Weekly Market Review as of August 12

August, 12 2013The Fed is in a Corner

The Fed fosters a public image of dispassionate experts working econometric magic that mere mortals (i.e. non-PhDs in Economics) cannot possibly understand. The reality is the Fed is as much a political and PR machine as it is a financial institution.

The Fed fosters a public image of dispassionate experts working econometric magic that mere mortals (i.e. non-PhDs in Economics) cannot possibly understand. The reality is the Fed is as much a political and PR machine as it is a financial institution.

The Fed has a dual mandate, and no, it’s not stable prices and employment.

1) Preserve and protect the banking sector’s power and share of the national income

2) Preserve and protect the Fed’s political and institutional power.

The best guess is that as much as the Federal Reserve would like to talk about returning to some previously normal world, they are not in that world anymore.

So as people become accustomed to expecting a zero federal funds rate, they will become accustomed to expecting a very low long-term rate on federal bonds and so the effort to reverse this is going to be a bit turbulent if not traumatic. Either they can try to push up the long-rate while keeping the short-rate low and that is kind of reversing the quantitative easing in which case they get large proportionate changes. And you begin to have real pullback effects in the mortgage markets and things of that nature. Or, they could change the expectation of the short rate by raising them, but when they do that, they get an inverted yield curve.

In order to protect itself and rely some of the responsibilities on the Administration (regaining some independence) the FED and its next Chair(wo)man will keep entertaining the illusion there are in control : Better to engineer a mini-crisis while you’re still in control than let a crisis you can’t control run away from you. Therefore, I wouldn’t be surprised if the Fed started tapering the punchbowl before even announcing it’s doing so.

What is still debated is whether or not the taper is actually “priced in” to risk assets: some say this is what the bond swoon of June was for, even though equities have largely digested the bond move 100 bps wider, and are just a fraction off their all time highs. Well, lately we saw that not only is the taper not priced in, but that there will be a substantial shock surrounding the September VIX bucket.

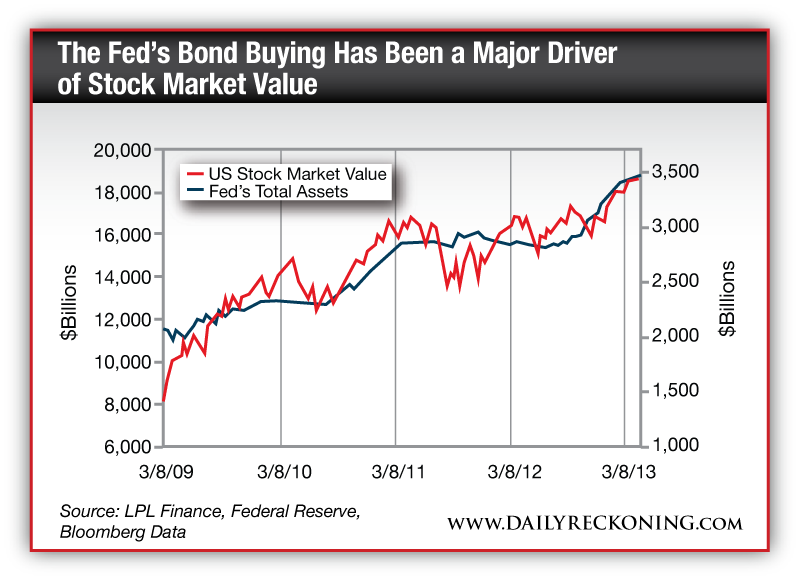

The higher the markets go because of quantitative easing, the bigger the drop will be—and there is no doubt in my mind that this market will fall hard once the money printing plug is put into place. As evidence, we offer the correlation between the stock market’s value and the Fed’s ever-expanding balance sheet:

Since 2009, stocks and the Fed have been attached at the hip. The stock market’s rise has been, in a word, manufactured. And if it hasn’t, we inquire: Why all the negative market reactions to the Fed’s “taper talk”? In our humble opinion, it’s because the Fed has, in fact, manufactured equities’ ascent… and in doing so, cobbled their descent.

We still have a long, exciting and probably sad experiment ahead of us

Eurocrisis Is Not Over

Signs of improvement in the eurozone helped France and Italy. However thre are still lots of warnings.

An internal Bundesbank document discovered by Der Spiegel states, in opposition to the comments by Germany’s electioneering Chancellor Merkel, that Europe “will certainly agree to a new aid program for Greece” by early 2014 at the latest. As Reuters reports, Frau Merkel has repeatedly played down suggestions Greece will require more aid (or debt relief) in light of German voters major skepticism over moar of their money being flushed into the Mediterranean. The document notes that the risks of the current aid package for Greece are “extremely high” and that recent approval of the tranche payments were politically motivated – directly contradicting Merkel’s ‘praise’ for Greek efforts as the report concludes Athens’ performance as “hardly satisfactory.”

