MARKETSCOPE : “Too Far, Too Fast !”

February, 13 2023The Shadow of Doubt

“In a world of uncertainty, the only thing you can be sure of is volatility.”

— Jim Rogers

It was not until the sixth trading week of 2023 that many global markets experienced a weekly decline. This moderation in risk appetite, which is slight at this stage, coincides with a return of doubts about the path of US monetary policy. All eyes were fixed upon Fed Chair Jay Powell Tuesday. The fleeting and effervescent hope that Powell might/could/would be dovish was (once again) rebuked.

Sorry bulls, not happening !

The Nasdaq posted its first weekly fall for this year last week, down 2.41%, while the S&P 500 ended the week lower 1.11% and the Dow Jones lost 0.17%, in a week dominated by hawkish commentary from Fed officials and earnings reports.

The Nasdaq posted its first weekly fall for this year last week, down 2.41%, while the S&P 500 ended the week lower 1.11% and the Dow Jones lost 0.17%, in a week dominated by hawkish commentary from Fed officials and earnings reports.

Energy stocks were the notable upside outlier and communication services shares the prominent laggard.

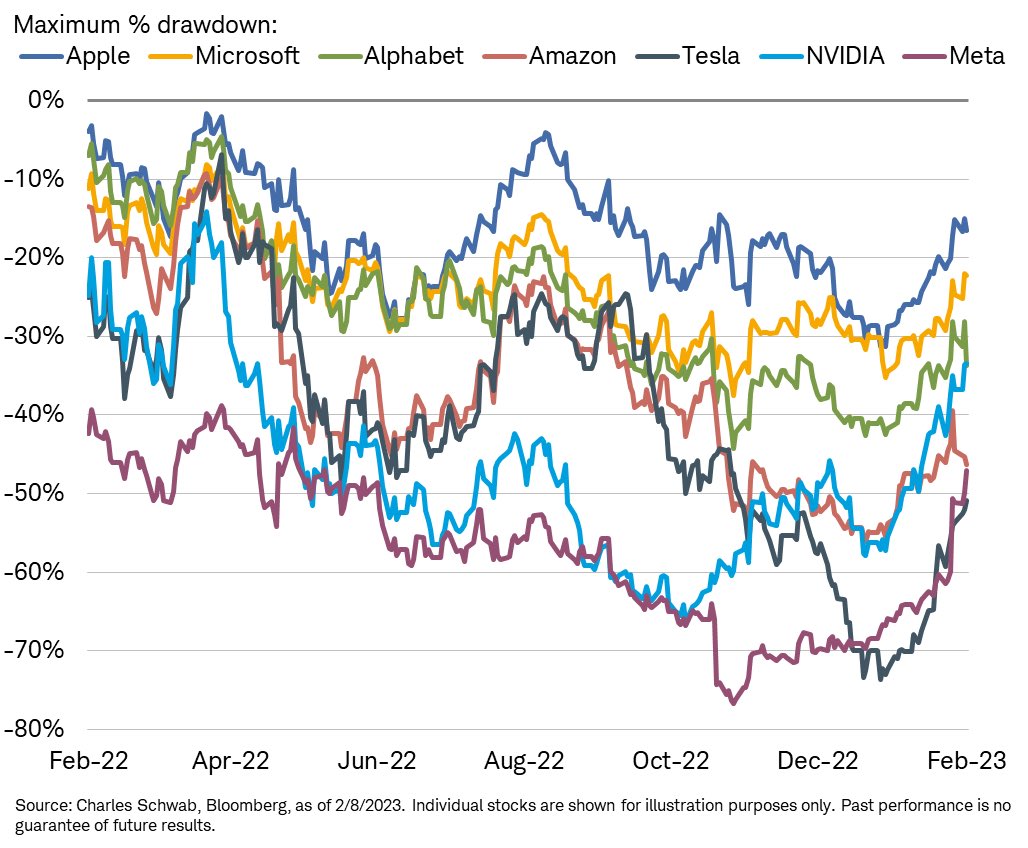

Shares of Google parent Alphabet lost roughly USD 100 billion in market capitalization on Wednesday. Comparing the performance of Microsoft (MSFT) and Alphabet (GOOG) one would be inclined to say that it is 1-0 in favour of MSFT with regards to artificial intelligence apps. Microsoft of course recently took a major (and expensive) stake in the highly popular ChatGPT, whilst Google went to present its own AI app, called Bard, earlier this week. Apparently, it was quite THE flop event and the stock tumbled close to ten percent on the week.

