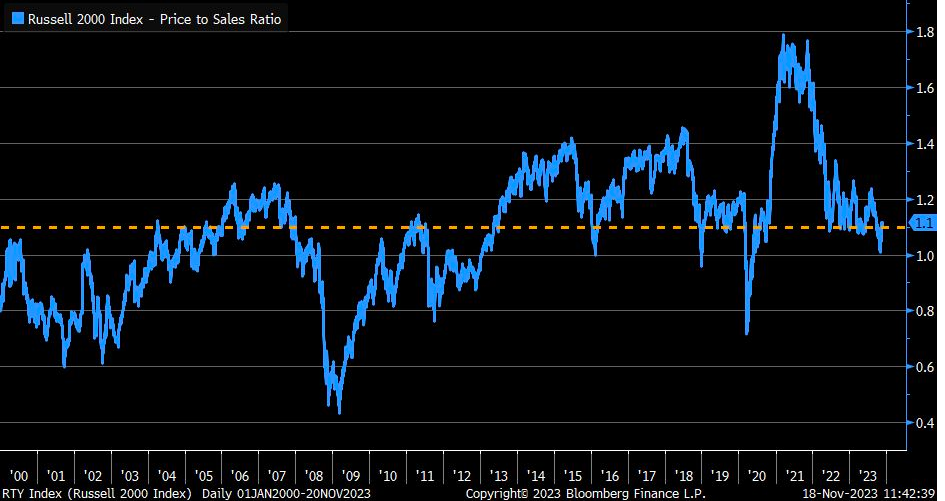

Never the less Bloomberg’s fair value model suggests the market is relatively well prepared for a recession and/or extremely slow growth. This model shows large cap stocks are currently priced for less than 2% profit growth over the next twelve months, and some modest easing in Fed policy to begin in the later half of 2024. Small caps appear to expect nothing but the worst, at nearly 30% below macro-implied fair value.

The Magnificents Seven or The Dirty Dozen

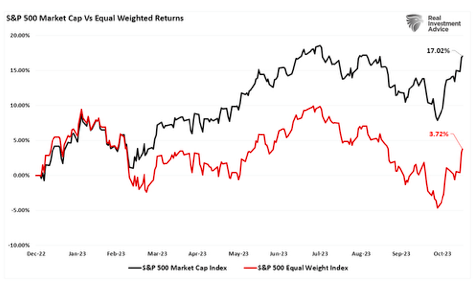

The market capitalization of the top seven stocks is so large that it skews the performance of the index overall. We can see this visually by comparing the performance of the market and equal-weighted S&P 500 indices.

Source RIA

The Magnificent Seven has led the market higher throughout 2023 and are responsible for most of the gains in the S&P 500 and NASDAQ year to date. However, these mega-caps have seen significant increases in their valuation ratios that have outpaced their revenue and earnings growth in 2023. This could leave them and the overall market vulnerable to a pullback as we head into 2024. these mega-caps are likely to face much stronger headwinds in 2024. Not only because of much higher valuations but because a recession seems likely in the coming year. Or, as the old adage says, trees don’t grow to the sky.

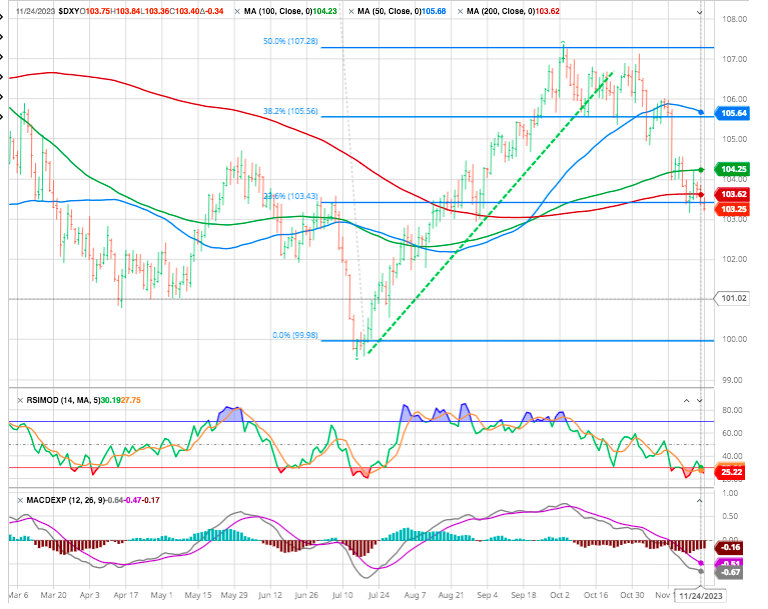

USD

The dollar ended lower for the 3rd week of the last 4, at 3-month lows.

The index is now below its 200-day moving average -red-, while the Japanese yen has strengthened beyond the Y150 per dollar level without direct intervention. China’s yuan has also been able to strengthen. At this point, this is what many wanted to see.