With these comments in mind it was interesting to recently read an article from famed hedge fund Bridgewater Associates, headed by Ray Dalio, and their views on whether a perfect storm was brewing in Europe? It is within this context of finding risks early that they note five potential issues facing Europe currently which could lead to a negative market event.

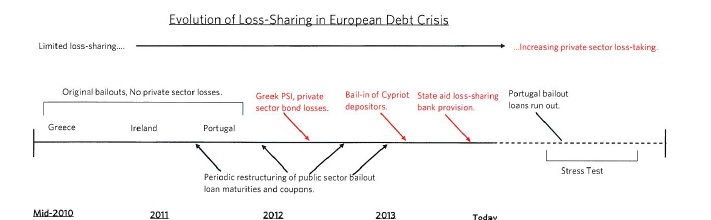

1) Financial institution stress tests could raise worries about specific banks (see chart below)

2) Plans for dealing with problematic banks could lead to Cyprus type situation

3) Portugal’s debts problem signals worries for other countries as well

4) France’s continuing debt build up could cause serious problems

5 ) International attention to all these problems could exacerbate the issues.

Bridgewater stated:

“This confluence of activities would cause sensible lenders to move from dangerous financial institutions to more secure ones, creating a variety of difficulties. Because of actual frailty in Western countries, another rise in costs and/or propagates could release material responses. Right now, both risk-free attention levels and credit score propagates are low and ‘risky asset’ costs high, so this threat is not priced in.”

While the piece, which is worth reading in its entirety, covers the issues in detail – the most important point that will likely pose the greatest threat to the financial system in the short term are the upcoming stress tests of the European banks. These test are likely to show the shortfalls of capital in the banks and could lead to a systemic crisis. This risk is further increased by the Basel III rules as they come into effect in the months ahead.

Bridgewater believes that Spanish and Italian banks will likely need a total of €19 billion. However, these banks are also the largest holders of soverign debt and have been increasing that exposure due to the ESM and ECB liquidity facilities. However, if the banks are held liable for holding soverign debt it will cause outside investors to be far more concerned about the relevant risks. This could lead to a shifting of assets back to more stable economies like the U.S. This risk increases Spanish and Italian banks need for capital to around €30 billion or they will need to reduce their exposure. Both events are a potential negative for the Eurozone and the markets.

China has shown some signs of bottoming in June/July and has trended upward over the last month or so. In terms of the market, Chinese growth related assets such as the Hang Seng Chinese Enterprises Index (+6% from the June lows) and the Shanghai Composite (+5% from the June lows) have also followed a similar trend.

Currencies: USD offered across the board, especially against sterling. Two currencies have made big moves this year. The first is JPY, which has fallen on the BoJ’s commitment to double the size of the monetary base in order to eliminate deflation. The second is AUD, which having traded at or above parity in 2011 and 2012, has slipped to less than 90 US cents. The change of fortunes reflects both deteriorating fundamentals and the policy response to them.

Commodities: Oil offered on fuel overhang caused by unusually high refinery rates. The better China trade data sparked a broad-based rally in mining stocks yesterday. The S&P500 metals and mining index closed at +4.7% (vs S&P500 at +0.4%) in its best gain in almost a year. Amongst the miners, gold companies had a very strong day possibly helped by short covering. Stocks in gold companies such as Barrick Gold (+10%) and Newmont (+8.6%) were up sharply.