The 5-day heatmap of the S&P 500 gives further evidence of how difficult the week was for many stocks in this benchmark index:

Statements from Fed officials sent stocks in opposite directions on Tuesday and Wednesday. On Tuesday, stocks rallied after Fed Chair Powell repeated an earlier reference to the disinflation process having started. A series of central bank officials declared their willingness to push interest rates higher to tamp down inflation pressures, raising fears that policymakers will stay hawkish longer than previously expected and seemed to send stocks back lower, however.

Meanwhile, yields on the benchmark 10-year U.S. Treasury note rose to their highest in more than a month following an auction Thursday of 30-year bonds that saw weak demand and the yield curve inverted further as fears grew that the Fed would need to push the economy into recession in order to tame inflation. (we discuss below).

Perhaps more worrying for investors, corporate earnings seem to be coming in a bit on the light side, as the number of companies beating Wall Street estimates is lagging the historical average. (we discuss below). The coming week will be full of more earnings releases from companies such as Nestlé, Coca-Cola, Cisco Systems, Hermes, Deere & Co and many others.

The week will be dominated by talk of inflation and interest rates with the consumer price index and producer price index reports due out on Tuesday. The Consumer Price Index report for January is forecast to show a 0.5% month-over-month rise with energy prices higher again. The headline year-over-year inflation reading is expected to drop to +6.2% from +6.5% in December. Food prices are seen bumping up from December, while some cooling with air fares and lodging is anticipated. The inflation reads will be accompanied by a heavy slate of Federal Reserve speakers.

A strong inflation print could force markets to rethink whether the Fed will actually cut rates by year-end – potentially hurting a rally that has boosted stocks and bonds after last year’s rout.

Shares in Europe weakened on concerns about overly aggressive central bank policy that might prolong an economic downturn. Chinese stocks retreated as the spy balloon controversy fanned tensions with the U.S.

Did you say spying? – © Chappatte in Le Monde, France

MARKETS : Dr. Jenkill and Mr. Hyde

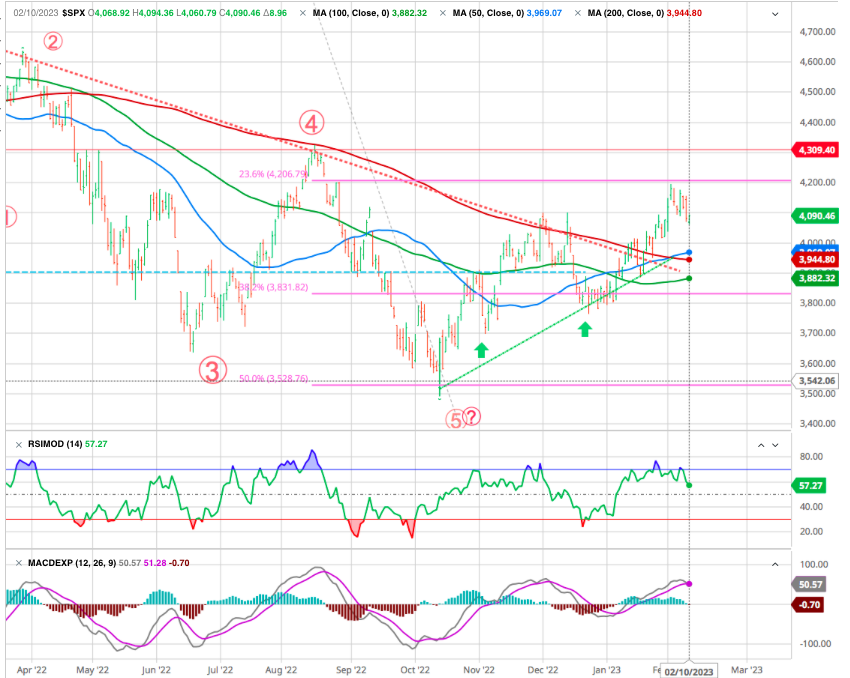

Given the strong rally to start the year, the market was due for a cool-off period, and we got that this week. As shown below, however, the S&P 500 remains above its 50 and 200-day moving average, and we’ve started to see shorter-term moving averages cross above longer-term ones which is typically a positive technical trend.