The US 10 year broke below the bigger trend line a few sessions ago. Note we almost touched the 100 day (4.33%) today. The HS flagged recently is big, but things seldomly move in a straight line. We need to see much more “frustration” if this is a top. The 200 day is down around the 4% area

Japanese Inflation Is Back

‘Turning Japanese’ could be our best bet for entering a tumultuous 2024.

Japanification has been a fact of life for three decades as the country sunk into a deflationary morass and failed to emerge, even after the concerted efforts of the late Shinzo Abe’s “Abenomics” program 10 years ago. But Covid appears to have achieved what Abe could not, and jolted core inflation up to its highest in 40 years. A return to a normal economic cycle is vital to the continuing normalization of the world’s monetary policy.

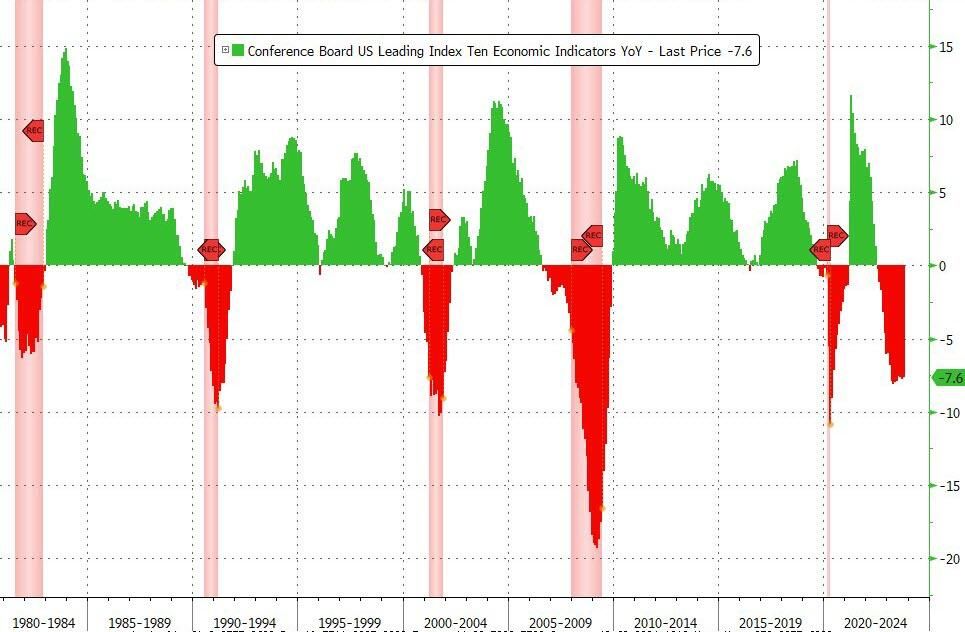

Economics Matters

The Conference Board’s Leading Index came in slightly below expectations, at -0.8% versus -0.7%. Just in time to arrest the growing optimism that a recession has been canceled and not merely postponed. Data continues to point to a recession in the months ahead.

LEI fell below -1% YOY in Aug 2022. This has never happened without the economy entering an official declared recession within a year. Likewise, the index is down 7.6% YoY – a drop never before recorded outside of recession. Over time, it’s been one of the most reliable recession indicators there is.

The guideposts that worked in the past suggest that the plane is in for a bumpy landing.

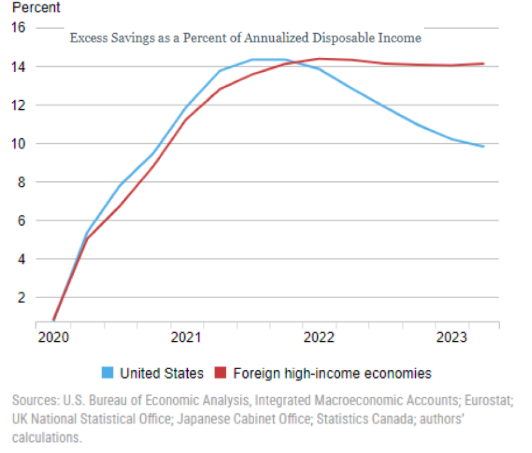

Americans the only consumers who responding down excess savings

The Federal Reserve expected the excess savings to be used up early in the year, but there’s still a lot of money left, even now. What they also failed to grasp was that Americans, behaving like optimists, would spend those savings while consumers elsewhere would not.

That’s illustrated by another great chart from Deutsche Bank AG’s George Saravelos

Looking around the outlooks, betting against credit is a popular call, and it’s easy to see why. Even if the economy’s landing is relatively soft, it’s clear that in some important respects, the monetary tightening hasn’t bitten at all yet. That doesn’t mean it never will. (source John Authers in Bloomberg Opinion)

The odds still point more to a downturn. That explains the negativity in opinion polls and surveys of consumers, even if it completely fails to explain the enthusiasm among consumers when they go shopping. And then there’s the issue of stock market sentiment, which is utterly baffling.

Happy trades

BONUS