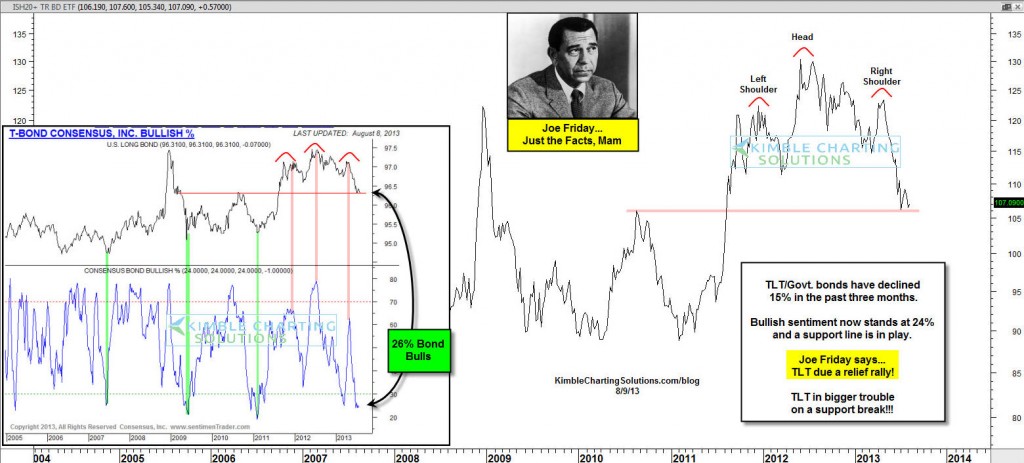

The Recent Bond Market Selloff in Historical Perspective

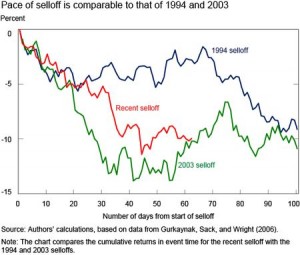

As bond yields rose sharply through much of May and June, market-watchers fought back against the notion that 2013 could be a repeat of the dreaded selloff of 1994. Tobias Adrian and Michael Fleming, economists at the FED New York point to 1994 and 2003 selloffs as comparisons to 2013 in a great analysis.

The three selloffs become more similar when the economists plot each year’s pace against each other. Returns mirror each other for the first month of each selloff. In the second month, 1994 returns held steady while 2013 and 2003 returns continued to trend downward. In the following months, 1994 returns continued to slide lower as 2013 and 2003 stabilized.

But there is a key difference between 1994 and 2013, which the economists highlight. This year, the selloff went alongside a widening differential between short-term and longer-term Treasurys, often known as a steepening yield curve. That indicates investors are simply demanding more yield, called a term premium, to hold longer-term Treasurys. In 1994, there was was little steepening, since yields rose across the curve because of the drastic change in Fed policies.

They conclude: “The finding that the selloff can be attributed nearly entirely to movements in the term premium is in stark contrast to decompositions of yield movements in the tightening cycles of 1994 and 2004, when yield movements were nearly entirely due to changes in the future path of policy.”

Addressing Marc Faber’s Call for an 1987-Style Crash

Thursday Marc Faber made front headlines across the web calling for a 1987-style crash in the stock market. Faber cites a strong rally in the face of lackluster corporate earnings growth and weakening market breadth to characterize the backdrop to 1987, and says we have a similar outcome today. In both cases,

- the stock market had rallied quite strongly from the start of the year. In 1987, the S&P 500 had rallied more than 30% by early August. Though not quite as strong, the S&P 500 has rallied 19% YTD;

- we also experienced sharply rising interest rates; however, the big difference today is they are coming off of extremely low levels. So, while we have seen a great percentage jump in interest rates this year, from an absolute level they have risen just over a single percent, while they jumped more than 3% in 1987.

Currently, the Fed is not raising interest rates, trade deficit is improving from a surge in domestic energy production and declining oil imports, and the USD Index has rallied more than 15% from the lows in 2011 to its recent highs—a complete polar opposite to the backdrop seen in 1987. The comparison of the current environment to 1987 is off the mark.

I do believe that stocks could tread water ahead of the September FOMC meeting and may possibly correct more (see paper ), I do not see the same circumstances in place that warrant a repeat of the 1987 crash, NOT YET AS LONG AS THE FED IS CUFFED BY THE MARKETS TO CARRY ON ITS UNORTHODOX POLICIES.

Our Current View I that Risk Far Outweighs Opportunity

We believe in the saying that something is “well bought if it’s half sold” . This means purchasing an asset at such an attractive price that it could relatively quickly be sold at a profit, in which case you probably will not want to sell it for some time. One very public example of this are the purchases Warren Buffett has made historically. As the quintessential “buy and hold” investor, throughout his career Buffett swooped in and made his largest, most aggressive purchases during ugly environments then moved to the sidelines. In so many repeated cases, the purchases where done so well there was no need to worry about the sale, and in many cases he never has sold. It is an example of why paying the right price is so important. Likewise, paying the wrong price can be devastating.

There are three cornerstones to our caution

- As 4 ½ years of $1 Trillion of fiscal stimulus and $1 Trillion of monetary stimulus per year wind down, there are likely to be negative repercussions.

- Since 2000, the rate of economic growth has been approximately half that of the previous 70 years. As such, we don’t believe that warrants paying above the historic multiple for the market.

- Finally, while earnings have recovered and registered new highs, overall the growth is low quality and as such unlikely to be sustainable without the economy picking up.

One can go further and talk about risks like a Different Fed next year, Debt Limit and Budget Battles, and relatively slow global growth.