Our primary short-term “sell” indicator has been triggered for the first time since early December. While that sell signal does NOT mean the market is about to crash, it does suggest that over the next couple of weeks to months, the market will likely consolidate or trade lower.

But as we established previously, the index could drop as low as 3,800, the previous 38.2% fibo retracement level, a strong intermediate support, without endangering the medium-term uptrend. The upper line in the sand for the continuation of the uptrend is now set at 4,200 (23.6% fibo).

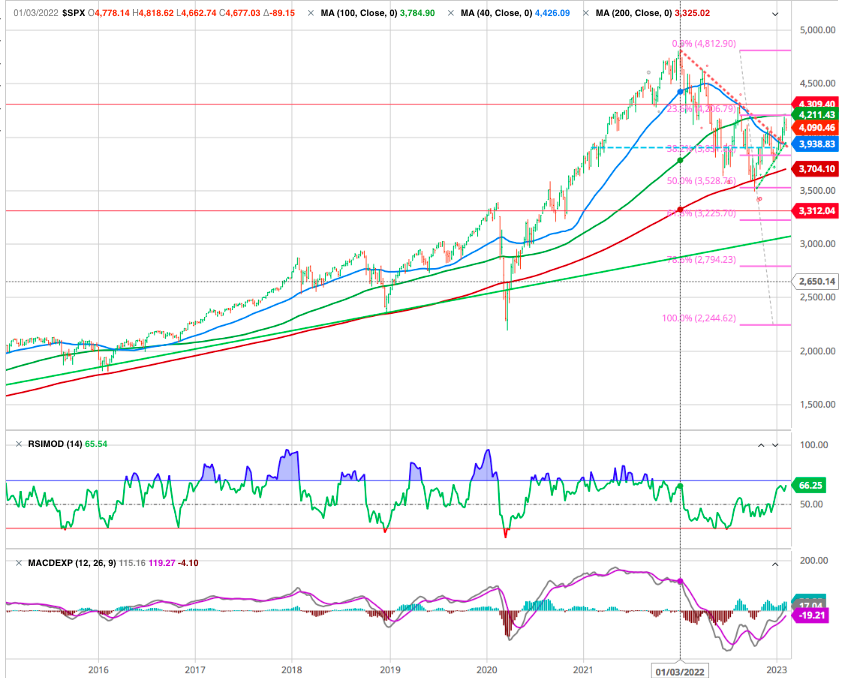

The chart below is a weekly price chart of the S&P 500, and as BofA notes, the market cleared the 40-week moving average (blue), which was apparent resistance during the entirety of 2022. Furthermore, the October low held support at the 200-week moving average (red), which remains support for the market since the 2009 lows.

Bears need to defend 4101 and break the weekly inflection of 4015 at the 50ma and the previous week’s low. A close at the lows of the past week this week would flip the near-term outlook bearish for a test of the crucial 3940-50 area.

SMI

The Swisss Index brokeits short term uptrend. Next support at 10’600 the 50 % fibo retracement level.

The venerable indicator states that the stock market will end the year with a gain if a National Football Conference team (such as the Philadelphia Eagles) wins the Super Bowl, but that stocks will fall if the American Football Conference team (the Kansas City Chiefs) is the winner.

This is really a tongue-and-cheek indicator. It has correlation but has absolutely no causation. As a result, diving aggressively into the stock market just because the Eagles beat the Chiefs in Super Bowl 57 is a bit of a stretch. While the Super Bowl Indicator would imply that markets would plunge like an eagle, but don’t bet we shall have a red tide on this indicator.

Inverted Yield Curve accelerated

However, likely having had a much larger contribution to the negative performance were rising yields after Friday surprise labour market report. Here’s the chart of the US 10-year yield. Indeed is the yield back to its highest level since late December.

As Chair Powell implied the job market’s strength and the persistence of inflation pressures means that the Fed will need to keep raising its benchmark interest rate this year. So bearish… and the market reacted in kind.

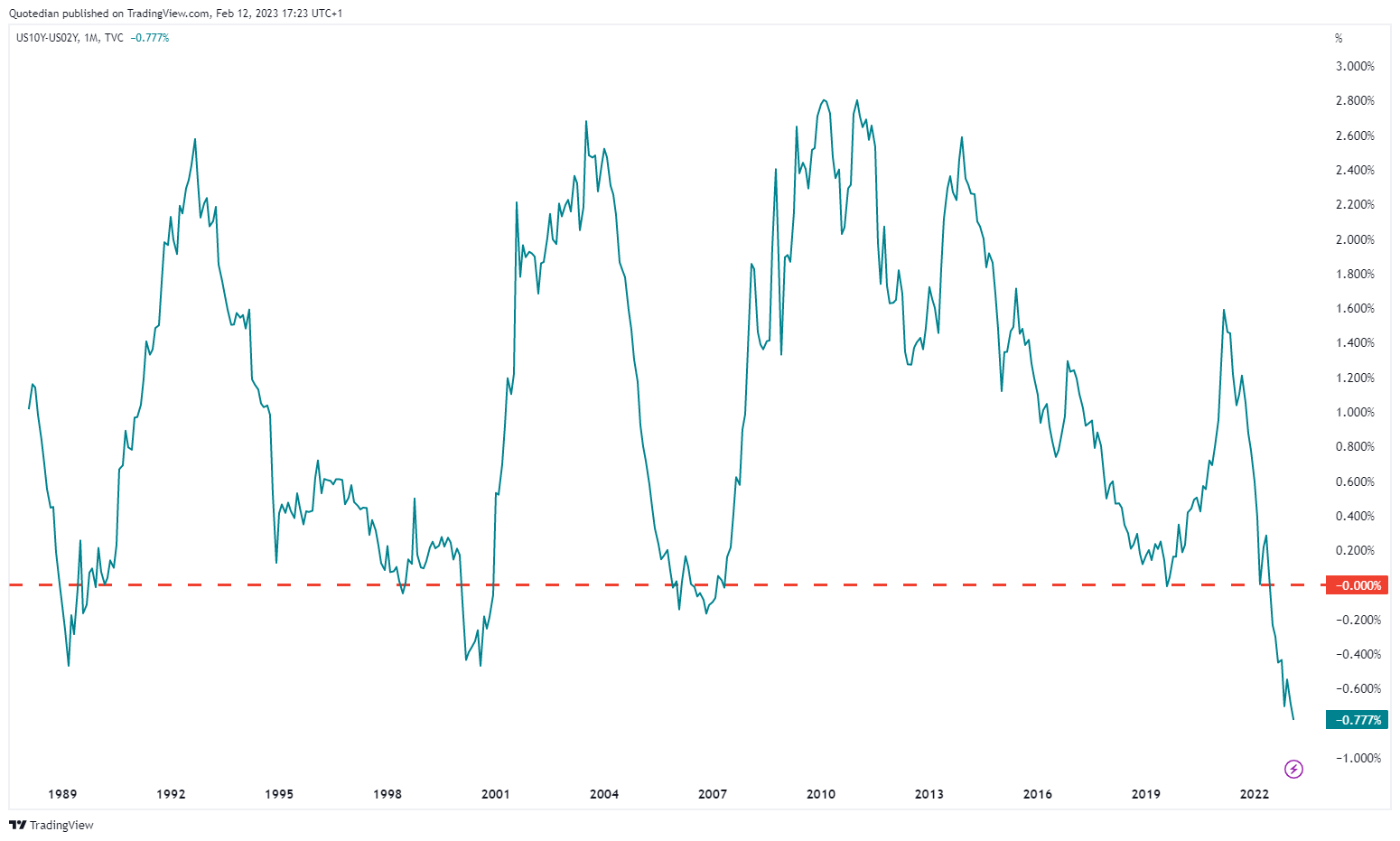

And the yield curve (10-2 year) continues with its record inversion pointing to recession.

Looking at implied rate hikes, the market added +0.5 rate hikes to the May 23 meeting, expecting 1.77 rate hikes (44.25). In other words, a 77% chance of a 50 bps hike.