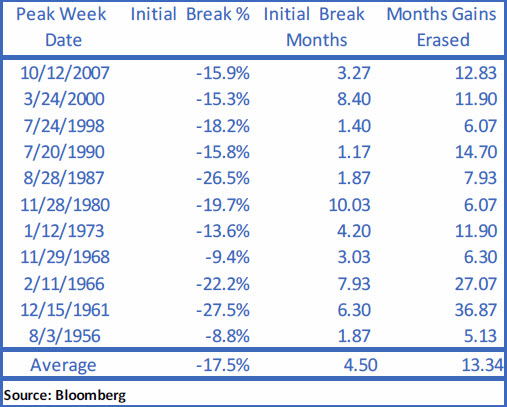

Although a top cannot be predicted, it is worth being aware that if one happens, it will likely erase a year’s worth of gains in fairly short order. Look at what has been the risk of paying the wrong prices.

With the exception of the 2000 peak, since 1985, market reversals averaged a 19% drop in less than 2 months. Although the 2000 peak gave S&P 500 investors 8 months to reduce risk, the real action was in the Nasdaq, which dropped 37% in a month.

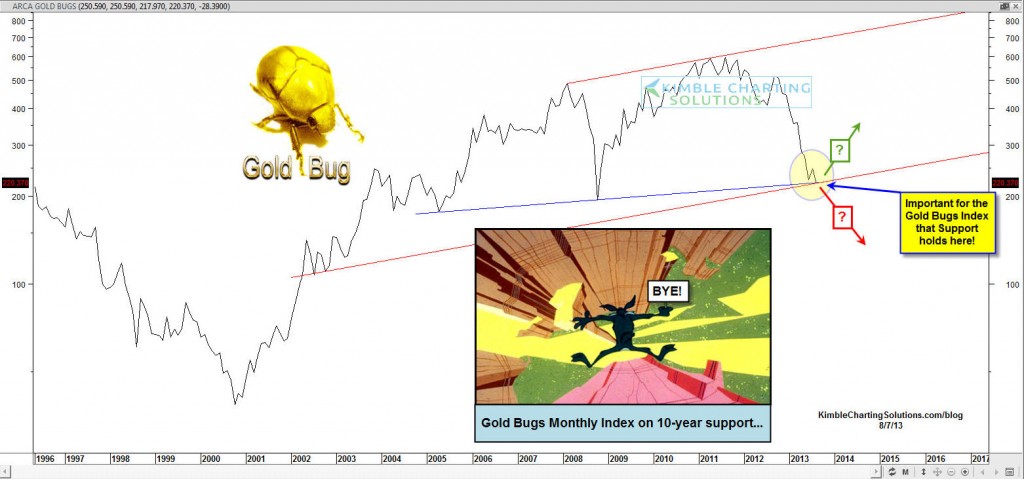

Gold: When Will the Next Buy Signal Emerge?

Gold may have recently bottomed and is currently in backwardation possibly an indication that the price could increase in the months ahead. So if gold continues to gain, as we can expect, a buy signal possibly as early as December 2013, but not much later than March according to Georg Vrba,2014.

Beaten down mining stocks have actually outperformed gold over the past six weeks. The widely followed Market Vectors Gold Miners ETF has jumped more than 8% since the end of June.

Gold has been seriously out of favor over the first half of the year. Having had twelve consecutive up years it is not surprising that the precious metal experienced a major correction, although it experienced a remarkable capitulation in the second quarter.

A support is a support as long as it holds !

To put it into context, there were a lot of non-fundamentally driven buyers that came into the market during the run up to the highs of 2011, chasing the trend, using leverage, and only interested in the idea of speculating on further price increases in the shorter term. Those marginal buyers have since then gone to the exits and indeed some have come in aggressively on the short side, exacerbating the trend in the opposite direction. Importantly from our standpoint, the fundamentals are still very positive as many parts of the world, including the US, are burdened with too much debt and the path of least resistance remains inflation and a gradual debasement of the purchasing power of the currency.

In our assessment, the US and many other governments around the world cannot support their bonds should their cost of borrowing rise significantly. In that sense, the sluggish recovery has been a godsend to governments. Taper talk might be hazardous to the price of gold, but we don’t see any central banker of the caliber of former Federal Reserve Chair Paul Volcker, who was willing to substantially raise rates to fight inflation. Pundits say inflation is not the problem of the day; they may be right, but the day will come where it just might be a problem. We don’t doubt the intentions of policy makers of fighting inflation, but we doubt their ability.

And we believe, ultimately, the Fed will have to err on the side of inflation, boosting the long-term prospects of the shiny metal.