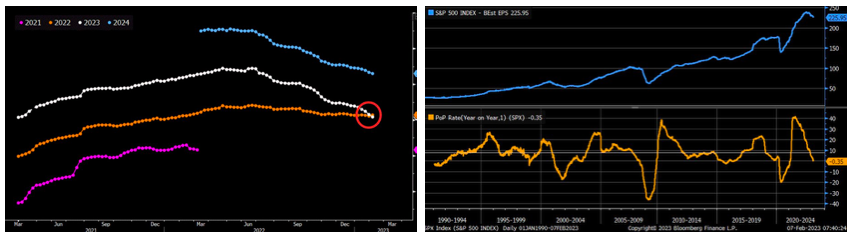

EARNINGS : Deterioration

Since the beginning of the year, the rise in the market has been purely a function of valuation expansion as both earnings, and earnings estimates, continue to deteriorate.

Consensus adjusted S&P 500 2023 EPS has dropped beneath 2022’s level, to $222.10 vs. $222.80 (left chart). Year/year % change in S&P 500 forward EPS growth has now turned negative (right chart).

Among sectors, energy, technology, health-care and materials are expected to have lower EPS in 2023 than in 2022.

USD

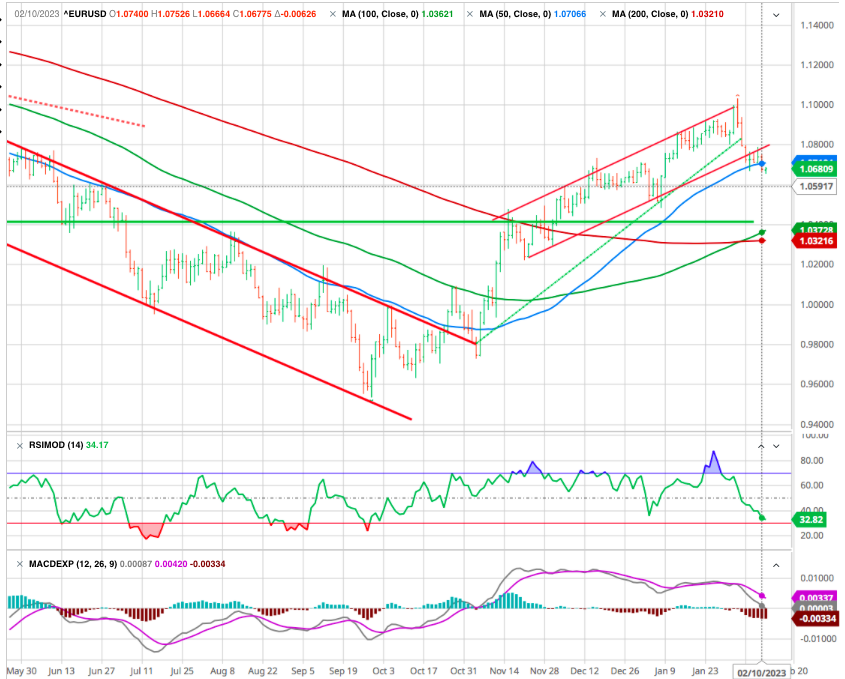

The dollar rallied overall this week, as traders raised their level of fear of a restrictive Fed monetary policy. The greenback rallied mostly against emerging market currencies. The big weekly loser is the ruble, which is falling against the major currencies.

Versus the Euro, the USD has gained some further ground over the week and fell out of the immediate uptrend channel, 1.0415(green horizontal line) would be support points (also 50 DMA).

CRYPTOS

For the second week in a row, bitcoin is running out of steam after an explosive January. The digital currency is shedding more than 4% since Monday and is back below $22,000. With investor confidence not yet massively back on risky assets, the cryptocurrency market is suffering in the absence of strong positive catalysts. It will surely take some more time to heal the scars of 2022 on this market.

Happy Trades

BONUS :

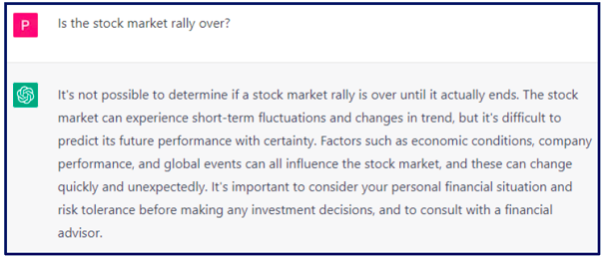

For all the fanfare and billions of dollars that have been plowed into AI and Chat GPT tools, what good is it if they can’t even tell us if this week’s pullback was a sign that the rally is over? Clearly it’s not ready for primetime!

Source Bespoke